Forex: Japanese Yen Rebound on BoJ Response to Abe Short-Lived

ASIA/EUROPE FOREX NEWS WRAP

Few key data out of Europe alongside general complacency has led to dull and uninspiring price action overnight in FX markets. The biggest news in the overnight was the Bank of Japan Rate Decision, in which Governor Masaaki Shirakawa defended the BoJ’s monetary policy, suggesting that comments issued last week by Japanese opposition leader Shinzo Abe were “unrealistic” and deconstructive to the BoJ’s intended policy path.

While the USD/JPY had only depreciated by -0.01% at the time this was written on Tuesday, the Yen’s strength was much more pronounced earlier in the day, as it appeared that the BoJ was going to resist any exogenous pressure (in this case, political) to alter its monetary policy. But the words of Governor Shirakawa have proven anything but reassuring – if so, I would have expected the USD/JPY to have quickly reversed course and move lower, especially considering the US fiscal cliff/slope is in the picture.

The lack of a positive reaction by the Yen could be a result of the US holiday this week, that has markets at half or no capacity Wednesday through Friday; fewer traders around mean that there’s not really a ‘market’ there to react to the comments. On the other hand, Asian and European markets are open as normal, which then offers a conflicting view: no one believes BoJ Governor Shirakawa that unlimited money printing is an unrealistic outcome at this point in time.

Meanwhile, if there is a chance for volatility today, trading around the European close might offer the clearest opportunity, with Euro-zone finance ministers meeting to discuss the Greek aid package today.

Taking a look at credit, peripheral bond yields are lower, keeping one possible impediment to the Euro on the sidelines. The Italian 2-year note yield has decreased to 2.184% (-3.3-bps) while the Spanish 2-year note yield has decreased to 3.190 % (-7.0-bps). Similarly, the Italian 10-year note yield has decreased to 4.881% (-1.0-bps) while the Spanish 10-year note yield has decreased to 5.858% (-1.2-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 11:50 GMT

GBP: +0.13%

JPY:+0.01%

EUR:-0.01%

CAD:-0.01%

CHF: -0.03%

AUD:-0.13%

NZD: -0.32%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.09% (+0.42% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EUR/USD: Last week’s high at 1.2800/10 was broken, but there’s been very little continuation and the daily RSI has had difficulty climbing over the 50 level; further downside may be in the cards. Overall, given the lack of volatility, my levels remain unchanged. Support comes in at 1.2650/55 (100-DMA) and 1.2400/35. Resistance is 1.2800/30 (20-EMA, 50-EMA, 100-DMA, last week’s high, mid-October swing low), 1.2880/1.2900, and 1.3015/20 (late-October high).

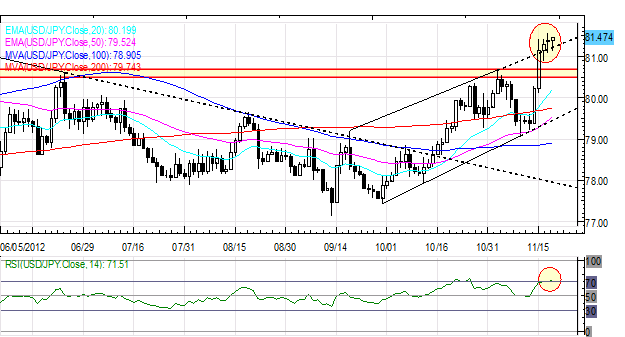

USD/JPY: The USDJPY is back testing its November high, leaving the mid-April swing high at 81.75/80 as the next major resistance level. However, with the daily RSI overbought once more, the next corrective leg may be around the corner. Support comes in at 81.15, 80.50/70 (former November high), and 79.10/30.

GBP/USD: No change: “The downtrend that’s been in place for the past two months remains, though the GBPUSD finds itself hold both its 100-DMA and 200-DMA on recent declines, suggesting the medium-term trend is to the upside. Resistance comes in at 1.5910/15 (October low), 1.5955/60 (20-EMA), 1.5975/80 (50-EMA) and 1.6170/80 (late-October highs). Support is 1.5870/75 (100-DMA), 1.5845/50 (200-DMA), and 1.5800/05.

AUD/USD: The AUDUSD has failed in the 1.0405/50 zone again today, after chopping through the area last week and failing to climb through on rallies in late-October and early-November. Support is at 1.0330/45 (trendline support off of the June 1 and October 23 lows) and 1.0235/80. Resistance is at 1.0405/50 (former swing highs and lows), 1.0475/80 (November high) and 1.0500/15.

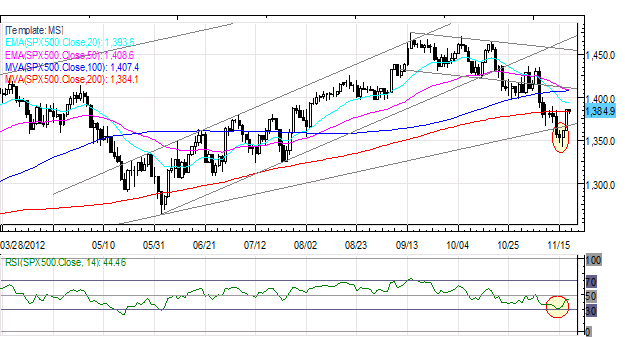

S&P 500: No change: “The key support noted for the past several weeks at 1350/65 has held. Although this is a broad zone, with multiple points of inflection occurring in this area, we know it will be an area in which buyers and sellers are looking at the market. If this breakdown is legitimate, then a healthy corrective rebound back towards 1380/85, 1400, and even 1420 could be possible. Support comes in at 1350/65 (monthly S2, ascending channel support off of November 2011 and June 2012 lows). Resistance comes in at 1383 (200-DMA) and1400/10 (20-EMA, 50-EMA, 100-EMA).”

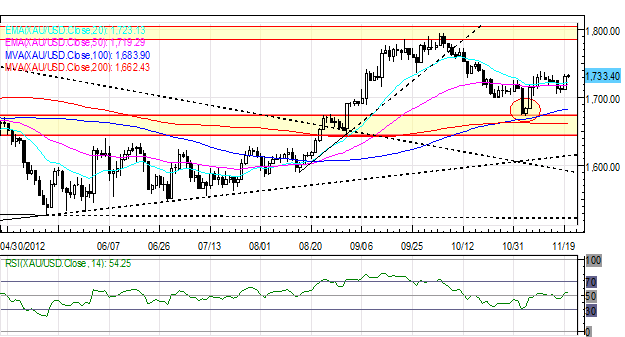

GOLD: Nothing has changed over the past three weeks, so neither has my bias: “Gold has consolidated just below its November highs, though considering that the US Dollar is at its strongest level in over two months, Gold is holding up well. As such, I still expect the 1700 area to be defended vigorously, and look to get long as low as 1675. Resistance is 1735, 1755/58 and 1785/1805. Support is 1700, 1680/85 (100-DMA, November low), and 1660/65 (200-DMA).”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance