FOREX ANALYSIS: Canadian Dollar Forecast to Depreciate

USDCAD –An aggressive shift in forex retail crowd positioning warns that the US Dollar (ticker: USDOLLAR) may be staging a larger rally against the Canadian Dollar.

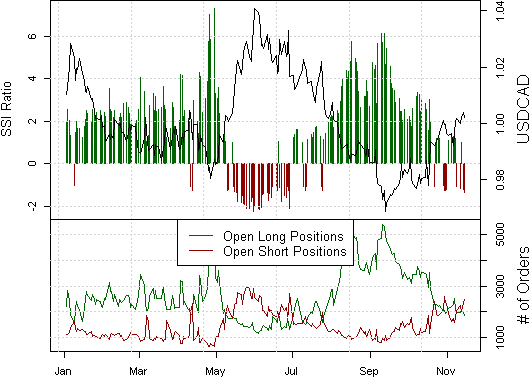

The ratio of long to short positions in the USDCAD stands at -1.17 as approximately 46% of traders are long. In detail, long positions are 4.6% lower than yesterday and 10.8% below levels seen last week. Short positions are unchanged from yesterday yet 20.7% above levels seen last week.

We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the USDCAD may continue higher. Current SSI is lower than yesterday and lower from last week. The combination of current sentiment and recent changes gives a further bullish trading bias.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

New to FX markets? Learn more in our video trading guide.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance