Forex: Euro Continues to Struggle as Yen Leads as US Fiscal Tensions Linger

ASIA/EUROPE FOREX NEWS WRAP

The Japanese Yen and the US Dollar have continued their post-US budget deal announcement rebound on Thursday, as the European currencies continue to sell-off as capital returns to the market at the beginning of 2013. Despite an eleventh hour deal that prevented the US economy from sliding towards its most severe contraction since the depths of the financial crisis, US politicians have seemingly failed to set forth a meaningful deal that inspires hope for further compromise.

Certainly, with both Democrats and Republicans digging into their respective positions – one on the back of a perceived victory, the other on the back of a perceived defeat – the upcoming fight over the debt limit appears it will be a brutal one. Adding fuel to the fire were reports last night that Speaker of the House John Boehner (R-OH) would be abandoning his policy to negotiate with President Barack Obama (D) one-on-one, meaning that any new agreements passed will take the traditional route: through the bureaucratic, self-interested halls of Congress.

When considering the fiscal follies of the United States alongside the reloaded QE program by the Federal Reserve, there are two very significant forces at work against the US Dollar. But as history has shown the past few years, and especially during July-August 2011, just because credit risk is increased or yields are undermined, that doesn’t mean the US Dollar can find appeal; it remains the world’s reserve currency. But these concerns have been great enough to offset traders’ distaste for the Yen, which is the best performing currency on the day.

Taking a look at European credit, weakness in peripheral bonds has weighed on the Euro. The Italian 2-year note yield has increased to 1.707% (+3.3-bps) while the Spanish 2-year note yield has increased to 2.465% (+3.8-bps). Likewise, the Italian 10-year note yield has increased to 4.288% (+2.4-bps) while the Spanish 10-year note yield has increased to 5.007% (+1.7-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 11:20 GMT

JPY: +0.36%

AUD: -0.01%

NZD: -0.07%

CAD:-0.08%

GBP:-0.41%

CHF:-0.49%

EUR:-0.61%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.14% (-0.05% past 5-days)

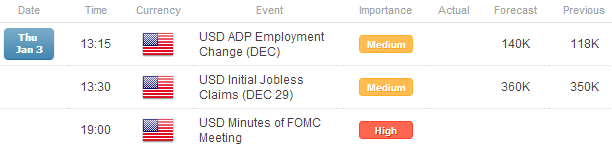

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: The pair failed once again at its May highs, posting a massive reversal yesterday (Inverted Hammer) and trading towards the descending trendline off of the September and October highs. The bearish RSI divergence seen on the daily chart (as well as the 4H) is being resolved, setting up a potential buying opportunity in the coming days; however, negative momentum is proving swift. Support comes in at 1.3060 and 1.2940 (ascending TL off of July and November lows). Resistance is 1.3170, 1.3280/85, and 1.3380/85 (mid-March swing high).

USDJPY: The pair has exploded to its highest level since July 2010, leaving the December 2008/January 2009 lows in focus at 87.00/20. Given BoJ policy, any dips seen in the USDJPY are viewed as constructive for further bullish price action (the market remains very net-short). Support comes in at 86.00 and 84.70/85 (200-DMA, November 2009 low). Resistance is 87.00/20 and 88.00/50.

GBPUSD: The pair has fallen back from 1.6300, again, though with no follow through yet, my levels remain the same (they haven’t changed since early-December). Resistance comes in at 1.6300/10 (post-QE3 announcement high in mid-September) and 1.6350/60 (monthly R1). Support is 1.6170, 1.6085/90 (50-EMA), and 1.6035 (100-EMA).

AUDUSD:The AUDUSD couldn’t break descending trendline resistance off of the July 2011 and February 2012 highs, which come in at 1.0530/55 today, but that doesn’t mean the uptrend is over just yet. With price holding just below the monthly R1 at 1.0535 and thelong-term Symmetrical Triangle starting to break to the upside, consolidation may be ahead the next few sessions. Support is at 1.0500/15, 1.0460, and 1.0235/80. Resistance is 1.0555/75 and 1.0605/25 (August and September highs.

S&P 500: The S&P 500is back above a very significant zone of 1445/50 (descending trendline off of September and October highs, 100% Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension), and a move higher necessarily points to 1470/75. Support comes in at 1425, 1400, 1390 (200-DMA) and 1345/50 (November low).

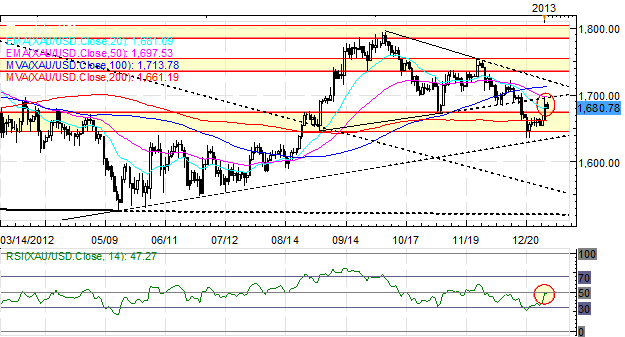

GOLD: As noted previously, “December is historically a bad month for precious metals. I will continue to look to get long as low as 1675.” While I’m interested in price down here, selling pressure is intense; though I suspect that a retest of the breakout leading up to QE3 in September could draw buying interest again at 1645. Resistance is 1700, 1735 and 1755/58. Support is 1661 (200-DMA) and 1645.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance