FMC Corp (FMC) Inks Deal to Acquire BioPhero for $200 Million

FMC Corporation FMC recently announced a definitive deal to acquire BioPhero ApS. The latter is a Denmark-based pheromone research and production company. The acquisition adds biologically produced state-of-the-art pheromone insect control technology to the company’s product portfolio and R&D pipeline, highlighting FMC's role as a leader in delivering innovative and sustainable crop protection solutions.

BioPhero has established a highly efficient yeast fermentation process for producing pheromones at considerably lower costs and with fewer production steps than competitors' traditional chemical synthesis methods. The lower costs expand the pheromone addressable market from the current focus on specialty fruit and vegetables to now include the large row crop market.

FMC projects pheromones and pheromone-based products to contribute roughly $1 billion in revenues at above company-average EBITDA margin by 2030. The acquisition is expected to complete at the end of the third quarter of 2022 and the purchase price of around $200 million will be paid at closing.

FMC stated that this acquisition demonstrates its continuing commitment to investing in biologicals and adjacent technologies, expanding its world-class portfolio while advancing sustainable agriculture.

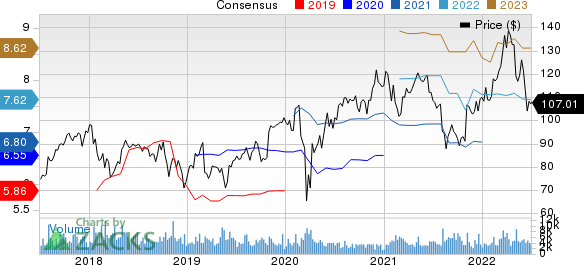

Shares of FMC Corp have declined 1.4% in the past year compared with a 14.4% fall of the industry.

Image Source: Zacks Investment Research

FMC, in its last earnings call, stated that it continues to expect revenues between $5.25 billion and $5.55 billion for 2022, indicating a rise of 7% at the midpoint from 2021 levels. Sales are expected to be driven by higher volumes and prices in all regions.

The company also forecasts adjusted EBITDA in the band of $1.32-$1.48 billion for 2022, indicating a 6% increase at the midpoint from 2021 levels.

FMC now expects adjusted earnings per share for 2022 in the range of $6.70-$8.00 (compared with $6.8-$8.10 expected earlier), suggesting an increase of 6% at the midpoint from 2021 figures.

Free cash flow for 2022 is projected to be $515-$735 million. The company also expects to repurchase $500-$600 million shares in 2022.

For second-quarter 2022, revenues are projected in the band of $1.31-$1.39 billion, reflecting an increase of 9% at the midpoint compared with the prior-year quarter’s levels. Adjusted earnings are forecast in the range of $1.70-$2.00 per share, representing an increase of 2% at the midpoint from the prior-year quarter’s levels. It also expects adjusted EBITDA in the range of $330-$370 million for the quarter.

FMC Corporation Price and Consensus

FMC Corporation price-consensus-chart | FMC Corporation Quote

Zacks Rank & Key Picks

FMC Corp currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Allegheny Technologies Inc. ATI, Cabot Corporation CBT and Nutrien Ltd. NTR.

Allegheny has a projected earnings growth rate of 1,076.9% for the current year. The Zacks Consensus Estimate for ATI's current-year earnings has been revised 40.4% upward in the past 60 days.

Allegheny’s earnings beat the Zacks Consensus Estimate in the last four quarters. It has a trailing four-quarter earnings surprise of roughly 128.9%, on average. ATI has gained around 8.7% in a year and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cabot, currently sporting a Zacks Rank #1, has an expected earnings growth rate of 22.5% for the current year. The Zacks Consensus Estimate for CBT's earnings for the current year has been revised 6% upward in the past 60 days.

Cabot’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.2%. CBT has gained around 10.2% over a year.

Nutrien has a projected earnings growth rate of 174.6% for the current year. The Zacks Consensus Estimate for NTR’s current-year earnings has been revised 30.7% upward in the past 60 days.

Nutrien’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the average being 5.8%. NTR has gained 31% in a year. The company flaunts a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allegheny Technologies Incorporated (ATI) : Free Stock Analysis Report

FMC Corporation (FMC) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance