Forex: Euro Retains Favor; EUR/USD Above $1.36 Before NFPs, ISM

ASIA/EUROPE FOREX NEWS WRAP

The new month has brought about more of the same: Euro strength, Japanese Yen weakness, and a very confused US Dollar. Typical correlations seen in FX have been breaking down, and today is the perfect microcosm: the Euro, the Swiss Franc, and the New Zealand Dollar are outperforming; while the Australian Dollar, the Canadian Dollar, and the British Pound are low. Typically, the Euro, the British Pound, and the Swiss Franc are highly correlated, while the Australian, Canadian, and New Zealand Dollars trade together.

But shifting trends in Euro-zone financials (with the European Central Bank tightening its monetary policy vis-à-vis LTRO repayments, while maintaining the OMT safety net underneath Italian and Spanish bonds) has not only made the Euro a stalwart on a monetary basis, but also a bit of a – prepare to be shocked – safe haven, when concern over anything has arisen. This makes sense, in the near-term, simply because the Euro-zone debt crisis, while still existing, has been quelled, removing a great deal of uncertainty that clouds many of the other major currencies.

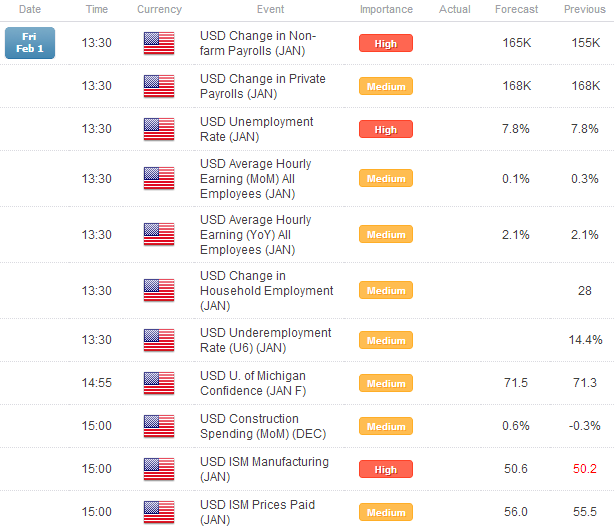

Accordingly, while I like the Euro higher now – both fundamentally and technically – it is only a matter of time before a) the Euro-zone crisis emerges, “surprising” everyone and b) the divergence in Euro-zone and US economics could provoke a sharp turnaround in the EURUSD. This divergence should be highlighted today, when the January US labor market reading is released, in which jobs growth maintains its uptrend; the expected print of +165K (updated consensus from Bloomberg News) would come in above the three-month, six-month, and twelve-month trailing averages of +151K, +160K, and +153K, respectively. Shortly after the US cash equity open, the January ISM Manufacturing print should maintain its slight rate of growth. Any near-term pullback in EURUSD as a result of today’s prints, in my opinion, does not mean the uptrend is over.

Taking a look at European credit, have fallen back, laying the groundwork for continuation in Euro strength. The Italian 2-year note yield has decreased to 1.524% (-8.1-bps) while the Spanish 2-year note yield has decreased to 2.473% (-3.7-bps). Likewise, the Italian 10-year note yield has decreased to 4.275% (-2.6-bps) while the Spanish 10-year note yield has decreased to 5.132% (-2.0-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 11:45 GMT

CHF: +0.62%

EUR: +0.54%

NZD: +0.25%

GBP:-0.15%

CAD:-0.20%

AUD:-0.36%

JPY:-0.46%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.19% (-0.16% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: The Bull Flag target was reached today at 1.3635, but the overshoot coincidentally lined up with the 100% Fibonacci extension off of the January swing lows at 1.3660, a few pips from the top today. Accordingly, with the daily RSI well into overbought territory, a pullback would be deemed healthy. Dips into 1.3500 are deemed constructive. Support is 1.3615/20 (weekly R2), 1.3540 (weekly R1), and 1.3500. Resistance is 1.3635/60 and 1.3755/85 (weekly R3, monthly R1).

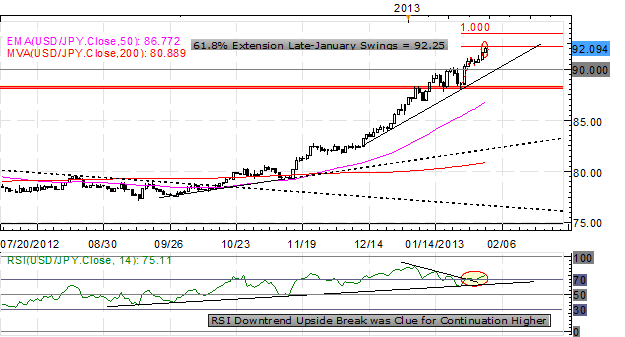

USDJPY: Further bullish price action as US Treasury yields strengthen and speculation over BoJ policy arises again. Resistance comes in at 92.00/05 (breaking now) (weekly R1), 93.15/20 (weekly R2), and 93.45/50 (monthly R3). Support comes in at 91.00 and 90.00/10 (weekly pivot, monthly R2).

GBPUSD: No change: “The pair has rallied off of the 61.8% Fibonacci retracement from the June low to January high, but I maintain: as long as the daily RSI downtrend holds, it is possible for a move lower.” This may break today, signaling an end to the bearish bias for the near-term, and wouldn’t rule out a rally back towards the 50-EMA and significant psychological resistance at 1.5990/6000. Support is 1.5700 and 1.5675/80.”

AUDUSD:No change: “The pair continues to range although it has showed signs of cracking, with both the ascending trendline off of the June low and the October low having been breached, as well as the ascending TL off of the June low and the December low. Accordingly, a weekly close below 1.0460 could signal a deeper retracement towards 1.0350/400, before a greater breakdown towards parity. Support comes in at 1.03800/400 (weekly low), 1.0340/50 (December low), and 1.0140/50 (October low). Resistance is 1.0460/70 (ascending TL off of the June and December lows, 50-EMA) and 1.0500/15.”

S&P 500: Tuesday I said: “as indicated on the charts the past weeks, noting “nearing the top 1505/1512” – the top was 1504.6. If this breaks, 1520 is in sight.” Indeed, the irrational exuberance has continued, bringing topline Bearish Rising Wedge resistance in focus at 1512/15; the December 2007 highs of 1520/24 could be reached on an overshoot. Bottom line: I’m expecting a crash in the S&P 500 unless volumes accelerate rapidly, given the disconnect from reality.

GOLD: The past few weeks I’ve maintained: "When considering the move off of the September highs, a measured A-B=C-D (as expressed on the Daily) suggests that a bottom could be in place at [1630/40].” The rebound has ensued, with the alternative safe haven rallying up to 1690 today. A daily close above 1700 points towards 1722/25 and 1755. Support is 1663 (200-EMA) and 1640/45.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance