Forex Analysis: Will US Dollar Continue Post-Presidential Election Rally?

The US Dollar (ticker: USDOLLAR) has rallied as the Dow Jones Industrial Average has fallen sharply following the re-election of the US President. Can this Dollar rally and Dow sell-off last?

Prosthat favor a US Dollar rally and Dow Jones sell-off:

Investors sell risky assets as they brace for Fiscal Cliff difficulties in Q4

Growth fears in Europe could keep pressure on Euro/US Dollar, European equities

We can’t ignore risks that this could be the start of a long-awaited EURUSD correction, however, and we see two key reasons for which this could be the start of a larger US Dollar bounce.

Consagainst continued US Dollar strength and selling EURUSD weakness:

USDOLLAR failure at key resistance could put Dollar rally at risk

The Euro/US Dollar trades near critical support and could bounce

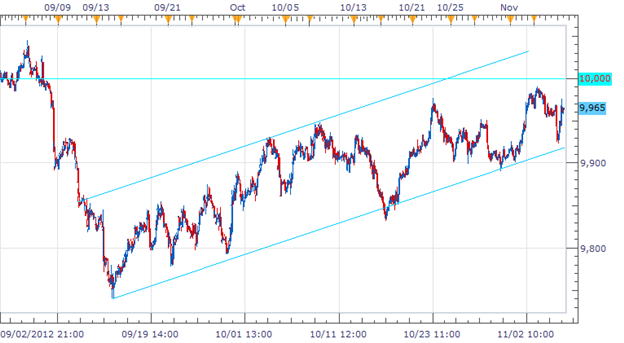

Dow Jones FXCM Dollar Index Nears Critical 10000 Mark as Dow Jones Industrials Tumble

Source: FXCM Trading Station Desktop

It will be critical to watch the USDOLLAR’s next moves as markets react to clear uncertainty following the US Presidential elections.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up to David’s e-mail distribution list via this link.

New to forex? Sign up for our DailyFX Forex Education Series

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance