Forex Analysis: Japanese Yen Bounce Clouds Outlook

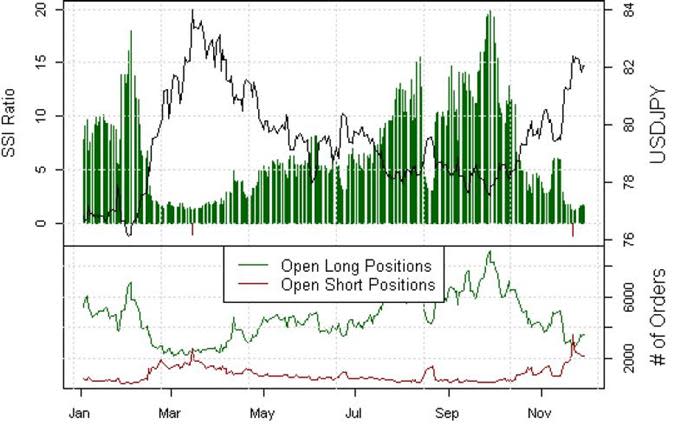

USDJPY – Forex trading crowds have bought into a recent US Dollar (ticker:ticker::USDOLLAR) pullback against the Japanese Yen, and the modest shift in sentiment clouds our previous forecasts for USDJPY strength.

We maintain that the USDJPY set a significant bottom through September, but the build in crowd buying crowds warns against the potential for a larger short-term pullback. We remain bullish as long as the USDJPY remains above key congestion levels between ¥81.10-¥81.60.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance