Forex: Euro Boosted by Greek Debt Buyback, Strong German ZEW Survey

ASIA/EUROPE FOREX NEWS WRAP

High beta currencies and risk-correlated assets have been steadily improving over the past several hours as a combination of better than expected data and positive news out of the Euro-zone has restored some near-term confidence in the single currency. The Euro is the day’s top performer, trading back towards 1.3000 against the US Dollar, as the December German ZEW Survey easily beat forecasts, and the Greek debt buyback is going as scheduled, a surprise for Greece considering policymakers have consistently disappointed the past several years.

While the German ZEW Survey for December didn’t reflect any optimism over the Current Situation, the Economic Sentiment gauge came in at its first positive value and highest since May 2012. Considering that the Economic Sentiment index registered -15.7 in October, the reading of 6.9 (against a forecast of -11.5) is a very significant improvement – certainly, if growth in the Euro-zone core is expected to pick back up in late-1Q or 2Q’13, we could see the periphery’s fundamentals start to steady as well.

Certainly, with news out of Europe improving and the US fiscal cliff/slope debate at a standstill (while no progress, no regression either), assets with higher yields, like the Australian and New Zealand Dollar could remain elevated against the Japanese Yen and the US Dollar. When considering that the Federal Reserve meets tomorrow and is expected to announce another QE program – either an extension/expansion of QE3 (agency MBS) or a new QE4 (outright Treasury purchases, like QE2) – the US Dollar could take a significant beating the next few days. Globally, markets are aligning for improved risk-appetite; even Italian and Spanish bonds are rebounding.

Taking a look at European credit, bond yields have eased, especially after the Greek news, helping boost the Euro. The Italian 2-year note yield has decreased to 2.218% (-6.4-bps) while the Spanish 2-year note yield has decreased to 2.934% (-8.6-bps). Similarly, the Italian 10-year note yield has decreased to 4.724% (-8.0-bps) while the Spanish 10-year note yield has decreased to 5.459% (-6.1-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 11:50 GMT

EUR: +0.32%

NZD: +0.31%

CHF: +0.12%

GBP:+0.06%

AUD:-0.01%

JPY:-0.10%

CAD:-0.16%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.09% (+0.31% past 5-days)

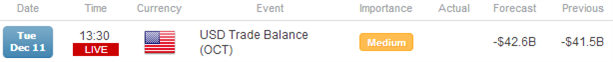

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

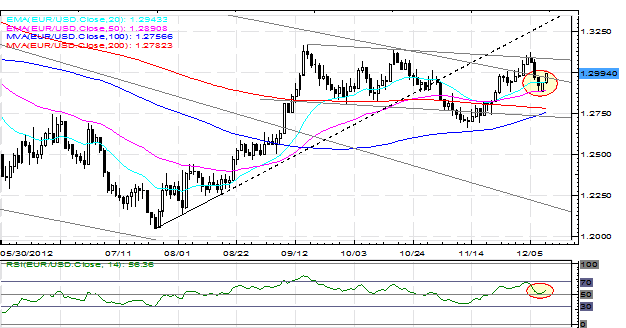

EURUSD: On Friday I said: “ Momentum is clearly to the downside, but with 1H and 4H RSI oversold once again, right as the pair comes into its weekly S1 and monthly pivot, a bounce is possible before another move lower occurs.” The EURUSD found support at these levels, and is now trading near 1.3000. Resistance is 1.3010/20 and 1.3075/90. Support is 1.2875/90 and 1.2800/20 (late-September/early-October swing low).

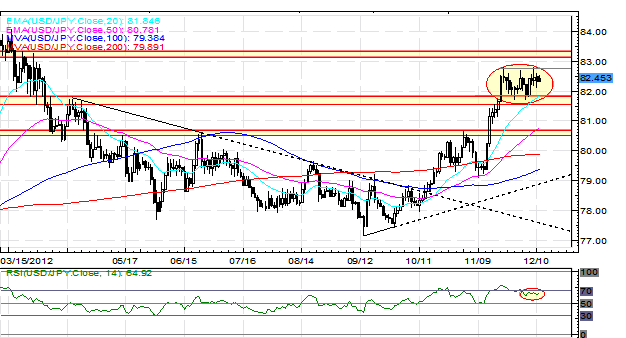

USDJPY: No change, although a Bull Flag is in place on the daily chart: “More range-bound price action as the pair fights diametrically opposite fundamental pressures (US fiscal cliff and Japanese elections), thus leaving my levels and outlook at neutral to bullish now. Support comes in at 81.75, 81.15, and 80.50/70 (former November high).Resistance is 82.90/83.00 and 83.30/55.”

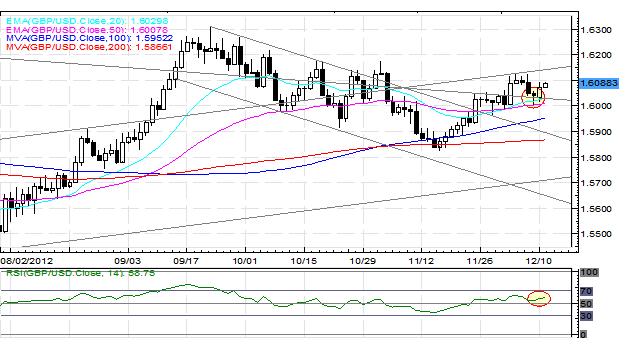

GBPUSD: My levels remain unchanged as the GBPUSD has been range-bound for the past week. Resistance comes in at 1.6125/30 (December high), 1.6170/80 (late-October highs) and 1.6300. Support is 1.6005/30 (20-EMA, 50-EMA), 1.5945/50 (100-DMA), and 1.5860/65 (200-DMA).

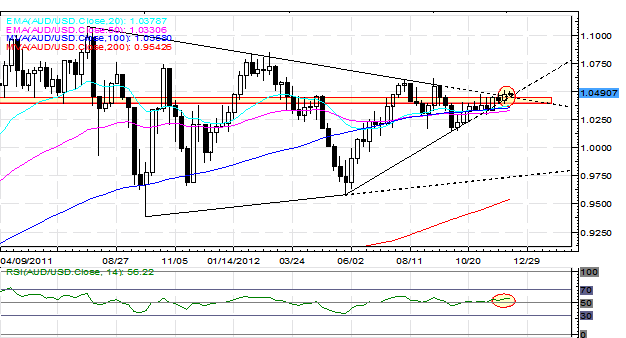

AUDUSD:The AUDUSD has started to poke out of its major technical pattern, though until 1.0500/15 is cleared, there’s little reason for excitement. As the pair has traded towards its Symmetrical Triangle termination point, and appears to be making a move to the upside; when considered in the big picture, the current pause witnessed the past year or so may be viewed as a consolidation. Support is at 1.0435/45 and 1.0235/80. Resistance is 1.0475/90 and 1.0500/15. Note: this is a weekly chart to highlight how close the AUDUSD to a potential breakout.

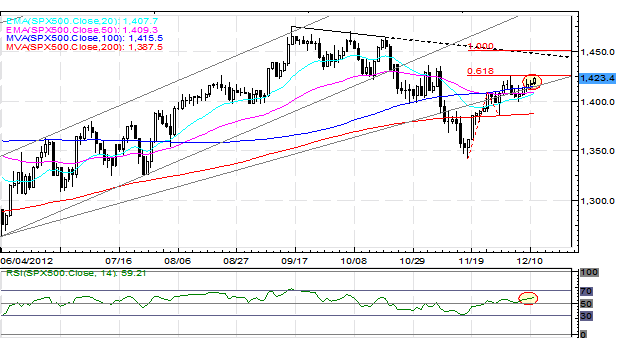

S&P 500: The S&P 500 is back at its December high, the measured move off of the low at 1425, given the 61.8 Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension. Support comes in at 1388 (200-DMA) and 1345/50 (November low). A move higher through 1425 points to 1435, 1450, and 1460.

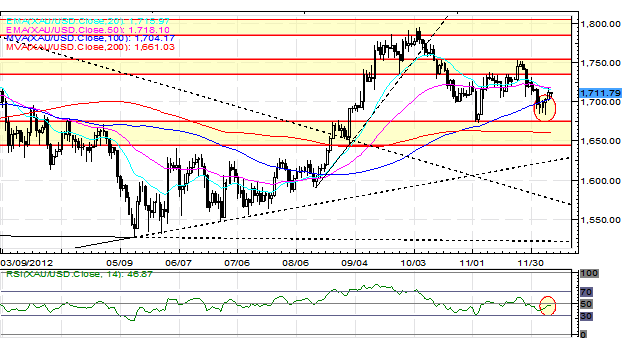

GOLD: No change: “Gold has fallen back off of its November and December highs near 1735, mainly on progress over the US fiscal cliff and demand for US Dollars amid the need to diversify away from the Japanese Yen. I still expect the 1700 area to be defended vigorously on declines, and will continue to look to get long as low as 1675. Resistance is 1735, 1755/58 and 1785/1805. Support is 1700, 1690/95 (100-DMA, November low), and 1660/65 (200-DMA).”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance