FOREX Analysis: Dollar and Stocks May Reverse again Early Next Week

The confluence of technical levels across multiple markets suggests that recent moves may extend for one or two days before markets reverse yet again. Expect support in the USDOLLAR at 9935/45 and resistance in the S&P 500 near 1425.

S&P 500

Daily

Prepared by Jamie Saettele, CMT

Equity Observation: The SPX rallied for a 5th consecutive day (last Friday was a JS Spike) and there is probably one to two days left on the upside before the market experiences a sharp reaction. The mid 1420s should produce a top. Of what significance I’m not sure but it’s possible that the top constitutes a secondary top ahead of the high (either a 2nd wave or B wave). The 61.8% retracement of the decline from the top comes in at 1424.20. The 100% extension of the rally from the low (1342.10-1390.90 from 1379.10) is at 1427.80. More importantly, 1424.90 is the April high and within the vicinity of pivots since August (circled).

Equity Trading Implication: Expect a top near 1325.

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR)

Daily

Prepared by Jamie Saettele, CMT

FOREX Observation: I wrote Wednesday to “respect potential for a reversal from current levels as the advance from Monday’s low is impulsive. This raises the possibility of truncation”. The USDOLLAR reversed sharply, producing a JS Thrust in the process. Near term focus is on the 38.2% retracement of the rally from 9740, at 9945. The level is reinforced by trendline support and the 10/10 high.

FOREX Trading Implication: I’m on the lookout for a low and opportunity to turn bullish again near 9945.

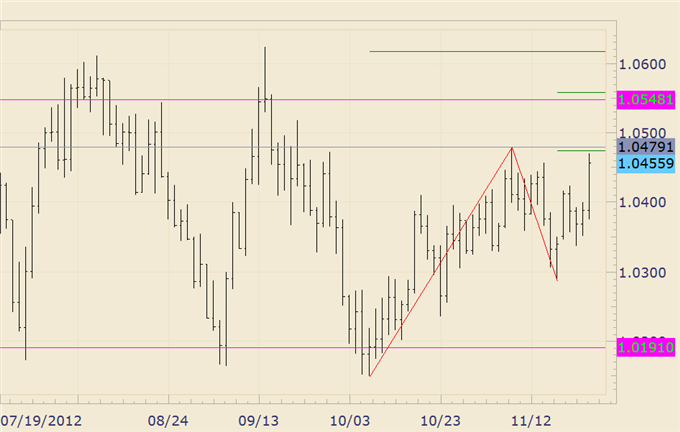

Euro / US Dollar

Daily

Prepared by Jamie Saettele, CMT

FOREX Observation: The EURUSD rallied through its November 1 high and settled at the 61.8% retracement of the decline from the top. Price has entered the bottom of a resistance zone that extends to about 13070. Near term pattern suggests slightly higher prices in stair step fashion (4th and 5th waves) before exhaustion. The topping process that began in May 2011 and February 2012 is similar to the current process that began in September.

FOREX Trading Implication: I noted Wednesday that that “the larger trend is down and I expect to short early next week, hopefully at higher levels.” I had figured that shorts would be initiated near 12900 but the rally offers and even better opportunity, probably closer to 13070.

Australian Dollar / US Dollar

Daily

Prepared by Jamie Saettele, CMT

FOREX Observation: The AUDUSD has nearly reached the 100% extension of the 10287-10424 rally at 10479 (right at the November high). As is the case across most markets, expect the current move to extend slightly higher over the next few days. 10550, the 9/14 reversal day close and 161.8% extension of 10287-10424, is a level that may produce the next top. It’s worth keeping in mind the longer term AUD/USD triangle, in which price probably declines towards parity or below in order to complete triangle wave E.

FOREX Trading Implication: I’m long from Wednesday at 10340 but looking for a top near 10550. 10438/48 is near term support.

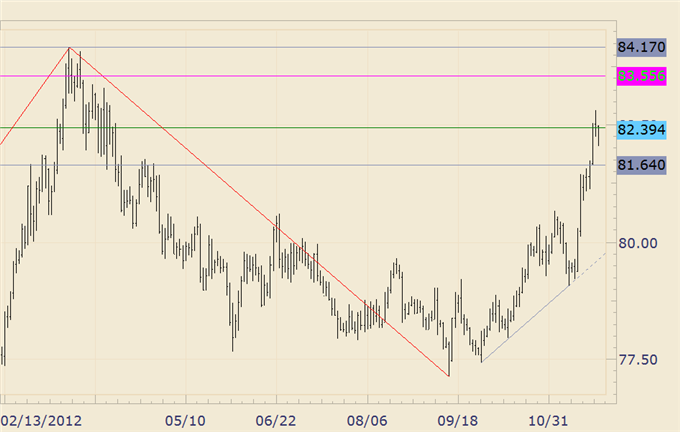

US Dollar / Japanese Yen

Daily

Prepared by Jamie Saettele, CMT

FOREX Technical Analysis Observation:The USDJPY has reached and bounced from support. The dip presented the opportunity to align with the move for a test of 8355 and potentially a break of the March high at 8417. 8164 is now the pivot.

FOREX Trading Implication: Look higher from current levels as the drop to 8206 probably completed a short term correction.

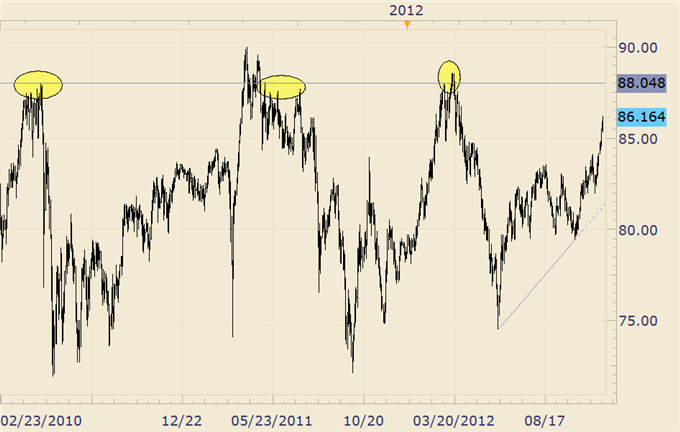

Australian Dollar / Japanese Yen

Daily

Prepared by Jamie Saettele, CMT

FOREX Technical Analysis Observation: TheAUDJPY has been expensive in recent years near 8800. Important tops formed in 2010 (8804), May 2011 (8810), and March 2012 (8804) just above the handle. 8595-8605 is short term support.

FOREX Trading Implication: 8800 is slightly less than 200 pips away so there is plenty of room for short term nimble traders to trade from the long side but I’ll probably act on any signs of exhaustion near 8800.

Euro / Australian Dollar

Daily

Prepared by Jamie Saettele, CMT

FOREX Technical Analysis Observation: The EURAUD rally has stalled at resistance from the 38.2% retracement of the decline from 12825. With 5 waves up from 12258, longs are vulnerable at current levels although it’s worth noting that 12500 is probably strong resistance if reached. 12500 is the 100% extension of the rally from the low and 10/11 low. I’m also on the lookout for a low in AUDCHF near 9620, which is defined by both the 61.8% retracement of its advance from 9436 and 100% extension of the 9904-9708 decline.

FOREX Trading Implication: I’m on the lookout for a EURAUD short early next week. Whether it’s from the current levels or slightly higher will depend on early week action.

--- Written by Jamie Saettele, CMT, Senior Technical Strategist for DailyFX.com

To contact Jamie e-mail jsaettele@dailyfx.com. Follow him on Twitter @JamieSaettele

Subscribe to Jamie Saettele's distribution list in order to receive actionable FX trading strategy delivered to your inbox once a day.

Jamie is the author of Sentiment in the Forex Market.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance