Forex Analysis: Australian Dollar at Risk on US Outlook, Chinese Data

Fundamental Forecast for Australian Dollar: Bearish

A short lull in headline-driving event risk will give financial markets an opportunity for some reflection in the week ahead. The most significant lingering uncertainty over the coming months remains the outlook for US economic growth and there is much to consider in the aftermath of last week’s volatility before the next major inflection point – the fight over an increase in the “debt ceiling” – enters the spotlight in earnest.

On one hand, risk appetite reacted favorably to a last-minute agreement averting the so-called “fiscal cliff”, but the reaction seemed overdone. While the smaller-scale tax hike baked into the accord is preferable to a far larger and broader increase that would have been triggered without a deal, it is nonetheless a headwind from an economic growth perspective.

Meanwhile, fears of an early end to the Fed’s stimulus efforts after the release of minutes from December’s FOMC sit-down seem likewise overblown. The decision to adopt the “Evans rule” linking rates to explicit inflation and unemployment targets was already mildly hawkish in that it established a firm exit strategy for the first time since the dawn of the Great Recession. However, even if the Fed cuts off asset purchases at the mid-year mark, the central bank will still expand its balance sheet by close to $0.5 trillion.

On balance, the fiscal side of the equation seems to carry a greater degree of near-term uncertainty than the monetary one. That suggests the path of least resistance likely favors risk aversion as markets digest recent news-flow and weigh up the various catalysts shaping the growth profile of the world’s largest economy. That bodes ill for the Australian Dollar, where prices continue to show a strong link to sentiment trends (the correlation between AUDUSD and the MSCI World Stock Index is now at 0.7 on 20-day percent change studies).

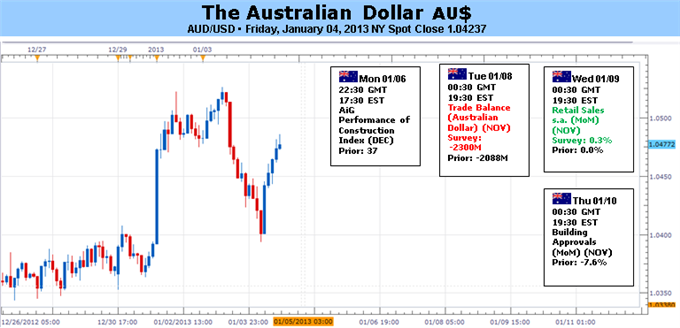

Turning to the economic calendar, a quiet homegrown docket puts the spotlight on the week’s Chinese data set. Consumer Price Index figures are due to show the year-on-year inflation rate accelerated to a seven-month high at 2.3 percent in December. The outcome may weigh against Chinese stimulus hopes and weigh on the Australian Dollar. Indeed, China is Australia’s largest export market so performance there is critical for the latter country’s own growth trends and thereby for its monetary policy as well as the Aussie.

December’s Trade Balance report is also due to cross the wires, with forex traders looking closely at the Exports gauge. Overseas sales growth is forecast to have picked up to a year-on-year rate of 5 percent from 2.9 percent in the prior month. While this may prove supportive for the Australian Dollar, the impact is likely to be modest considering the result would fall well below near- and medium-term trend growth averages.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance