Forex Analysis: US Dollar Springs Higher as S&P 500 Sinks Past Support

THE TAKEAWAY: The US Dollar pushed higher to challenge key technical resistance as the S&P 500 sank downward, boosting demand for the go-to safe haven currency.

US DOLLAR TECHNICAL ANALYSIS– Prices took out resistance at 9982, the 50% Fibonacci retracement, with buyers now challenging the top of a rising channel established from mid-September (10020). This barrier is reinforced by the 61.8% Fib at 10038. A push above the latter boundary exposes the 76.4% retracement at 10109. The 9982 level has been recast as support, with a drop below that exposing the 38.2% mark at 9925.

Daily Chart - Created Using FXCM Marketscope 2.0

S&P 500 TECHNICAL ANALYSIS – Prices broke support at 1369.40, the 50% Fibonacci retracement level, exposing the 61.8% level at 1344.50 as the next downside objective. The 1369.40 level has been recast as resistance, with a reversal back above that targeting the 38.2% Fib at 1394.30.

Daily Chart - Created Using FXCM Marketscope 2.0

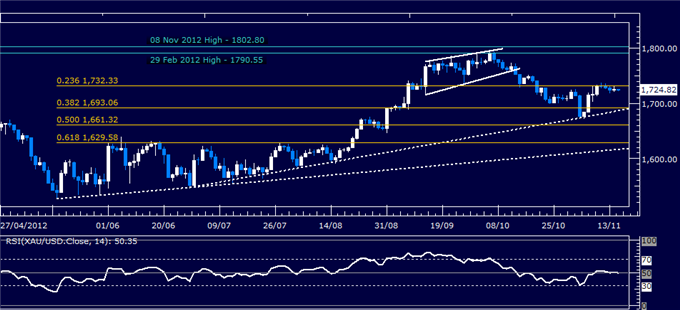

GOLD TECHNICAL ANALYSIS – Prices are testing resistance at 1732.33, the 23.6% Fibonacci retracement. A push above that targets the 1790.55-1802.80 area. Near-term support is at 1693.06, the 38.2% Fib, a barrier reinforced by a rising trend line set from late June (now at 1687.00). A drop beneath the latter level targets the 50% Fib at 1661.32.

Daily Chart - Created Using FXCM Marketscope 2.0

Want to learn more about RSI? Watch this Video.

CRUDE OIL TECHNICAL ANALYSIS– Prices continue to hover above the 50%Fibonacci expansion at 83.76.A break below that exposes 80.00 figure and the 61.8% level at 7978. Resistance is at 86.95, marked by a falling trend line set from the September 14 high and reinforced by the 38.2% Fib 87.66. A push above that aims for the 90.00 figure and the 23.6% expansion at 92.53.

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for Dailyfx.com

To contact Ilya, e-mail ispivak@dailyfx.com. Follow Ilya on Twitter at @IlyaSpivak

To be added to Ilya's e-mail distribution list, please CLICK HERE

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance