Forex Analysis: Euro May Have Set Important Top

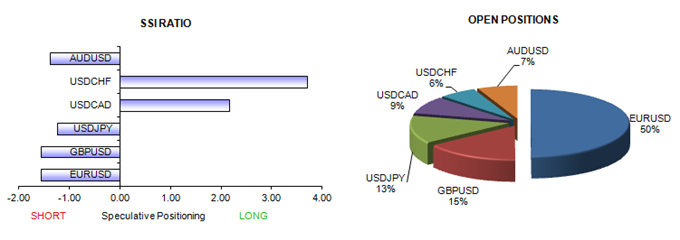

An important turn in US Dollar (ticker: USDOLLAR) trading sentiment warns that the EURUSD set an important top, while the USDJPY and AUDUSD see key risks of correction.

View individual currency sections:

EURUSD - Trading Systems Sell Euro on Major Sentiment Shift

GBPUSD - British Pound Sentiment Warns of Continued Weakness

USDJPY - Japanese Yen At Clear Risk of Correction

USDCHF - Swiss Franc Outlook Remains Bullish

USDCAD - Canadian Dollar Forecast to Strengthen

AUDUSD - Australian Dollar Forecast Turns Positive

One of our proprietary sentiment-based trading strategies has recently gone short EURUSD on an important week-over-week change in trading crowd positioning. And though it’s always risky to trade reversals, early signs favor EURUSD weakness.

Yet we’ve seen the opposite US Dollar trading signal for the AUDUSD; our systems have most recently turned in favor of strength. The USD may likewise see weakness against the downtrodden Japanese Yen as the risk of correction is significant.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

New to FX markets? Learn more in our video trading guide.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance