Forex: Commentary from Japanese Officials Adds Fuel to Technical Turn in Yen

ASIA/EUROPE FOREX NEWS WRAP

With the Euro pulling back significantly yesterday, and the commodity currencies in general signaling broader risk-aversion for the past few weeks, a bit of interesting commentary from a key Japanese official has provoked a sharp pullback in the Yen-crosses (AUDJPY, EURJPY, USDJPY, etc. lower). Japanese Finance Minister Taro Aso said in parliament today that “the yen’s sudden move from ¥78 or ¥79 to ¥90 [versus the US Dollar) was not something we anticipated.”

As Senior Technical Strategist Jamie Saettele made note of in the DailyFX Real Time News feed this morning, a number of ‘bells’ are going off suggesting that we may have arrived at a turning point in the Yen-crosses. Specifically, our attention is on EURJPY; earlier this week, taking a fundamental perspective, I suggested that the Euro may have topped. If the technical conditions are in place to see the Yen bottom and the Euro top, the fundamentals are certainly there as well. According to the CFTC’s COT report, net non-commercial futures positioning remains near its shortest level in the Yen since July 2007. Meanwhile, Euro long positioning has surged. In Japan, Bank of Japan Governor Masaaki Shirakawa announced that he would step down on March 19 earlier this week, but this does not present a material change to the view that further dovish policies will be in place until the new BoJ Governor takes the reins.

Europe is a trickier situation, but one that is starting to look rather fragile. Political concerns in both Italy and Spain are heating up, with the former on the verge of tight elections, while the latter is seeing corruption charges and general disintegrating sentiment towards the government build. On the monetary front, with European Central Bank President Mario Draghi emphatically underscoring the softening inflation and growth outlooks, rate expectations have turned south, sending the EURJPY has towards ¥123.50.

Taking a look at European credit, peripheral yields have eased, but the hangover of the ECB press conference yesterday has held back the Euro from rallying. The Italian 2-year note yield has decreased to 1.594% (-6.5-bps) while the Spanish 2-year note yield has decreased to 2.671% (-8.1-bps). Similarly, the Italian 10-year note yield has decreased to 4.519% (-5.6-bps) while the Spanish 10-year note yield has decreased to 5.294% (-9.4-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 11:30 GMT

JPY: +1.15%

AUD: +0.53%

NZD: +0.50%

GBP:+0.20%

CHF:+0.15%

EUR:+0.06%

CAD:+0.02%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.48% (+0.53 % past 5-days)

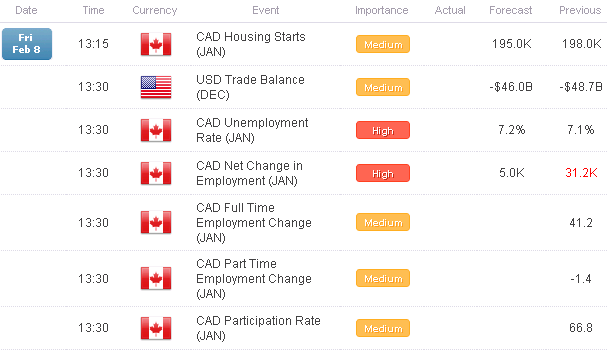

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

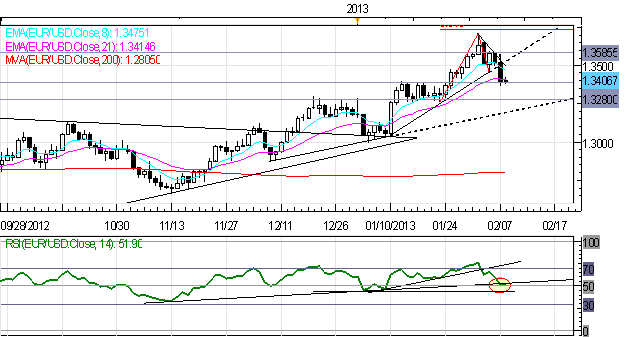

EURUSD: No change: “Consolidation occurring after overshoot towards 1.3700; with the daily RSI uptrend breaking, a pullback towards 1.3500 should not be ruled out. I maintain: with the daily RSI well into overbought territory, a pullback would be deemed healthy. Dips into 1.3500 are deemed constructive. Support is 1.3615/20 (weekly R2), 1.3540 (weekly R1), and 1.3500. Resistance is 1.3635/60 and 1.3755/85 (weekly R3, monthly R1).”

USDJPY: No change: “Further bullish price action as US Treasury yields strengthen and speculation over BoJ policy arises again. Resistance comes in at 92.00/05 (breaking now) (weekly R1), 93.15/20 (weekly R2), and 93.45/50 (monthly R3). Support comes in at 91.00 and 90.00/10 (weekly pivot, monthly R2).”

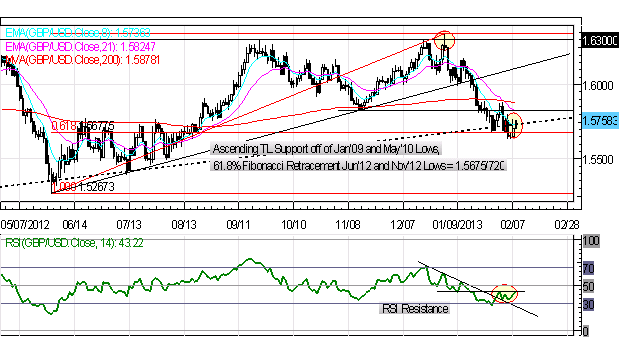

GBPUSD: The pair is holding below the 61.8% Fibonacci retracement from the June low to January high, vindicating the “cover on dips, sell rallies” perspective. I continue to look to sell rallies in the pair as significant RSI divergence exists. A hold below 1.5675 eyes a move towards 1.5500, and ultimately, 1.5265/70, the June low. Resistance comes in at 1.5825 and 1.5885/90. Support is 1.5675 and 1.5580 (monthly S1).

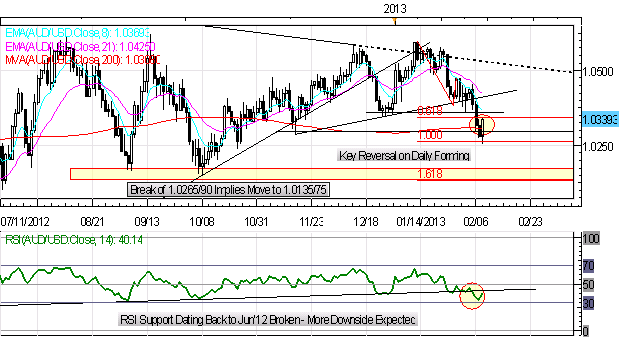

AUDUSD:A break below 1.0360 has given way to a move into the November swing low and 200-DMA at 1.0285/310, which could prove to be an area to look for a bounce. However, the daily RSI support dating back to June 2012 is breaking, suggesting that further downside should be sought. Resistance comes in at 1.0360 and 1.0425. Support is 1.0290 and 1.0150.

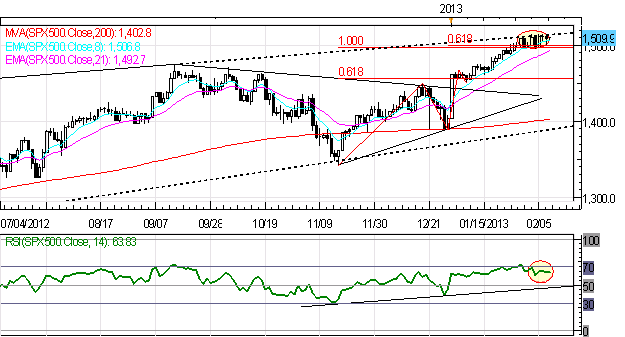

S&P 500: Tuesday I said: “as indicated on the charts the past weeks, noting “nearing the top 1505/1512” – the top was 1504.6. If this breaks, 1520 is in sight.” Indeed, the irrational exuberance has continued, bringing topline Bearish Rising Wedge resistance in focus at 1512/15; the December 2007 highs of 1520/24 could be reached on an overshoot. Bottom line: I’m expecting a crash in the S&P 500 unless volumes accelerate rapidly, given the disconnect from reality.

GOLD: The past few weeks I’ve maintained: "When considering the move off of the September highs, a measured A-B=C-D (as expressed on the Daily) suggests that a bottom could be in place at [1630/40].” The rebound has ensued, with the alternative safe haven rallying up to 1690 today. A daily close above 1700 points towards 1722/25 and 1755. Support is 1663 (200-EMA) and 1640/45.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance