Forex Analysis: Crowds Extremely Long US Dollar, May Continue Lower

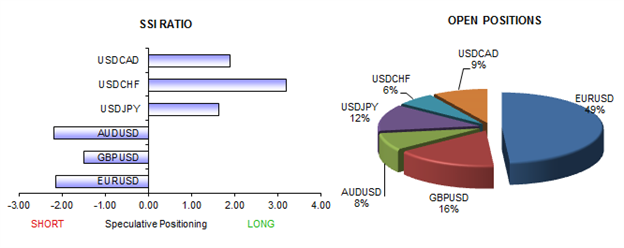

Retail forex trading crowds have bought aggressively into US Dollar (ticker: USDOLLAR) weakness against the Euro and broader counterparts. We’ll take a contrarian view in favor of further USD declines.

View individual currency sections:

EURUSD - Forex Crowds Sell Euro, We Favor Gains

GBPUSD - British Pound Poised for Further Strength

USDJPY - Japanese Yen Bounce Clouds Outlook

USDCHF - Swiss Franc Outlook Bullish

USDCAD - Canadian Dollar Forecast to Strengthen

AUDUSD - Australian Dollar Targets November Highs

The significant shift in trader sentiment has been enough to force our sentiment-based forex trading strategies to sell the US Dollar across the board. Yet this is with the important caveat that retail crowds are often most net-long at the bottom of the market.

We’ll keep a close eye on whether the USDOLLAR is able to trade above psychologically significant resistance at the 10000 mark. If we do indeed see a USD breakout, it might serve as short-term confirmation of an important reversal.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

New to FX markets? Learn more in our video trading guide.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance