Forex Education: Learning from our Top Trading Mistakes in 2012

A good trader never stops learning, and every mistake is another potential learning experience. Here are some of our top mistakes from our own personal trading for 2012.

John Kicklighter, Chief Currency Strategist

EURCHF: 20 Pips of Greed Cost Me My Biggest Trade of the Year

We had a one-of-a-kind trade setup this past year in the EURCHF. The commitment of the Swiss National Bank to maintain a floor of 1.2000 for the pair essentially made it a one-sided market. I - like many others - took advantage of this opportunity and went long in April before it fully bottomed out at a 1.2035 rate. Given that there was a central bank dedicating itself to offsetting the effects of a relentless flow of Euro-area capital flooding into the Swiss banking system looking for safety, I decided to trade in a size far larger than my standard (normally I trade with a maximum of 2 percent of my account at risk with each trade, this trade was closer to 10 percent). After a final tumble, the EURCHF bottomed out when the SNB stepped in at 1.2000 as promised. From then on, it was a waiting game.

For five months, I waited with a modest drawdown (made large on a notional basis due to my position size). When September rolled around, I saw a quick jump higher that brought the exchange rate back up to my initial entry level. There were three previous, short-term jumps like this in the preceding months, and this looked like a similar situation. So, I exited my 5-month long trade for a few pips of profit and set an entry to reenter a long position down at 1.2015 (allowing for the spread and SNB buffer). It seemed a logical move to lower my entry level and earn a few more pips when the pair eventually took off. What I didn’t account for was that the move I decided to take advantage of was a lasting one. The market was discounting the more extreme Eurozone crisis outcomes, and EURCHF proceeded to rally another 150 pips. I could have jumped back in when the pair showed persistent buoyancy, but I kept my order in place. A 30 percent return on my account was sacrificed for a 20 pip improvement on entry. I was patient for so long only to be undone by greed.

David Rodriguez, Quantitative Strategist

Don’t Look for the Reversal that Isn’t There

It’s always tempting to call for major tops and bottoms—the potential gains on trading a major turn are significant. Yet the probabilities of catching such a move are very slim. The impressive uptrend in the Australian Dollar in 2012 was, in retrospect, a classic case of trying too hard to see a reversal that never quite materialized.

First and foremost, I thought that significant risks to global financial markets would serve as a major headwind to the risk-sensitive currency. As a result I was constantly on the lookout for evidence in favor of Australian Dollar weakness. All told I was wrong on 57% of all of my AUD trades and posted a net-loss when trading it.

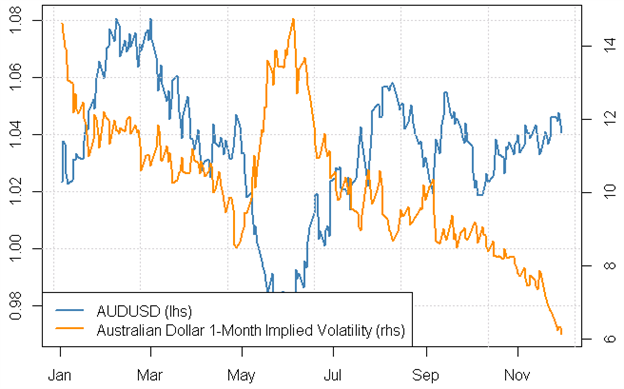

Where did I go wrong? Put simply, I was up against impressively complacent market conditions. Despite clear risk to the Australian economy from a global economic slowdown, traders were predicting the smallest AUDUSD moves in five years.

Extremely Low Volatility Favors Australian Dollar Strength

Despite clear risks to the Australian Dollar, the pair looks likely to stay near its highs as long as traders do not fear major volatility. In retrospect it seems obvious, of course, and it’s a lesson I won’t soon forget.

Jamie Saettele, CMT, Senior Technical Strategist

Don’t Predict, Trade

"Those who have knowledge don't predict. Those who predict don't have knowledge." Lao Tzu, 6th century BC.

I submit forecasts as part of my job so following this advice is difficult. Prediction creates a false sense of knowledge and undermines one of the most important traits of a successful trader, pliability (the ability to change one’s mind). For example, I had forecasted earlier in the year that the AUDUSD would decline below the October 2011 low of 9386 in order to complete a flat correction before reversing higher. The AUDUSD bottomed 200 pips before that level and within a week was over 400 pips higher. The exact principles that I teach at seminars, such as the first day of the month importance (the AUDUSD bottomed on June 1), news blow-offs (the bottom was on June NFP), divergence between related assets (the NZDUSD and AUDUSD had been diverging) were present at the low yet I was married to the idea of a flat correction. I ended up shorting the AUDUSD at parity and took a 200 pip loss within a week, going completely against my rules for operating following JS Thrusts (one occurred on June 6th) and monthly seasonality. In other words, conditions had changed but I was convinced of my forecast in part because a lot of thought went into it and changing would be admitting that I was wrong.

The experience is why my writing style and charts have changed to focus much more on objective technical measures rather than subjective measures. I believe a thorough understanding of the wave principle is paramount to understanding market behavior but interpretations of price behavior must be viewed through the lens of objective technical measures before action can be taken. My writing is more ‘trader’ than ‘analyst’. I may have thought that was the case before, but it wasn’t.

The following happens on Twitter often. I write “I’m long EURUSD with stop X and target X”. Someone will ask “will the EURUSD rally?” and I’ll answer “I don’t know.” Confusion reigns. I’m not being glib; I’m being honest and trying to keep my brain in a state that I’m not married to a direction. Also, if anyone tells you they know what’s going to happen with certainty, then run quickly in the other direction. Markets do not care what you think but they do create conditions that are consistent with times when one should make a decision. If you reserve the right to change your mind, then you just might make the correct decision.

Ilya Spivak, Currency Strategist

Markets – Like People – Have a Short Memory

My philosophy on technical analysis is that chart setups ought to look as aesthetically pleasing and “obvious” to the naked eye as possible. This increases the probability that a multitude of others are seeing the same thing and trading on it, improving the likelihood that the pattern or signal I’ve identified will play out. After a deeply frustrating “lesson” at the hands of EURUSD, I will now add a qualifier to this approach: timely setups matter most.

I sold EURUSD on a textbook retest of support-turned-resistance after prices took out a trend line guiding the July-October rebound. The trade began to work almost immediately, with prices sinking from just below 1.30 toward the 1.27 figure. When the pair found interim support and corrected higher I was not too concerned, thinking that as long as prices remained below the major falling trend line set from the May 2011 top I would continue to hold.

When the pair initially broke this barrier, I was disappointed but not too angry. “C’est la vie,” I thought – sometimes you get stopped out. It was two days later when the pair reversed sharply lower and I began scrambling for what happened, only to realize that while I was admiring a pretty long-term trend line that seemed to fit prices just-so, I missed a fairly obvious (and arguably less exciting) channel that capped the upside and produced a clean reversal in what would’ve been my direction.

Michael Boutros, Currency Strategist

When Technicals and Fundamentals Collide, Paralysis Can be Costly

Trading requires conviction, technique, and patience. But what do you do when global headlines are littered with doom and gloom yet markets continue to move against your fundamental bias? When the market speaks, listen.

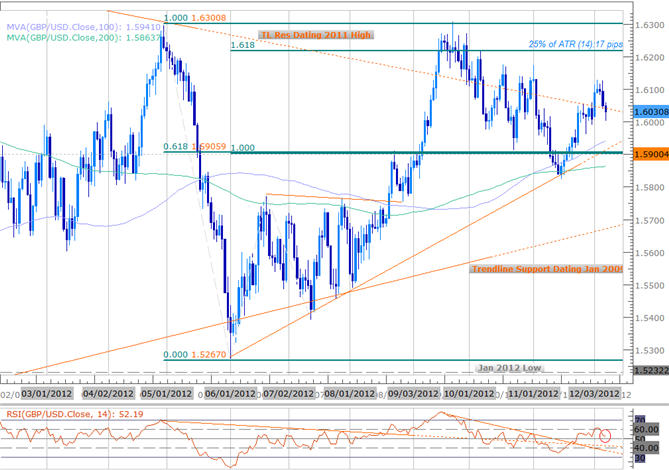

In July of 2012 the Bank of England increased their asset purchase program by £50Billion after the UK posted its third quarterly contraction in GDP. UK headlines continued to flash reports of weaker than expected retail sales, employment data and growth metrics which fed an endless stream of bearish commentary from media sources and analysts across the board. And with more easing expected from the central bank, the sterling's position seemed precarious as it approached a multi-month trendline resistance in late August, which inevitably gave way to an advance into the 1.59-handle.

From a technical standpoint, (the foundation of my analysis) the 1.59-threshold had been a paramount level noted multiple times in previous weeks as a key pivot for the pair going back as far as June of 2011. Further highlighting this figure was the presence of key Fibonacci levels with the 61.8% retracement from the late-April decline and the 100% extension off the June lows converging just above the 1.59-handle. Even momentum indicators, which my strategy utilizes as a trigger, marked the break with a breach and rebound off RSI trend line resistance dating back to the April highs. All the technicals were inline when the level was compromised on September 6th, 2012.

However the endless barrage of headlines and concerns over the deepening crisis in the neighboring euro-zone instilled a paralysis which held me back from taking the position despite my conviction on the technical validity of the move. When all was told, the break above 1.59 yielded a 400pip rally into the highs of the year just above 1.63. Obviously, hindsight is 20/20 and throughout a traders career there will be thousands of judgment calls you will review and analyze to no end. But the lesson to be learned is that a trader must always recognize what is relevant to his/her strategy. The very metrics you base your strategy off will dictate what information/developments are relative to your trading.

The situation repeated itself in late October and mid-November when both a sharp rebound and a false break below this key threshold offered favorable long entries for scalps into the 1.61-figure, both of which I was able to capitalize on. Moral of the story, listen to the market as it pertains to your brand of trading. There will always be chatter and noise across the air waves, but when your channel is coming in crystal clear, act on what you hear. At the end of the day, price action is the single best indicator. . . and it never lies.

David Song, Currency Analyst

Stay Nimble

Coming into 2012, I ran with the theme of ‘Don’t Jump the Gun.’ Throughout the year, I worked on being more prudent in my trading style. Although the new thought process helped to avoid losses, it also held me back from taking advantage of some profitable opportunities. In light of the headline driven market, we saw major currency swing throughout the year, and many of the market trends are expected to carry into 2013 as the fundamental outlook for the world economy remains clouded with high uncertainty.

With my longer-term trading style, I’ve developed a general tendency of standardizing the size of my position based on the type of trade. I commonly implement this approach, especially with news events. However, at times, I found myself in a much better position when I was more flexible with risk tolerance.

One currency pair that comes to mind is the EURUSD. As the weakening outlook for growth and inflation in the Euro-area encouraged a bearish outlook for the Euro, there was a slew of negative data that weighed on the exchange rate, such as the interest rate cuts from the European Central Bank (ECB). I could have been more aggressive when trading those outcomes that have a potential of having a more-lasting impact on the exchange rate. At the same time, current market conditions have increased my willingness to turn shorter-term trades into a larger position amid the large swings in the exchange rate, and will continue to be flexible with my risk tolerance as major macro themes continue to dictate price action in the currency market.

Christopher Vecchio, Currency Analyst

Ignoring the Details

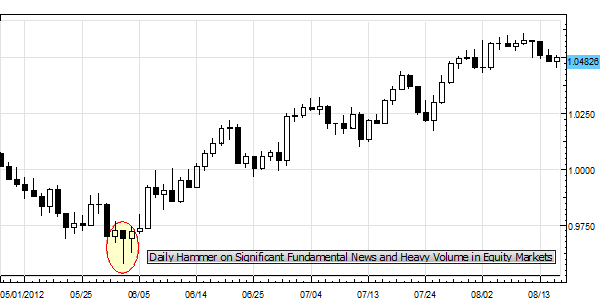

My top trading mistake of 2012 was continuing to trade the AUDUSD short after June 1, despite very obvious reasons not to.

From the technical perspective: the AUDUSD made a daily Hammer, a reversal bar, on heavy volume in US equity markets; technical patterns are deemed more credible when market participation rates are higher. Additionally, the pair broke a downtrend that took place throughout April and May, clearing late-May swing highs and out of the channel on June 6; this is another sign that remaining short was a poor decision.

The catalyst for the break of the downtrend was a dismal US Nonfarm Payrolls report for May, released on June 1, which dramatically raised the likelihood of another round of QE from the Federal Reserve (this proved to be true, as the FOMC announced QE3 in September). Conventional wisdom at the time was that both Asian and European economics were weakening, but the weak US labor market reading switched the narrative to a very bullish, excitable mindset in the near-term. Ignoring the shift in the short-term fundamentals and staying fixated on the long-term growth fundamentals was a mistake.

The Reserve Bank of Australia meeting on June 4 was the microcosm of this idea. That week, following the RBA Rate Decision, the 1Q’12 GDP print was due, as was the May labor market reading and the April trade data report. The swaps market was pricing in a near certainty that the RBA would cut its key interest rate at its meeting, but it did not. This was a good indication that events on the immediate horizon had materially altered the economy’s growth path. After the RBA, the ensuing key data releases beat expectations handily – remaining short was a poor decision and yet the clues were on the table.

Written by the DailyFX Research Team

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance