Forex: Euro Rallies on Strong Spanish Bond Auction - ECB Ahead

ASIA/EUROPE FOREX NEWS WRAP

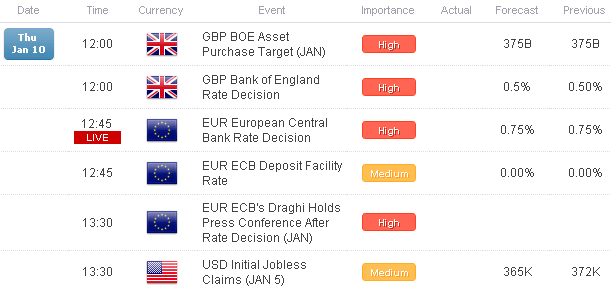

A continued weakening of the Japanese Yen and a strong Spanish bond auction have pushed up demand for high beta currencies and risk-correlated assets in the first half of the European trading day, as investors now wait to see what the European Central Bank has to say at their policy meeting, scheduled for 07:45 EST / 12:45 GMT, followed by ECB President Mario Draghi’s press conference at 08:30 EST / 13:30 GMT.

Unlike the Bank of England Rate Decision, just released a few moments ago which showed no change in their key rate (as it has been on hold at 0.50% since March 2009) or their Asset Purchase Target, the ECB Rate Decision today offers the opportunity to see how confident Euro-zone leaders are with respect to the progress of the crisis.

Although no major changes are expected, the results of the Spanish bond auction are, in my opinion, an indication of the success of the ECB’s “whatever it takes” to save the Euro plan, the OMTs, which were announced in September. Although the ECB has not yet had the need to implement such measures, the fact remains that the implicit backstop behind Spain has given the country significant time to get its finances together.

Accordingly, perhaps a hold in ECB policy today allows the Euro to run a little higher before retracing some of its gains today versus the US Dollar. Considering that, since the September meeting, the ECB has done little but downgrade the region’s growth prospects, subsequent meetings have produced negative outcomes: the EURUSD fell by -24-pips on the day of the November meeting; and the EURUSD fell by -98-pips on the day of the December meeting. With market sentiment today roundly positive, a more optimistic President Draghi could help lift the EURUSD initially.

Taking a look at European credit, the strong Spanish auction has boosted peripheral bonds and proved very supportive for the Euro. The Italian 2-year note yield has decreased to 1.320% (-19.4-bps) while the Spanish 2-year note yield has decreased to 2.012% (-29.0-bps). Similarly, the Italian 10-year note yield has decreased to 4.149% (-11.3-bps) while the Spanish 10-year note yield has decreased to 4.930% (-17.0-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 11:55 GMT

AUD: +0.61%

NZD: +0.49%

CHF: +0.31%

EUR:+0.31%

CAD:+0.23%

GBP:+0.22%

JPY:-0.32%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.32% (-0.11% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

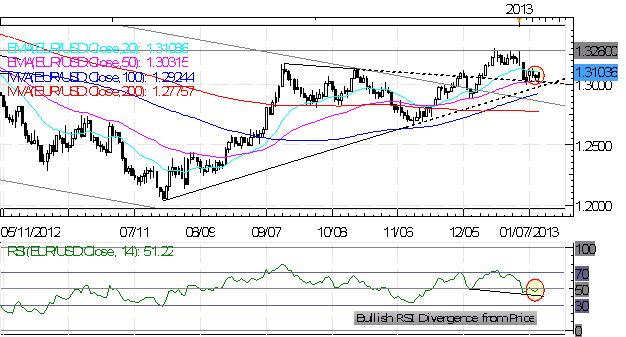

EURUSD: On Monday I said: “the bearish RSI divergence seen on the daily chart (as well as the 4H) is now resolved; if anything, bullish RSI divergence is forming. With price act the descending TL off of the September and October highs, the pair is at a critical juncture.” While this juncture produced a rally, price has consolidated off of its lows, near 1.3100 ahead of the ECB today. Support comes in 1.3030/35 (50-EMA), 1.3000 (weekly low), 1.2950/65 (ascending TL off of July and November lows) and 1.2875/95. Resistance is 1.3170, 1.3280/85, and 1.3380/85 (mid-March swing high).

USDJPY: No change: “The pair has exploded to its highest level since July 2010, leaving the December 2008/January 2009 lows in focus at 87.00/20. Given BoJ policy, any dips seen in the USDJPY are viewed as constructive for further bullish price action (the market remains very net-short the JPY, however).” With 87.00/20 easily broken, the pair is now in a zone that proved to be strong support throughout 2009 and 2010, at 88.15/95 (note: monthly R1 at 88.40, rejected on Monday). Support comes in at 87.00/20, 86.75/95, and 86.20/40.

GBPUSD: No change: “The pair has fallen back from 1.6300, again, though with no follow through yet, my levels remain the same (they haven’t changed since early-December). However, the pair is now coming into ascending TL support off of the July and November lows at 1.5985. Support is there and 1.5895 (200-DMA). Resistance comes in at 1.6085/90 (50-EMA), 1.6180, and 1.6300/10 (post-QE3 announcement high in mid-September).”

AUDUSD:No change: “The AUDUSD still can’t break the descending trendline resistance off of the July 2011 and February 2012 highs, which come in at 1.0530/50 today, but that doesn’t mean the uptrend is over just yet. However, as noted the past several weeks, the “consolidation…the next few sessions” may be ending.” The pair is testing the December highs and a break signals a push towards 1.0605/25. Support is at 1.0340/50, 1.0280/95 (November swing low, 200-DMA), and 1.0145/65. Resistance is 1.0530/85 and 1.0605/25 (August and September highs).”

S&P 500: No change: “The S&P 500is back above a very significant zone of 1445/50 (descending trendline off of September and October highs, 100% Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension), and a move higher necessarily points to 1470/75. Support comes in at 1425, 1400, 1390 (200-DMA) and 1345/50 (November low).”

GOLD: No change: “Gold is at a make or break level right now, former Symmetrical Triangle support at 1630/40, and its lowest level since August, before the ECB and the Fed’s QE intervention hopes took hold. Additionally, when considering the move off of the September highs, a measured A-B=C-D (as expressed on the Daily) suggests that a bottom could be in place at these levels as well. Support is there at 1580. Resistance is 1690/95, 1735, 1755, and 1785/1805.”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance