FMC Corp (FMC) Up 20% in 6 Months: What's Behind the Rally?

Shares of FMC Corporation FMC have shot up 19.6% over the past six months. The company has also outperformed its industry’s rise of 12.8% over the same time frame. It has also topped the S&P 500’s roughly 6% rise over the same period.

Let’s take a look into the factors that are driving this Zacks Rank #3 (Hold) stock.

Image Source: Zacks Investment Research

What’s Aiding FMC?

FMC Corp is seeing healthy demand for its industry leading products, driven by strong global agricultural market fundamentals. It is well placed to capitalize on the underlying strength in global crop protection markets thanks to high commodity prices.

The strong demand environment coupled with the company’s price increase actions is driving its top line. It is actively taking price increase measures to mitigate the impact of cost inflation.

Moreover, FMC remains focused on boosting its market position and strengthening its product portfolio. It is investing in technologies and products as well as new launches to enhance value to the farmers. New products launched in Europe, North America and Asia are gaining significant traction and are contributing to volume growth. Product introductions are expected to support the company’s results this year.

The acquisition of BioPhero ApS, a Denmark-based pheromone research and production company, also adds biologically produced state-of-the-art pheromone insect control technology to the company’s product portfolio and R&D pipeline, highlighting FMC's role as a leader in delivering innovative and sustainable crop protection solutions.

FMC Corp, in its third-quarter call, raised its revenue outlook for 2022 to the range of $5.6-$5.8 billion (from $5.5-$5.7 billion), indicating a rise of 13% at the midpoint from 2021 levels. Sales are expected to be driven by higher volumes and prices in all regions partly offset by foreign currency headwinds. The company also now expects adjusted earnings per share for 2022 in the range of $7.10-$7.60, suggesting an increase of 7% at the midpoint from the 2021 level.

The company also sees fourth-quarter revenues in the range of $1.42-$1.62 billion, reflecting an 8% rise at the midpoint compared with the prior-year quarter’s levels. Adjusted earnings are forecast in the range of $2.05-$2.55 per share, representing a rise of 9% at the midpoint from the prior-year quarter’s levels. It also expects adjusted EBITDA in the range of $395-$455 million for the quarter, representing a rise of 15% at the midpoint from the prior-year quarter’s levels.

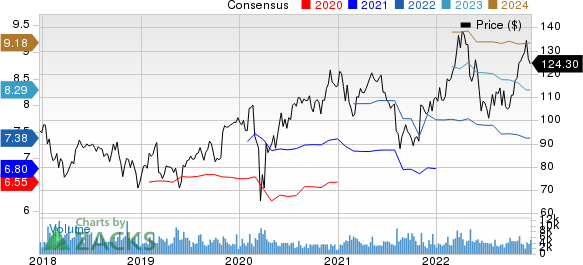

FMC Corporation Price and Consensus

FMC Corporation price-consensus-chart | FMC Corporation Quote

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space include Olympic Steel, Inc. ZEUS, Commercial Metals Company CMC and Sociedad Quimica y Minera de Chile S.A. SQM.

Olympic Steel currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for ZEUS's current-year earnings has been revised 4.8% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 25.4%, on average. ZEUS has rallied around 45% in a year.

Commercial Metals currently carries a Zacks Rank #1. The consensus estimate for CMC's current-year earnings has been revised 8.7% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 19.7%, on average. CMC has gained around 45% in a year.

Sociedad has a projected earnings growth rate of 540.5% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 1.5% upward in the past 60 days.

Sociedad has a trailing four-quarter earnings surprise of roughly 37.4%. SQM has rallied roughly 80% in a year. The company currently carries a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

FMC Corporation (FMC) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance