Forex Analysis: Japanese Yen Forecast to Fall Further

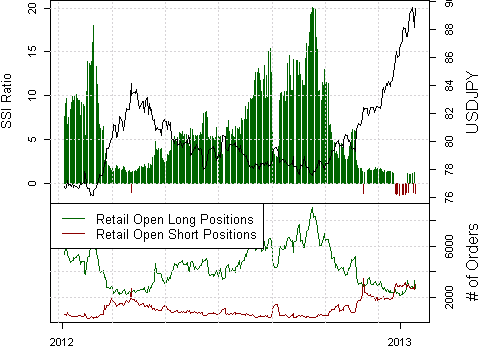

USDJPY – Forex trading crowds remain net-short the US Dollar (ticker: USDOLLAR) against the Japanese Yen as the pair surges to fresh multi-year highs. Two weeks ago we warned of a potential sentiment extreme and short-term USDJPY top. Yet the reversal clearly proved short-lived and a run towards ¥90 seems likely.

Trade Implications – USDJPY: One of our retail sentiment-based trading strategies most recently attempted to go short USDJPY but got stopped out at breakeven. That same system is now close to going long, and the severity of the USDJPY uptrend makes this our preferred position.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

New to FX markets? Learn more in our video trading guide.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance