Forex Analysis: Trading Systems Sell US Dollar

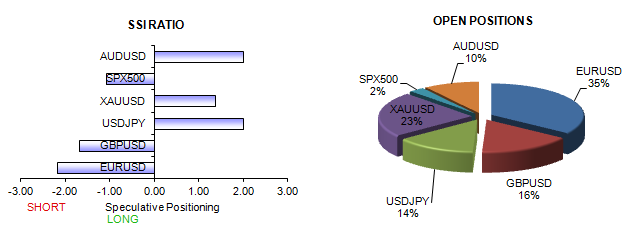

Retail forex traders remain heavily long the US Dollar (ticker: USDOLLAR), and our sentiment-based strategies have sold the USD versus the Euro and other major counterparts.

View individual currency sections:

EURUSD - Trading Systems buy Euro versus US Dollar

GBPUSD - British Pound Could Fall Further versus US Dollar

USDJPY - Japanese Yen Forecast to Fall Further

USDCAD - Canadian Dollar Offers Range Trading

USDCHF - Swiss Franc Forecast to Fall Further

AUDUSD - Australian Dollar Could Break Lower

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

Our proprietary sentiment-based trading strategies have actively sold the US Dollar and the Japanese Yen against major counterparts. Recent readings on USD and JPY trading conditions leave us broadly in favor of selling any short-term rallies; we like the systems’ recent trades.

Two important exceptions are the Swiss Franc and the Australian Dollar. The USDCHF has broken decisively higher and current momentum favors buying the USD against the Swiss currency. Our SSI-based systems have recently gone long the AUDUSD, but it will be critical to watch the pair’s next moves as it could break decisively below key support.

Download eight years worth of SSI data via this link.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

New to FX markets? Learn more in our video trading guide.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance