Flying Through the Business Cycle, Fed Needs to Land the Plane (Capital Market Research) (Weekly Market Outlook)

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

1

Moody’s Analytics and Moody’s Investors Service maintain separate and independent economic forecasts. This publication uses the

forecasts of Moody’s Analytics. Moody’s Analytics markets and distributes all Moody’s Capital Markets Research materials.

Moody’s Analytics does not provide investment advisory services or products. For further detail, please see the last page.

Flying Through the Business

Cycle, Fed Needs to Land the

Plane

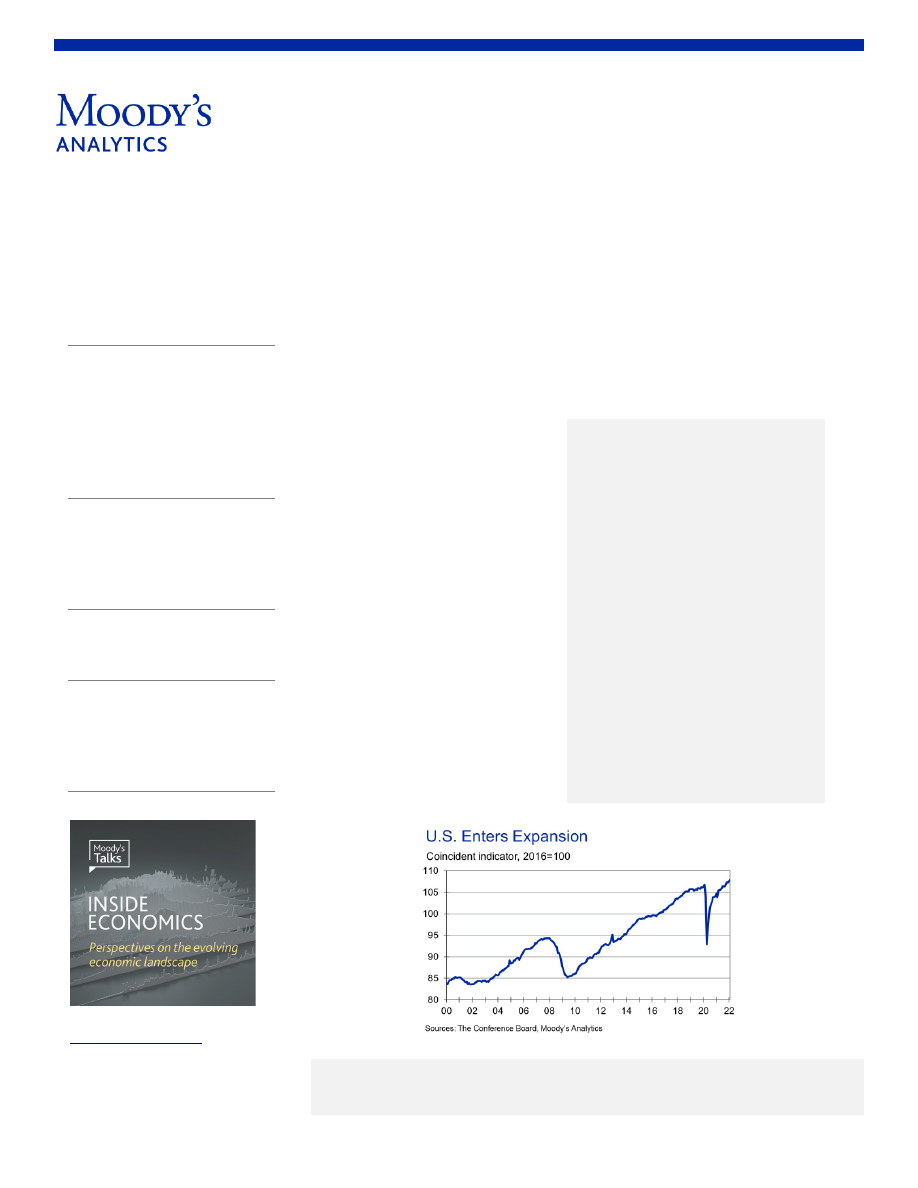

The U.S. economy is flying through the

different phases of the business cycle;

we recently moved the economy from

the recovery to expansion phase of the

business cycle. This was partly based on

the Conference Board’s consumer

coincident indicator, which recently

surpassed its prior peak.

Not everyone differentiates between

recoveries and expansions, and the two

terms are sometimes used

interchangeably. The National Bureau of

Economic Research's Business Cycle

Dating Committee—the de facto arbiter

of the economy's peaks and troughs—

defines any period from a trough to a

peak as an expansion, labeling the

remainder of the cycle a recession.

WEEKLY MARKET

OUTLOOK

MARCH 24, 2022

Lead Authors

Ryan Sweet

Senior Director-Economic Research

Mark Zandi

Chief Economist

Chris Lafakis

Director

Asia-Pacific

Denise Cheok

Economist

Heron Lim

Economist

Europe

Ross Cioffi

Economist

U.S.

Steven Shields

Economist

Matt Orefice

Data Specialist

Podcast

Table of Contents

Top of Mind ....................................... 3

Week Ahead in Global Economy .. 6

Geopolitical Risks ............................ 7

The Long View

U.S. ....................................................................... 8

Europe ............................................................... 12

Asia-Pacific ..................................................... 13

Ratings Roundup ............................ 14

Market Data .................................... 18

CDS Movers .................................... 19

Issuance ........................................... 22

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

2

Many economists, however, use "recovery" to mean the

period just after a recession, until real GDP surpasses its

prerecession level. However, this is a rather narrow

definition; GDP often recovers ahead of other indicators.

The Conference Board's indicator incorporates a broader

range of factors to determine when a recovery becomes an

expansion.

There are three phases of an expansion: early-, mid- and

late-stage, with the mid-stage usually being the longest. To

identify where we are in the expansion, we used a K-means

clustering approach to spot patterns and map the economic

data. It points toward an early-stage expansion. Considering

the nature of the recession and the subsequent recovery,

odds are that the economy will likely continue to shift

through the different states of the business cycle more

quickly than in the past.

Is the Fed panicking?

Our baseline forecast is for what the Federal Reserve will do,

rather than what it should do. Therefore, odds are there will

be some material changes to our assumptions about

monetary policy when we update the April baseline forecast.

Fed Chair Jerome Powell’s comments on Monday suggest

the Fed may not have any patience left and is set to

accelerate the removal of monetary policy accommodation.

Powell said, “There is an obvious need to move expeditiously

to return the stance of monetary policy to a more neutral

level.” This caused financial markets to adjust their

expectations for the path of the target fed funds rate.

Markets now expect the fed funds rate to be 2.25% at the

end of this year, a significant deviation from their

expectations this time last year.

Various measures of the yield curve continue to flatten,

which will catch the Fed’s attention. Lost in the debate

about the yield curve is that the correlation between

inversions and recessions doesn’t imply causation. The

inversion simply reflects the conditions that cause

recessions—for example, an overheating economy and

tighter monetary policy. Therefore, the Fed cannot lower the

risk of recession by simply pausing its current tightening

cycle to avoid an inversion in the yield curve. This could

increase the odds of recession, since delaying rate hikes

would cause the economy to overheat more quickly. Either

way, the Fed is in an enormous bind.

Could corporate bond market provide a pause?

Conditions in the U.S. corporate bond market also could

appear soon on the Fed’s radar. Recently, investment-grade

and high-yield U.S. corporate bond spreads widened

noticeably, albeit from very low levels. However, the speed

of the widening in U.S. corporate bond spreads has caught

our attention, even though it is unlikely to have an

immediate effect on monetary policy. There have been

instances in past tightening cycles where wider spreads in

the U.S. corporate bond market caused the Fed to pause.

The same likely holds today, but the Fed’s tolerance now is

for spreads significantly higher than they are right now.

Even with spreads widening, U.S. dollar-denominated

corporate bond issuance has held up well. This should

temper immediate concerns that wider spreads are going to

undermine businesses' access to credit. Corporate balance

sheets remain strong and the forecast for defaults remains

favorable, so the widening in corporate bond spreads may

not ding issuance as much as some fear. For now, the Fed

will forge ahead with its aggressive tightening cycle.

Soft landing or hard?

An aggressive Fed is priced in by the bond market as are the

odds of a policy error. The current U.S. Treasury futures

curve shows that the spread between the 10-year and two-

year Treasury yields will invert in the next three to six

months. The Treasury futures curve shows an inversion

between the 10-year and three-month Treasury yields in the

next 12 months. Markets believe a soft landing by the Fed is

unlikely.

We will keep a close eye on the yield curve. For the five

recessions we focused on, the average number of months

between an inversion in the spread for 10-year and two-year

Treasury yields and a recession was 24.5 months. However,

a more troubling development than an inversion in the yield

curve would be a steady rise in the unemployment rate or

declines in employment over several months. Both have

proven to be more accurate predictors of recessions, and

with shorter lead times than the yield curve.

If the unemployment rate begins to steadily increase in the

next 12 to 18 months, that would significantly increase the

risk of the U.S. experiencing a bout of stagflation.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

3

TOP OF MIND

Tough to Handicap the U.S. Outlook

BY MARK ZANDI and CHRIS LAFAKIS

The Russian invasion of Ukraine is a significant blow to the

global economy. Its impact is magnified as the economy

continues grappling with the ongoing

pandemic.

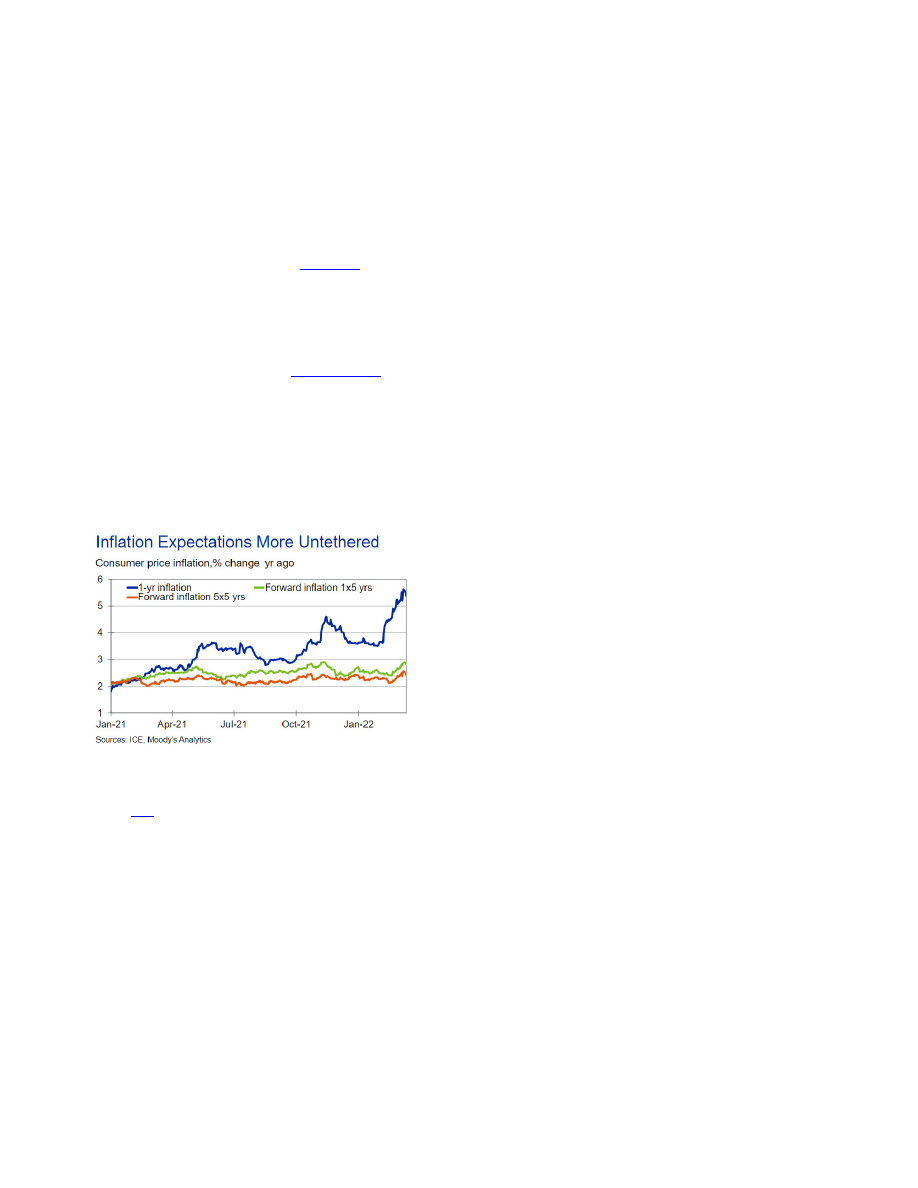

Sudden higher oil, natural gas, agricultural and metal prices

are conflating with already painfully high inflation caused by

the pandemic disruptions to supply chains and labor

markets. Inflation expectations were on the high side of

what is comfortable before the Russian invasion and now

appear increasingly untethered. The

began

normalizing interest rates last week but has much more

work to do, more quickly, to ensure that high inflation does

not become endemic. How the near-term economic outlook

unfolds critically depends on the path of the pandemic, how

the Russian invasion of Ukraine plays out, and whether the

Fed is successful in calibrating monetary policy to these

shocks and any other that may occur.

The most likely near-term outlook—our baseline—remains

that the

economic recovery will evolve into a self-

sustaining expansion in coming months (a 50% probability).

But recession is a serious threat (35% probability), and

dreaded stagflation—high inflation and high

unemployment—has become a meaningful possibility (10%

probability). While more of a stretch (5% probability),

events could turn out better for the economy, since there is

evidence that underlying productivity growth is reviving.

Despite all the economy has had to deal with, odds are that

the current economic recovery will evolve into a self-

sustaining expansion. That is, by late this year, the economy

will return to full employment. This is consistent with an

unemployment rate in the low 3s and an employment-to-

population ratio for prime-age workers of over 80%. Real

GDP growth will throttle back to the economy’s potential

growth rate of near 2%. Inflation should also moderate back

to the Fed’s target of close to 2%, but this will take longer,

until late 2023. For this sanguine outlook to come to pass,

the pandemic must continue to fade—with each new wave

of the virus less disruptive to the economy than the one

before it—and the worst of the fallout from the Russian

invasion of Ukraine on oil and other commodity prices must

be at hand. It is critical that the Fed gets monetary policy

more or less right, which means quickly normalizing interest

rates over the next 18 months. We also need to catch a

break, so that nothing else goes materially wrong for the

economy.

While worries about the pandemic—and precautionary

efforts to contain the virus—have receded, the economy is

still struggling with its fallout. According to the Census

Bureau’s most recent pandemic-focused Pulse survey from

early February, close to 10 million workers said they were

not working because they were either sick, taking care of

someone who was, or fearful of getting sick. This goes a long

way to explain the near-record 11 million unfilled job

positions, a situation fanning wage and price pressures. It

stands to reason that as the pandemic winds down, people

will get back to work, positions will be filled, and wage

growth will moderate. Scrambled supply chains will also

untangle, easing shortages and prices. Some of the worst

bottlenecks have already been ironed out, but things have

gotten more complicated with the re-emergence of the

virus in China and other parts of Asia , where most supply

chains begin and pandemic responses are more restrictive.

By itself, the fallout of Russia’s invasion of Ukraine on the

U.S. economy should be modest. American businesses and

financial institutions have links to Russia , but in part because

of previously imposed sanctions on Russia resulting from its

takeover of Crimea those links are not consequential. The

principal link is through oil prices, as Russia accounts for just

over one-tenth of global oil production, including crude and

refined products, and a similar share of global oil exports,

totaling 7.5 million barrels per day. Prices have jumped more

than $30 per barrel to over $100 since a Russian invasion

looked possible late last year. This reflects the loss of

approximately 3 million barrels a day of Russian oil due to

an explicit U.S. ban on imports of Russian oil and self-

sanctioning by global energy companies. There is also a risk

premium in prices reflecting the possibility of even greater

disruptions. A handy rule of thumb is that every $10 -per-

barrel increase in oil prices results in a 30-cent increase in

the price of a gallon of regular unleaded, costing the typical

household $30 more per month to fill their tanks and

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

4

costing households collectively about $35 billion more over

a year. The Russian invasion has thus lifted gas prices by

about $1 to a record $4.30 per gallon. While that is a

financial hit to households, cushioning the blow to the

broader economy is that the U.S. fossil fuel industry, which

vies with Saudi Arabia as the world’s largest, benefits. A $10 -

per-barrel increase in the price of oil thus shaves only 0.1%

from U.S. real GDP growth over the subsequent year. A $30 -

per-barrel increase, if sustained, will reduce real GDP by

0.3%. A modest impact.

This is our baseline outlook, as we assume that Russia finds a

way to stand down from its invasion, allowing hostilities to

abate by this time next year, and there are no greater

disruptions to Russian oil exports. Oil prices average about

$100 per barrel in coming months, then come down as U.S. ,

Saudi and UAE oil production increases in response. Along

with greater global inventory drawdowns, including releases

from U.S. and other nations' strategic petroleum reserves,

the missing Russian oil is replaced.

Of course, Russia’s invasion of Ukraine could take any of a

number of darker turns resulting in much more serious

economic consequences. Indeed, it is not difficult to

envisage a scenario in which the conflict intensifies, resulting

in even stiffer sanctions on Russia , including a European ban

on Russian oil imports. This would result in the loss of 5.4

million barrels a day of Russian oil, which would take much

longer to replace, and oil prices would spike even higher. Oil

prices closer to $150 per barrel would result for weeks if not

months, pushing U.S. gasoline prices to near $6 per gallon.

The previously provided rules of thumb would suggest that

GDP growth this year would be reduced by 0.8%. But this

surely understates the blow to the economy, as the much

higher oil prices and resulting inflation surge would

undermine already fragile consumer, business and investor

sentiment. Inflation expectations, already high, could be

completely dislodged. The Federal Reserve, faced with the

Hobson’s choice of responding to the struggling economy or

higher inflation, would likely ultimately decide to rein in the

inflation and inflation expectations. Policymakers will

appropriately figure that it is better to risk a near-term

recession than stagflation, which, based on the debilitating

experience with stagflation in the 1970s and early 1980s,

can only be dealt with by a much more severe downturn. As

long as Russia continues to pursue its invasion of Ukraine ,

recession and stagflation will be serious threats.

Whether the economic outlook will be characterized by a

self-sustaining expansion, recession or stagflation critically

depends on whether the Fed is able to calibrate the

normalization of interest rates. That is, raise rates fast

enough to sufficiently slow growth and quell inflation and

inflation expectations, but not so fast that it undermines

growth and the recovery. This will be tricky. Policymakers

have much work to do to get rates up to where they need to

be consistent with unemployment, inflation, inflation

expectations and financial conditions. These are the

measures in their so-called reaction function, which Fed

officials use to gauge where rates should be. Based on our

estimation of their reaction function, the funds rate should

be 2.5% and the Fed should be engaged in quantitative

tightening by allowing the Treasury and mortgage-backed

securities on its balance sheet to mature and prepay. For

context, 2.5% is policymakers’ estimate, as well as our own,

of the so-called equilibrium rate, or r-star—where the funds

rate should be in the long run. To be sure, the pandemic and

uncertainty created by the Russian invasion are good

reasons why the Fed has been slow to begin normalizing

policy. But policymakers now need to work quickly—though

not too quickly. No wonder recession and stagflation risks

are so uncomfortably high.

A prescient gauge of the economic outlook is the shape of

the Treasury yield curve. The curve as measured by the

difference between 10-year and two-year Treasury yields has

been especially accurate in predicting future recessions. Each

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

5

time the curve has inverted in the past half-century—

meaning two-year yields have risen above 10-year yields—a

recession has soon followed. The thought is that the two-

year yield is a good barometer of what bond investors think

the Fed is going to do with rates. When investors believe the

Fed will raise rates aggressively, which will ultimately slow

growth and inflation, they sell two-year Treasuries, pushing

yields up, and purchase 10-year Treasuries, keeping a lid on

those yields.

When investors believe the Fed is going to push rates up too

quickly and tip the economy into recession, the curve

inverts. Right now, the curve remains positively sloped with

10-year yields higher than two-year yields, but not by much.

Of course, the curve already reflects investor expectations

that the Fed will aggressively raise rates and normalize them

by late 2023. This is similar to our baseline outlook.

Investors, like us, continue to believe in a self-sustaining

economic expansion. But also like us, they believe recession

risks are high.

Given all that has gone wrong over the two years since the

pandemic hit, it feels somewhat pollyannaish to argue that

there could be an upside surprise for the economy. But there

could be. Little noticed is the seeming revival in productivity

growth to near its long-run 2% per annum pace. The

shackles put on productivity growth since the financial crisis

have been broken, and the bounce in business investment

and business formations and the widespread adoption of

remote work during the pandemic augur well for even

stronger productivity gains dead ahead. There is no better

antidote for stagflation than stronger productivity, which

supports more growth and lower inflation. Of course, lots

has to go right for this upside surprise to happen. But we are

certainly due.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

6

The Week Ahead in the Global Economy

U.S.

We’ll see a packed week for U.S. economic data, and any

comments by Fed official will have the potential to rattle

financial markets. The Fed is sending a clear signal that it

may need to be more aggressive in removing monetary

policy accommodation. A 50 basis point rate hike is on the

table at the next couple of meetings, if the data cooperate.

The March employment report is due, and early indications

are that job growth remains solid. The unemployment rate

likely will have dipped from 3.8% to 3.7%. Even if March

employment was a dud, the Fed would likely look through

one month of data. What will catch its attention are

February headline and core PCE deflators. Fed Chair Jerome

Powell is looking for a noticeable deceleration in month-to-

month growth in consumer prices, but that likely didn’t

occur in February and will reaccelerate for March because of

the jump in global oil prices. We also get the Conference

Board’s Consumer confidence index for March, revisions to

fourth quarter GDP, monthly personal income and spending,

and initial claims for unemployment insurance benefits.

Europe

The euro zone’s preliminary estimate of the March HICP will

stand out in a busy week. We expect inflation to jump to 7%

y/y this March from 5.9% in February. Energy will be the

main driver. The military conflict in Ukraine has sent a shock

to commodity prices, which will show up first in the energy

segment and then pass to the food and core baskets. Food

prices will be growing strongly, continuing an upward trend

predating the conflict, as will those of core goods. Services

price growth will be relatively modest, since we don’t expect

a fuller recovery in the sector until this summer.

The conflict will also impose a shock to business and

consumer sentiment this month. We foresee the euro zone’s

Economic Sentiment Indicator dropping to 100 from 114

previously. There will be hits to consumer, industrial and, to

a lesser extent, services sectors. Each will be greatly

concerned about inflation; and industry will have an added

weight from a worsened view on inventories and supply, not

just to the conflict but also to lockdowns in China . Services,

namely tourism, may report weaker demand expectations

given the absence of Russian tourist flows for the

foreseeable future.

The euro zone unemployment rate was likely unchanged at

6.8% in February. Germany’s likely slid 0.1 ppt to 4.9%, but

we expect Italy’s was unchanged at 8.8%. As infections from

the Omicron wave of the pandemic fell and countries began

loosening social distancing measures, we expect an uptick in

hiring by services in anticipation for a more conducive

business environment. Since the pandemic was not

completely out of the picture, and we expect most post-

pandemic demand to be oriented toward services, retail

sales should grow tepidly for February. In France , household

consumption of goods likely rebounded 0.6% m/m, after a

prior 1.5% drop. In Germany , retail sales growth likely

slowed to 0.5% m/m from 2%, while in Spain we expect

they stabilized with zero growth, after pulling back in the

previous two months.

Russian retail sales likely grew 7.2% y/y in February,

speeding up from the previous month. The invasion of

Ukraine will eventually weigh heavily on the Russian

economy, but at the outset, retail sales will be pushed up as

consumer’s rushed to stockpile food and goods. Regarding

the unemployment rate, we are forecasting a small 0.1 ppt

increase to 4.5% from the previous month, not due to the

invasion but to underlying weakness reflected in the

month’s PMI releases. As for final estimates of fourth-

quarter GDP in France and the U.K. , we are not expecting

changes from the preliminary estimates of 0.7% and 1% q/q,

respectively. There is the risk, however, that consumption

was lower than initially forecast. For example, there was a

slight downward revision to December retail sales in France .

Asia-Pacific

Japan will release a suite of indicators for February. On

balance, we expect a softening given the Omicron wave of

COVID-19 subduing domestic demand, the challenging

external outlook including higher commodity prices, and the

ongoing semiconductor chip shortage. Industrial production

likely rose 0.5% m/m in February, partially recovering from

January’s 1.3% fall. We look for retail trade to fall 0.2% m/m

in February after the 1.9% slump in January. The pandemic

outlook has improved (daily new infections have declined),

but lingering virus concerns and elevated hospitalisations

will weigh on near-term household spending. The

unemployment rate likely held at 2.8% in February. The

Tankan survey diffusion index likely deteriorated to -2 in

March from 2 in December. Weak domestic demand and

higher commodity prices, especially for energy, have

clouded the outlook for manufacturers in the near term.

The Bank of Thailand will keep the policy rate steady at

0.5%. Inflation hit a 13-year high in February at 5.3% y/y

amid higher energy costs. Core CPI growth came in at more

modest 1.8%. The central bank is reluctant to begin

normalising policy settings despite upside risks to inflation

from high commodity prices.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

7

Geopolitical Calendar

Date

Country

Event

Economic

Importance

Financial Market Risk

28-29-Mar

ASEAN

U.S. -ASEAN summit

Low

Low

10-Apr

France

General elections

Medium

Medium

8-May

Hong Kong

Chief executive election

Low

Low

9-May

Philippines

Presidential election

Low

Low

29-May

Colombia

Presidential election

Medium

Low

Jun

Switzerland

World Economic Forum annual meeting

Medium

Low

29-30-Jun

NATO

NATO Summit, hosted by Madrid

Medium

Medium

Jun/Jul

PNG

National general election

Low

Low

2-Oct

Brazil

Presidential and congressional elections

High

Medium

Oct/Nov

China

National Party Congress

High

Medium

7-Nov

U.N .

U.N . Climate Change Conference 2022 (COP 27)

Medium

Low

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

8

THE LONG VIEW: U.S.

Q2 GDP Expected to Rise 4.8% Annualized

BY RYAN SWEET

CREDIT SPREADS

Moody's long-term average corporate bond spread is 162

basis points, 4 bps wider than the 158 bps at this time last

week and wider than the 136 bps average in February. The

long-term average industrial corporate bond spread widened

by 3 bps to 147. It averaged 154 bps in February.

The recent ICE BofA U.S. high-yield option adjusted bond

spread is off its recent peak of 420 basis points as its now

closer to 370 bps. This is still well above that seen at the

beginning of the year, but the recent tightening is

encouraging. The Bloomberg Barclays high-yield option

adjusted spread has bounced around recently and is

currently 358 bps, compared with the 386 bs this time last

week. The high-yield option adjusted bond spreads

approximate what is suggested by the accompanying long-

term Baa industrial company bond yield spread and that

implied by a VIX of 23.

Defaults

The trailing 12-month global speculative-grade default rate

rose to 2% at the end of February from 1.8% in January. In

Europe , the default rate jumped to 2.1% from 1.2%. Under

our baseline scenario, Moody's Credit Transition Model

predicts that the global speculative-grade corporate default

rate will decline to 1.7% in the second quarter before rising

to 2.8% at the end of February 2023. That rate would still

be well below the long-term average of 4.1%.

Our baseline forecasts assume that the U.S. high-yield

spread will widen from about 400 basis points currently to

548 bps over the next four quarters. This widening would be

partially offset by improvement in the U.S. unemployment

rate, which we assume will decline to 3.5% by the end of

February 2023 from the current rate of 3.8%. Our baseline

forecasts are underpinned by positive factors such as good

corporate fundamentals, low refinancing risk in the near

term, and the transition of the global economy from a

tentative recovery toward more stable growth, bolstered by

improvement in the COVID-19 health situation. However,

risks have grown following the invasion of Ukraine and the

subsequent sanctions on Russia . Although we expect the Fed

to raise interest rates at a pace that will not severely disrupt

the U.S. economic recovery and financing conditions, the

Russia - Ukraine conflict could add substantial risk to the

default outlook through multiple channels, especially in

Europe .

U.S. Corporate Bond Issuance

First-quarter 2020’s worldwide offerings of corporate bonds

revealed annual advances of 14% for IG and 19% for high-

yield, wherein US$-denominated offerings increased 45%

for IG and grew 12% for high yield.

Second-quarter 2020’s worldwide offerings of corporate

bonds revealed annual surges of 69% for IG and 32% for

high-yield, wherein US$-denominated offerings increased

142% for IG and grew 45% for high yield.

Third-quarter 2020’s worldwide offerings of corporate

bonds revealed an annual decline of 6% for IG and an

annual advance of 44% for high-yield, wherein US$-

denominated offerings increased 12% for IG and soared

upward 56% for high yield.

Fourth-quarter 2020’s worldwide offerings of corporate

bonds revealed an annual decline of 3% for IG and an

annual advance of 8% for high-yield, wherein US$-

denominated offerings increased 16% for IG and 11% for

high yield.

First-quarter 2021’s worldwide offerings of corporate bonds

revealed an annual decline of 4% for IG and an annual

advance of 57% for high-yield, wherein US$-denominated

offerings sank 9% for IG and advanced 64% for high yield.

Issuance weakened in the second quarter of 2021 as

worldwide offerings of corporate bonds revealed a year-

over-year decline of 35% for investment grade. High-yield

issuance faired noticeably better in the second quarter.

Issuance softened in the third quarter of 2021 as worldwide

offerings of corporate bonds revealed a year-over-year

decline of 5% for investment grade. U.S. denominated

corporate bond issuance also fell, dropping 16% on a year-

ago basis. High-yield issuance faired noticeably better in the

third quarter.

Fourth-quarter 2021’s worldwide offerings of corporate

bonds fell 9.4% for investment grade. High-yield US$

denominated high-yield corporate bond issuance fell from

$133 billion in the third quarter to $92 billion in the final

three months of 2021. December was a disappointment for

high-yield corporate bond issuance, since it was 33% below

its prior five-year average for the month.

In the week ended March 18, US$-denominated high-yield

issuance totaled $1 billion , weaker than then $4 billion

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

9

increase in the prior week. This brings the year-to-date total

to $52.5 billion . Investment-grade bond issuance rose $31.3

billion in the latest week, bringing its year-to-date total to

$427.5 billion . Total US$-denominated issuance is currently

tracking that seen in 2018 and 2019.

U.S. ECONOMIC OUTLOOK

There were some adjustments to our forecast between the

February and March baselines, as the latest incorporates

new assumptions around the effect of the military conflict

between Russia and Ukraine . There are many scenarios on

how the Russian invasion of Ukraine will unfold, each darker

than the next, but the most likely scenario is that Russian

troops will go no farther than Ukraine and any disruptions to

oil, natural gas and other commodity markets will be limited

and temporary. If so, the impact of the Russian invasion on

the U.S. economy will be on the margins.

The U.S. banking and trade exposure to either Russia or

Ukraine is very small. The primary channels through which

the military conflict will adversely impact the U.S. economy

is oil prices and financial market conditions. Europe’s

economy will be hit harder, but its economic recovery will

continue. Russia , however, will suffer a debilitating recession,

and for Ukraine’s economy this is a catastrophe.

Smaller fiscal package

President Biden renamed his economic agenda from “Build

Back Better” to “Building a Better America.” Prior to Biden’s

first State of the Union, we revised our BBA assumptions in

the March forecast. We no longer assume Democrats pass a

$1.2 trillion package of social safety net and climate policies

through budget reconciliation, but rather a $600 billion

legislation. We jettisoned the following two provisions that

had been included in the February forecast: $400 billion in

Affordable Care Act premium credits and $200 billion in

universal preschool investments.

The BBA package would pass by the end of the third quarter,

with implementation starting in the fourth quarter. It would

center around $330 billion in clean energy tax credits and

$230 billion in direct federal spending to address climate

change. The reconciliation bill would also modestly expand

the Child Tax Credit by $40 billion by making it fully

refundable on a permanent basis. The BBA would be a

virtual nonevent for the economy in 2022, but its gross

fiscal support would amount to 0.1% of GDP in 2023, peak

at 0.25% in 2026, and settle at less than 0.2% by the end of

a 10-year budget horizon.

Because we have rolled back the number of BBA

investments, the March forecast also assumes a smaller

number of pay-fors. We removed the following offsets that

were previously part of the February forecast: a new excise

tax applying to stock buybacks, higher taxes on global

intangible low-taxed income for U.S. multinationals, and

other international tax changes.

The March forecast still includes the following changes to

the personal tax code: ensuring high-income business

owners pay either the 3.8% Medicare tax or the 3.8% net

investment income tax and limiting business loss deductions

for noncorporate taxpayers. In addition, IRS funding would

increase to improve tax compliance. Finally, prescription

drug savings would solely come from repealing a Trump-era

rule eliminating safe harbor from a federal anti-kickback law

for rebates paid by pharmaceutical manufacturers to health

plans and pharmacy benefit managers in Medicare Part D.

We do not assume Democrats implement other prescription

drug reforms such as allowing the federal government to

negotiate drug prices in Medicare or requiring drug

companies to pay rebates when annual increases in drug

prices for Medicare and private insurance exceed the rate of

inflation.

In sum, the BBA would include $700 billion in tax increases

on well-to-do households, as well as prescription drug

savings. As a result, it would lead to a net deficit reduction

of $100 billion over the next 10 years. Our BBA assumption

in the March forecast is broadly in line with recent

comments by Senator Joe Manchin.

COVID-19 assumptions

We adjusted our epidemiological assumptions to anticipate

that total confirmed COVID-19 cases in the U.S. will be 81

million, less than the 82.9 million in the February baseline.

However, the number of assumed cases is still well above

that assumed before the Omicron variant. The seven-day

moving average of daily confirmed cases dropped sharply

recently and was around 39,000, below its recent peak of

807,000 and among the lowest since July. The date for

abatement of the pandemic, where total case growth is less

than 0.05% per day, changed slightly, as it has already

occurred. We had expected it to abate on April 4.

We have replaced the concept of herd immunity with

“effective immunity,” which is a rolling number of infections

plus vaccinations to account for the fact that immunity is

not permanent. The forecast still assumes that COVID-19

will be endemic and seasonal.

Oil bites into GDP

The March baseline factors in the recent jump in energy

prices, and that led us to revise our forecast lower for U.S.

GDP growth by 0.2 of a percentage point to 3.5% this year.

We nudged up the forecast for GDP growth in 2023 from

3% to 3.1%.

The bulk of the downward revision was in the second

quarter, when real GDP is expected to rise 4.8% at an

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

10

annualized rate, compared with the 6.1% in the February

baseline forecast. We now expect oil prices to peak in the

second quarter, with West Texas Intermediate crude oil

prices averaging $100 per barrel. Our rule of thumb is that

every $10 increase in the per barrel price of oil increases U.S.

retail gasoline prices by 30 cents a gallon. Every penny

increase in retail gasoline prices reduces consumer spending

by about $1.5 billion over the course of a year.

GDP growth in the second half of this year will average 2.7%

at an annualized rate. The Bloomberg consensus is for real

GDP to increase 3.6% this year and 2.4% in 2023.

Oil prices, financial market conditions, inventories, and

global supply-chain issues remain downside risks to the

near-term forecast. While inventories played an enormous

role in the gain in fourth-quarter GDP, they are on track,

along with net exports, to be a significant drag on growth

early this year. Our high-frequency GDP model’s tracking

estimate of first-quarter GDP growth keeps heading south,

but it has nothing to do with recent geopolitical events.

Currently, first-quarter GDP is on track to rise 0.5% at an

annualized rate.

Business investment and housing

Fundamentals have turned less supportive for business

investment as corporate credit spreads continue to widen.

However, corporate profit margins are fairly wide, and banks

are easing lending standards.

We have real business equipment spending rising 7.3% this

year, compared with 8.2% in the February baseline. The

forecast is for real business equipment spending to increase

5.6% in 2023, a touch stronger than the 5.4% gain in the

February baseline forecast.

Risks are weighted to the downside for nonenergy business

investment, as financial markets could tighten more than we

anticipate and corporate credit spreads widen further. The

correlation coefficient between monthly changes in the

high-yield corporate bond spread and changes in the S&P

500 is -0.71 since 2000. The relationship is still strong if we

look at it on a weekly basis. Using no and various lags, the

Granger causality tests showed changes in the S&P 500

caused changes in the high-yield corporate bond spread. The

causal relationship runs in one direction.

The real nonresidential structures investment is now

expected to increase 14.4% this year, compared with the

11% gain in the February forecast. Some of the upward

revision is the boost to business investment from higher

energy prices, primarily in mining exploration, shafts and

wells. The Bureau of Economic Analysis uses the American

Petroleum Institute’s weighted average of footage drilled

along with rotary rig counts from Baker Hughes in its

current-quarter estimate of private fixed investment in

mining exploration, shafts and wells. This segment now

accounts for more than 10% of nominal private fixed

investment in nonresidential structures. Therefore, a rise in

energy prices would lead to an increase in the number of

active rotary rigs.

Separately, growth in the Commercial Property Price Index

was revised higher; it is now expected to increase 8.6% this

year, compared with 5.2% in the February baseline. We

raised the forecast next year from 2% to 7.7%.

Revisions to housing starts were small. Housing starts are

expected to be 1.81 million, compared with 1.84 million in

the February baseline. Revisions to housing starts next year

were also modest. Risks are heavily weighted to the

downside. There are likely only so many homes that can be

built each year because of labor-supply constraints and lack

of buildable lots. Some of the labor-supply issues will ease

as the pandemic winds down, but the reduction in

immigration is particularly problematic for homebuilders'

ability to find workers. Revisions to the forecast for new-

and existing-home sales this year were minor, as mortgage

rates haven’t risen either fast or high enough to cut

noticeably into sales.

We nudged up the forecast for the FHFA All-Transactions

House Price Index this year, with it rising 11.5%, compared

with 9.8% in the February baseline. House price growth

moderates noticeably in 2023, as prices are forecast to rise

2.3%, a touch weaker than the 2.4% in the February

baseline. This is attributable to rebalancing of supply and

demand.

Labor market

The February employment data are incorporated into the

March baseline forecast. They led to minor tweaks to the

forecast. We have job growth averaging 367,000 per month

this year, compared with the February baseline forecast of

384,000. There weren't material changes to the forecast for

the unemployment rate this year, as it is still expected to

average 3.4% in the final three months of this year and

3.4% in the fourth quarter of next year.

We assume a full-employment economy is one with a 3.5%

unemployment rate, around a 62.5% labor force

participation rate, and an 80% prime-age employment-to-

population ratio. All of these conditions will be met by late

this year or early next.

Fed sticks to its plan

Federal Reserve Chair Jerome Powell was explicit during his

semiannual testimony to the House Committee on Financial

Services. He took away all uncertainty about the outcome of

March’s Federal Open Market Committee meeting by

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

11

throwing his support behind a 25-basis point rate hike and

saying that plans to reduce the size of the balance sheet will

not be finalized.

Normally, Fed chairs avoid tipping their hands, as it could be

seen as front-running the FOMC . However, Russia’s invasion

of Ukraine has caused a lot of volatility in financial markets

and created new uncertainty. Therefore, Powell likely

wanted to reduce any uncertainty about the Fed’s intention

at its upcoming meeting. Powell did leave the door open for

larger rate hikes at future meetings.

He sounded optimistic that the Fed can engineer a soft

landing, where it raises interest rates enough to curb

inflation but not enough to tip the economy into recession.

Powell floated the idea that this tightening cycle will end

above his estimate of the neutral fed funds rate of 2% to

2.5%.

We maintained our assumption that the Fed raises the

target range for the fed funds rate four times this year, 25

basis points each time. Markets are pricing in more hikes,

just south of seven hikes over the next 12 months. The

tightening in financial market conditions did some of the

Fed’s work for it. The primary channel through which

monetary policy impacts the economy is financial markets.

With financial market conditions tightening, the Fed doesn’t

need to do as much this year.

The Fed is also expected to begin quantitative tightening

this summer. That is, the central bank will not replace the

Treasury and mortgage securities it owns as they mature or

prepay, allowing its balance sheet to slowly shrink, and

putting upward pressure on longer-term rates.

Risks are weighted toward more rate hikes this year. Higher

energy prices are going to cause inflation to peak higher

than we had previously expected. We look for year-over-

year growth in the consumer price index to be 7.4% in the

first quarter, compared with 7% in the February baseline.

The inflation forecast follows a similar trajectory as past

baseline forecasts, just higher. Inflation moderates through

the remainder of the year, returning to the Fed’s target in

the first half of next year. Key to this forecast is that oil

prices average $100 per barrel in the second quarter, with

that being the peak. Also, supply-chain issues are expected

to ease, leading to significant disinflation in goods prices.

We didn’t make significant changes to the forecast for the

10-year Treasury yield. The forecast is that the Dow Jones

Industrial Average incorporates the recent developments.

The new baseline will have the Dow Jones Industrial Average

lower than its February baseline. The recent decline

accounted for the bulk of the decline we expected to occur

throughout the year. Therefore, the March baseline has

another leg lower in equity prices, which we expect will

remain within a tight range through the end of next year.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

12

THE LONG VIEW: EUROPE

Invasion Exacerbates Inflation Across Continent

BY ROSS CIOFFI

The Russian invasion of Ukraine has exacerbated inflation

across Europe and worsened an already elevated cost-of-

living crisis in Spain . Surging energy costs have triggered

protests by truck drivers, fishermen and farmers, who are all

on the front line of rapidly increasing fuel prices. Households

and businesses across the country are also facing soaring

fuel and electricity bills. The situation in Spain is among the

most acute in the euro zone given the prevalence of variably

rated utility contracts in the country. The government has

already rolled over VAT cuts on utilities, initially debuted

last fall. It plans to unveil another relief package on March

29 with more direct measures. The government agreed this

past Monday on an aid package of €500 million to help with

transporters' fuel costs.

Germany’s government, meanwhile, announced another set

of measures on Thursday aimed at alleviating rising energy

costs. These include a €300 rebate to all taxpayers and an

extra €100 for child support, a three-month reduction in

taxes on fuels, and a three-month cost reduction for

monthly public transport tickets. These come on top of

similar measures announced a month ago, the total of

which could cost around €30 billion (there have not been

precise estimates of costs yet).

European PMIs outperform expectations

The flash estimate of the euro zone’s March PMI beat our

expectations. The reading for the composite index slumped

modestly to 54.5 from 55.5 in February. We were not

expecting the surveys to signal a contraction in activity

(reflected by a below-50 reading), but we did suspect the

reading might fall more significantly. Ultimately, with

COVID-19 restrictions easing, demand got a boost,

particularly for services. The military conflict in Ukraine has

worsened global supply conditions, though, which had a

worse effect on the manufacturing PMI. That said, services

and manufacturing surveys reported significant inflation

pressures and faltering confidence. The flash reading of the

manufacturing survey fell to 57 from 58.2 previously, while

the services reading inched lower to 54.8 from 55.5.

The U.K.’s composite PMI reading did even better, falling just

0.2 percentage point to 59.7 in March. The details of the

survey were similar, given the effects of the Russian invasion

of Ukraine on global supply conditions and prices. However,

the services PMI increased during the month, supported by a

wave of post-pandemic demand. The services PMI reading

rose to 61 from 60.5 a month earlier, while the

manufacturing PMI fell to 55.5 from 58 previously. The flash

readings for the euro zone and the U.K. support our view of

continued stability in labor markets, struggling output

despite resilient demand, and a continued acceleration in

inflation in the first quarter.

Swiss National Bank holds rates steady

The Swiss National Bank maintained its policy rate at -

0.75% at its March meeting. The inflation rate rose above

target to 2.2% y/y in February on the back of higher oil

prices and global supply bottlenecks. The SNB upwardly

revised its 2022 inflation forecast to 2.1%. A strong franc is

mitigating inflation pressures, however. The monetary

authority maintained its commitment to intervene in

foreign exchange markets to limit appreciation. The SNB

expects the inflation rate to fall back below target to 0.9%

in 2023 and 2024, so the currently more expansionary

policy stance is still in line with the bank’s mandate for price

stability and economic growth. Our March baseline foresees

a similar path for inflation, expecting no rate hikes in the

short term.

Norges Bank hikes

The Norges Bank raised the sight deposit rate by 25 basis

points to 0.75%. Policymakers are battling headline and core

inflation, both of which are above target as of the February

release (3.7% y/y and 2.1%, respectively). Inflation pressures

on producers and consumers will remain strong in the form

of elevated input and energy prices due to global supply

disruptions and the military conflict in Ukraine . But on top

of this, wage inflation has been stronger than anticipated,

which has pushed up prospects for robust inflation in the

medium term. We expect policymakers will act on their

guidance and respond with another rate hike in June; the

bank’s forward guidance furthermore specified hikes

culminating in a 2.5% policy rate by the end of 2023.

.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

13

THE LONG VIEW: ASIA-PACIFIC

Singapore Inflation Soars

BY DENISE CHEOK and HERON LIM

Singapore’s headline inflation soared to 4.3% in February, the

largest increase since February 2013. Much of the rise was due

to an increase in car prices caused by higher taxes rather than

supply-chain issues. Core inflation, which excludes

accommodation and private transportation, saw a slower rate

of increase compared with the previous month’s reading.

Prices of food and energy increased at a slower rate than in

January, although downside risks still abound. Singapore

imports almost all of its fresh food and energy, making it

highly susceptible to external shocks.

The Russian invasion of Ukraine has pushed oil prices above

$100 per barrel, and we expect energy prices to stay high in

the first half of the year. This should ease in the second half,

which will quell inflation pressures in countries including

Singapore . Supply-chain disruptions from the COVID-19

pandemic are ongoing as well. Although most of the world

has transitioned to living with the virus; China is a notable

exception. Several key Chinese cities such as Shenzhen were

locked down because of COVID-19 outbreaks. The country is

unlikely to relax its stance against the virus in coming months,

and this will weigh heavily on global supply chains.

The Monetary Authority of Singapore noted that core

inflation “could reach 3% by the middle of the year” before

easing in the latter half. This will bring core inflation near the

upper bound of the central bank’s projection of 2% to 3%.

February’s CPI reading is the last before the MAS meets next

month. With headline inflation exceeding the central bank’s

projections for the fourth straight month, we expect to see

further tightening of monetary policy at the April meeting.

…While Hong Kong’s inflation remains subdued

Hong Kong’s headline composite consumer price index rose

by 1.6% over the year in February, a 0.4-percentage point

increase from January. After netting out the effect of one-off

relief measures, consumer prices still saw a year-on-year

increase of 1.6% in February. This was expected because

demand-side pressures were subdued by tightened social

distancing measures designed to keep an outbreak of the

Omicron variant of COVID-19 in check. There was reduced

demand in consumer services and the housing market. The

housing market plays an oversize role in Hong Kong’s CPI,

making up more than 40% of the current CPI basket, and

weaknesses in the housing market, which saw a 0.3%

decrease over the year, will lead to softer CPI increases

overall.

However, prices increased in other categories. Clothing and

footwear saw the biggest spike over the year at 8%, while

transport and food prices increased 8% and 3.6%,

respectively. Even though the headline inflation rate is

relatively low compared with regional peers such as

Singapore and Taiwan , Hong Kong has not been immune to

the inflation tailwinds caused by climbing commodity and

energy prices.

Hong Kong’s zero-COVID policy has put significant strain on

its healthcare system as the city deals with its worst virus

surge. However, Hong Kong has seen a steep decline in new

cases since early March. Officials are looking to gradually lift

restrictions from April.

Still, there are headwinds to inflation. The housing market is

expected to remain subdued in the near term, as demand

from Mainland China is expected to remain soft for 2022 (a

reopening with China is still in the works with no set date at

the time of writing). We also see interest rate normalisation

by U.S. Federal Reserve increasing borrowing costs within

Hong Kong ; borrowing rates in Hong Kong largely reflect

those in the U.S. due to the hard currency peg. This will

reduce consumption activity and keep overall consumer

inflation slow. We currently expect the annual inflation rate

to reach 2.8% for 2022.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

14

RATINGS ROUNDUP

Europe Changes Turn Overwhelmingly Positive

BY STEVEN SHIELDS

U.S.

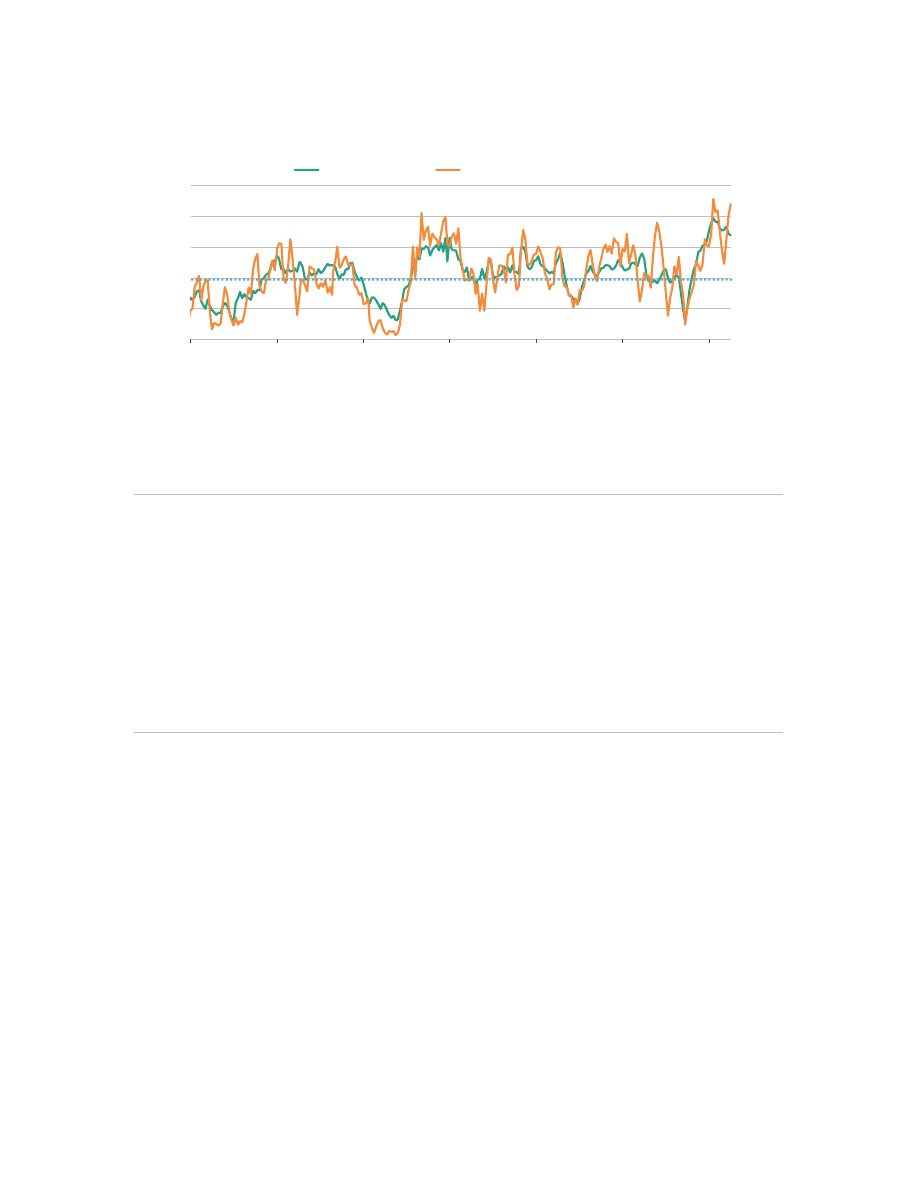

U.S. corporate credit quality improved in the latest period

with credit upgrades accounting for nearly two-thirds of

changes and 60% of the affected debt. The changes

spanned a diverse set of industrial groups with investment-

grade firms accounting for three of the seven upgrades.

Endeavor Energy Resources L.P. was the largest change in

terms of total debt affected at $1.6 billion . Moody’s

Investors Service raised Endeavor’s senior unsecured notes

to Ba2 from Ba3, raised its Corporate Family Rating to Ba1

from Ba2, and revised the outlook to stable from positive.

The upgrade reflects Endeavor's increased scale, reduced

debt balance and our expectation of continued growth and

free cash flow generation under favorable price conditions

through 2023.

Meanwhile, Toll Road Investors Partnership II L.P. and Jets

Stadium Development LLC both received an upgrade on

their respective senior unsecured notes to A1. Moody’s

Investors Service lowered TPC Group Inc.’s first lien priming

notes to B3 from B2, first lien notes to Caa3 from Caa2, and

its CFR to Caa3 from Caa1. The downgrade follows TPC’s

forbearance agreement in early February after a missed

interest payment. The CFR downgrade to Caa3 reflects the

fact that in bankruptcy, noteholders could be required to

take a meaningful haircut to outstanding debt at TPC, given

the uncertainty over future cash outflows related to the

explosion and fire at TPC's Port Neches facility in November

2019. It also reflects Moody's view of an average recovery on

TPC's debt given the value of the business and the potential

proceeds from its insurance policies. While the company's

financial performance has been unusually weak since the

pandemic, Moody's expects a meaningful recovery in 2022

due to higher C4 Processing volumes owing to ongoing

improvements at its facilities, and increased profitability in

the Performance Products segment.

Europe

Ratings activity was once again elevated across Western

Europe with the region receiving 44 rating changes in the

period. However, unlike the previous week, activity was

overwhelmingly positive. All but four of the changes

occurred to firms located within the United Kingdom . The

change reflects Moody’s recent upgrade of Assured

Guaranty and its subsidiaries following the resolution of the

group’s exposure to the general obligation bonds issued by

the Commonwealth of Puerto Rico . As a result, Moody’s

ratings on securities that are guaranteed or “wrapped” by

Assured Guaranty were also upgraded.

.

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

15

RATINGS ROUND-UP

0.0

0.2

0.4

0.6

0.8

1.0

0.0

0.2

0.4

0.6

0.8

1.0

Apr01

Aug04

Dec07

Apr11

Aug14

Dec17

Apr21

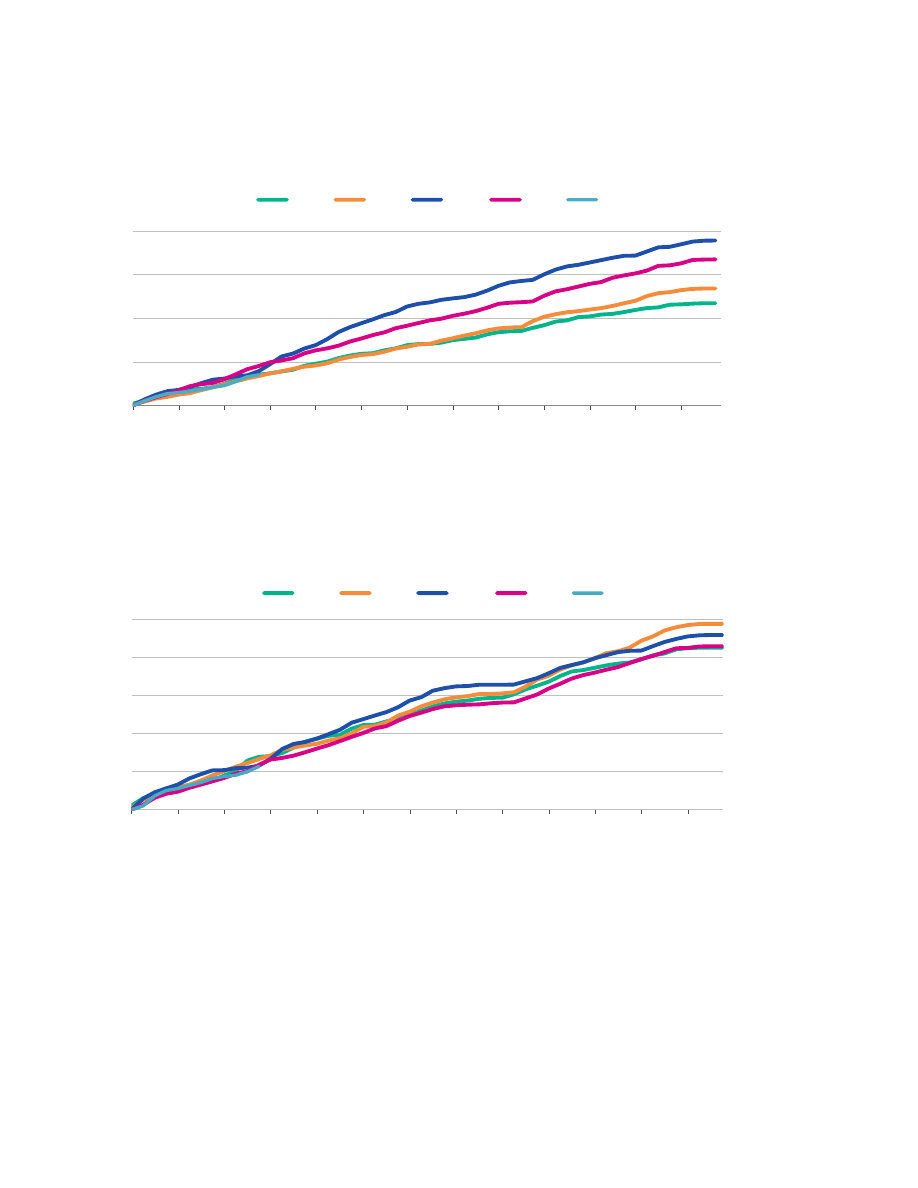

FIGURE 1

Rating Changes - US Corporate & Financial Institutions: Favorable as a % of Total Actions

By Count of Actions

By Amount of Debt Affected

* Trailing 3-month average

Source: Moody's

FIGURE 2

BCF

Bank Credit Facility Rating

MM

Money-Market

CFR

Corporate Family Rating

MTN

MTN Program Rating

CP

Commercial Paper Rating

Notes

Notes

FSR

Bank Financial Strength Rating

PDR

Probability of Default Rating

IFS

Insurance Financial Strength Rating

PS

Preferred Stock Rating

IR

Issuer Rating

SGLR

Speculative-Grade Liquidity Rating

JrSub

Junior Subordinated Rating

SLTD

Short- and Long-Term Deposit Rating

LGD

Loss Given Default Rating

SrSec

Senior Secured Rating

LTCF

Long-Term Corporate Family Rating

SrUnsec

Senior Unsecured Rating

LTD

Long-Term Deposit Rating

SrSub

Senior Subordinated

LTIR

Long-Term Issuer Rating

STD

Short-Term Deposit Rating

Rating Key

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

16

FIGURE 3

Rating Changes: Corporate & Financial Institutions - US

Date

Company

Sector

Rating

Amount

($ Million)

Up/

Down

Old

LTD

Rating

New LTD

Rating

IG/S

G

3/17/2022

WW INTERNATIONAL, INC.

Industrial

SrSec/BCF/LTCFR/PDR

500.00

D

Ba3

B1

SG

3/17/2022

GREIF, INC.

Industrial

LTCFR/PDR

U

Ba2

Ba1

SG

3/18/2022

TOLL ROAD INVESTORS PARTNERSHIP II, L.P. Industrial

SrUnsec

571.10

U

A2

A1

IG

3/18/2022

JETS STADIUM DEVELOPMENT, LLC

Industrial

SrUnsec

455.00

U

A2

A1

IG

3/18/2022

BROOKLYN ARENA LOCAL DEVELOPMENT

CORPORATION

Industrial

SrSec

U

A2

A1

IG

3/18/2022

GOGO INC.

Industrial

SrSec/BCF/LTCFR/PDR

U

B3

B2

SG

3/18/2022

HORIZON THERAPEUTICS PLC-HORIZON

THERAPEUTICS USA , INC.

Industrial

SrUnsec/LTCFR/PDR

600.00

U

Ba3

Ba2

SG

3/21/2022

TPC GROUP INC.

Industrial

SrSec/LTCFR/PDR

1083.00

D

B2

B3

SG

3/22/2022

ENDEAVOR ENERGY RESOURCES, L.P.

Industrial

SrUnsec/LTCFR/PDR

1600.00

U

Ba3

Ba2

SG

3/22/2022

KINDER MORGAN, INC. -RUBY PIPELINE, LLC Industrial

SrUnsec/LTCFR/PDR

693.75

D

Caa1

Ca

SG

3/22/2022

JHW CJF TOPCO, INC.-ALPHIA, INC.

Industrial

SrSec/BCF/LTCFR/PDR

D

B2

Caa1

SG

Source: Moody's

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

17

FIGURE 4

Rating Changes: Corporate & Financial Institutions - Europe

Date

Company

Sector

Rating

Amount

($ Million)

Up/

Down

Old

LTD

Rating

New

LTD

Rating

O

l

d

e

w

IG/

SG

Country

3/18/2022

KELDA GROUP LIMITED- YORKSHIRE WATER

SERVICES FINANCE LIMITED

Utility

SrSec

447.61

U

A2

A1

IG UNITED KINGDOM

3/18/2022

AUTOLINK CONCESSIONAIRES (M6) PLC

Industrial

SrSec

171.88

U

A2

A1

IG UNITED KINGDOM

3/18/2022

STIRLING WATER SEAFIELD FINANCE PLC

Utility

SrSec

141.72

U

A2

A1

IG UNITED KINGDOM

3/18/2022

WORCESTERSHIRE HOSPITAL SPC PLC

Industrial

SrSec

133.87

U

A2

A1

IG UNITED KINGDOM

3/18/2022

CRITERION HEALTHCARE PLC

Industrial

SrSec

89.03

U

A2

A1

IG UNITED KINGDOM

3/18/2022

ENDEAVOUR SCH PLC

Industrial

SrSec

189.37

U

A2

A1

IG UNITED KINGDOM

3/18/2022

HPC KING'S COLLEGE HOSPITAL (ISSUER)

PLC

Industrial

SrSec

127.31

U

A2

A1

IG UNITED KINGDOM

3/18/2022

BAGLAN MOOR HEALTHCARE PLC

Industrial

SrSec

90.83

U

A2

A1

IG UNITED KINGDOM

3/18/2022

SUTTON AND EAST SURREY WATER PLC

Utility

SrSec

137.73

U

A2

A1

IG UNITED KINGDOM

3/18/2022

DWR CYMRU (HOLDINGS) LIMITED-DWR

CYMRU (FINANCING) UK PLC

Utility

SrSec

1101.81

U

A2

A1

IG UNITED KINGDOM

3/18/2022

ELLENBROOK DEVELOPMENTS PLC

Industrial

SrSec

82.59

U

A2

A1

IG UNITED KINGDOM

3/18/2022

INVESTORS IN THE COMMUNITY ( BUXTON )

LTD

Industrial

SrSec

89.21

U

A2

A1

IG UNITED KINGDOM

3/18/2022

FRIGOGLASS SAIC

Industrial

SrSec/LTCFR/PDR

302.81

D

Caa1

Caa2

SG NETHERLANDS

3/18/2022

ENTERPRISE CIVIC BUILDINGS LIMITED

Industrial

SrSec

29.58

U

A2

A1

IG UNITED KINGDOM

3/18/2022

HOSPITAL COMPANY ( DARTFORD ) ISSUER

PLC (THE)

Industrial

SrSec

210.07

U

A2

A1

IG UNITED KINGDOM

3/18/2022

MOYLE INTERCONNECTOR (FINANCING)

PLC

Utility

SrSec

185.94

U

A2

A1

IG UNITED KINGDOM

3/18/2022

DERBY HEALTHCARE PLC

Industrial

SrSec

615.07

U

A2

A1

IG UNITED KINGDOM

3/18/2022

CATALYST HEALTHCARE ( ROMFORD )

FINANCING PLC

Industrial

SrSec/BCF

176.84

U

A2

A1

IG UNITED KINGDOM

3/18/2022

OCTAGON HEALTHCARE FUNDING PLC

Industrial

SrSec

421.89

U

A2

A1

IG UNITED KINGDOM

3/18/2022

UNITED HEALTHCARE ( BROMLEY ) LIMITED

Industrial

SrSec

190.66

U

A2

A1

IG UNITED KINGDOM

3/18/2022

HOSPITAL COMPANY (QAH PORTSMOUTH )

LIMITED

Industrial

SrSec/BCF

U

A2

A1

IG UNITED KINGDOM

3/18/2022

CENTRAL NOTTINGHAMSHIRE HOSPITALS

PLC

Industrial

SrSec

484.66

U

A2

A1

IG UNITED KINGDOM

3/18/2022

CAPITAL HOSPITALS (ISSUER) PLC

Industrial

SrSec/BCF

702.68

U

A2

A1

IG UNITED KINGDOM

3/18/2022

ARTESIAN FINANCE III PLC

Utility

SrSec

153.43

U

A2

A1

IG UNITED KINGDOM

3/18/2022

HIGHWAY MANAGEMENT (CITY) FINANCE

PLC

Industrial

SrSec/BCF

101.50

U

A2

A1

IG UNITED KINGDOM

3/18/2022

ASPIRE DEFENCE FINANCE PLC

Industrial

SrSec

1007.57

U

A2

A1

IG UNITED KINGDOM

3/18/2022

CATALYST HIGHER EDUCATION ( SHEFFIELD )

PLC

Industrial

SrSec

215.95

U

A2

A1

IG UNITED KINGDOM

3/18/2022

NEWHOSPITALS ( ST. HELENS AND

KNOWSLEY) FINANCE PLC

Industrial

SrSec/BCF

236.20

U

A2

A1

IG UNITED KINGDOM

3/18/2022

INSPIRED EDUCATION (SOUTH

LANARKSHIRE ) PLC

Industrial

SrSec

485.14

U

A2

A1

IG UNITED KINGDOM

3/18/2022

HOSPITAL COMPANY ( SWINDON AND

MARLBOROUGH) LTD

Industrial

SrSec

220.36

U

A2

A1

IG UNITED KINGDOM

3/18/2022

COVENTRY AND RUGBY HOSPITAL

COMPANY PLC (THE)

Industrial

SrSec

560.87

U

A2

A1

IG UNITED KINGDOM

3/18/2022

HEALTHCARE SUPPORT (NORTH STAFFS )

FINANCE PLC

Industrial

SrSec/BCF

261.70

U

A2

A1

IG UNITED KINGDOM

3/18/2022

CHANNEL LINK ENTERPRISES FINANCE PLC

Industrial

SrSub

584.38

U

A2

A1

IG UNITED KINGDOM

3/18/2022

WALSALL HOSPITAL COMPANY PLC

Industrial

SrSec

220.84

U

A2

A1

IG UNITED KINGDOM

3/18/2022

AUTOVIA DE LA MANCHA S.A.

Industrial

SrSec/BCF

U

A2

A1

IG SPAIN

3/18/2022

OSPREY ACQUISITIONS LIMITED-ANGLIAN

WATER SERVICES FINANCING PLC

Utility

SrSec

495.81

U

A2

A1

IG UNITED KINGDOM

3/18/2022

HOLYROOD STUDENT ACCOMMODATION

PLC

Industrial

SrSec

86.78

U

A2

A1

IG UNITED KINGDOM

3/18/2022

SUSTAINABLE COMMUNITIES FOR LEEDS

(FINANCE) PLC

Industrial

SrSec

140.25

U

A2

A1

IG UNITED KINGDOM

3/18/2022

SOLUTIONS 4 NORTH TYNESIDE (FINANCE)

PLC

Industrial

SrSec

105.55

U

A2

A1

IG UNITED KINGDOM

3/18/2022

S4B (ISSUER) PLC

Industrial

SrSec

101.26

U

A2

A1

IG UNITED KINGDOM

3/18/2022

SCOTIA GAS NETWORKS LIMITED-

SCOTLAND GAS NETWORKS PLC

Utility

SrUnsec

743.72

U

A2

A1

IG UNITED KINGDOM

3/18/2022

SBANKEN ASA

Financial

LTD/MTN

U

A2

Aa2

IG NORWAY

3/18/2022

QAH FINANCE PLC

Industrial

SrSec

451.02

U

A2

A1

IG UNITED KINGDOM

3/21/2022

WEPA HYGIENEPRODUKTE GMBH

Industrial

SrSec/LTCFR/PDR

698.79

D

B1

B2

SG GERMANY

Source: Moody's

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

18

MARKET DATA

0

200

400

600

800

0

200

400

600

800

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Spread (bp)

Spread (bp)

Aa2

A2

Baa2

Source: Moody's

Figure 1: 5-Year Median Spreads-Global Data (High Grade)

0

400

800

1,200

1,600

2,000

0

400

800

1,200

1,600

2,000

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Spread (bp)

Spread (bp)

Ba2

B2

Caa-C

Source: Moody's

Figure 2: 5-Year Median Spreads-Global Data (High Yield)

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

19

CDS MOVERS

CDS Implied Rating Rises

Issuer

Mar. 23

Mar. 16

Senior Ratings

Abbott Laboratories

Aa2

A1

A1

JPMorgan Chase & Co.

Baa1

Baa2

A2

Citigroup Inc.

Baa2

Baa3

A3

Goldman Sachs Group, Inc. (The)

Baa2

Baa3

A2

Wells Fargo & Company

Baa1

Baa2

A1

JPMorgan Chase Bank, N.A.

A3

Baa1

Aa2

Comcast Corporation

A2

A3

A3

Oracle Corporation

Baa2

Baa3

Baa2

CVS Health Corporation

A1

A2

Baa2

Exxon Mobil Corporation

Aa1

Aa2

Aa2

CDS Implied Rating Declines

Issuer

Mar. 23

Mar. 16

Senior Ratings

CenterPoint Energy, Inc.

Baa2

A3

Baa2

PepsiCo, Inc.

A2

A1

A1

Philip Morris International Inc.

A2

A1

A2

General Electric Company

Baa3

Baa2

Baa1

Eli Lilly and Company

Aa2

Aa1

A2

FirstEnergy Corp.

Baa3

Baa2

Ba1

Emerson Electric Company

Baa1

A3

A2

Danaher Corporation

A3

A2

Baa1

Archer-Daniels-Midland Company

A2

A1

A2

United Rentals ( North America ), Inc.

Ba2

Ba1

Ba2

CDS Spread Increases

Issuer

Senior Ratings

Mar. 23

Mar. 16

Spread Diff

Talen Energy Supply, LLC

Caa2

10,691

7,717

2,973

American Airlines Group Inc.

Caa1

1,192

1,014

178

United Airlines Holdings, Inc.

Ba3

728

637

91

Liberty Interactive LLC

B2

761

703

58

Goodyear Tire & Rubber Company (The)

B2

432

387

45

Macy's Retail Holdings, LLC

Ba2

360

325

35

American Axle & Manufacturing, Inc .

B2

525

493

32

Embarq Corporation

Ba2

315

285

30

Xerox Corporation

Ba2

358

330

28

Beazer Homes USA, Inc.

B3

469

446

24

CDS Spread Decreases

Issuer

Senior Ratings

Mar. 23

Mar. 16

Spread Diff

Nabors Industries, Inc .

Caa2

502

583

-82

Staples, Inc.

Caa2

1,231

1,311

-80

Rite Aid Corporation

Caa2

1,356

1,412

-56

Murphy Oil Corporation

Ba3

263

318

-54

Nissan Motor Acceptance Company LLC

Baa3

247

275

-28

Avis Budget Car Rental, LLC

B2

332

357

-26

Tenet Healthcare Corporation

B3

281

302

-21

Travel + Leisure Co.

B1

217

237

-21

Occidental Petroleum Corporation

Ba1

129

149

-20

Calpine Corporation

B2

424

444

-19

Source: Moody's, CMA

CDS Spreads

CDS Implied Ratings

CDS Implied Ratings

CDS Spreads

Figure 3. CDS Movers - US ( March 16, 2022 – March 23, 2022)

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

20

CDS Movers

CDS Implied Rating Rises

Issuer

Mar. 23

Mar. 16

Senior Ratings

ASML Holding N.V.

Aa2

A1

A2

UniCredit Bank AG

A2

A3

A2

ENEL S.p.A .

Baa2

Baa3

Baa1

Anheuser-Busch InBev SA /NV

A3

Baa1

Baa1

Heineken N.V.

Aa1

Aa2

Baa1

Telia Company AB

A1

A2

Baa1

Iberdrola International B.V .

A3

Baa1

Baa1

Veolia Environnement S.A.

A2

A3

Baa1

Autoroutes du Sud de la France (ASF)

A2

A3

A3

National Grid Electricity Transmission plc

A2

A3

Baa1

CDS Implied Rating Declines

Issuer

Mar. 23

Mar. 16

Senior Ratings

Spain , Government of

Aa3

Aa2

Baa1

NatWest Markets Plc

Baa1

A3

A2

Swedbank AB

A2

A1

Aa3

Landesbank Hessen-Thueringen GZ

Aa3

Aa2

Aa3

SEB AB

A1

Aa3

Aa3

EnBW Energie Baden-Wuerttemberg AG

A3

A2

Baa1

thyssenkrupp AG

Ba3

Ba2

B1

Coca-Cola HBC Finance B.V .

A3

A2

Baa1

NatWest Markets N.V .

Aa2

Aa1

A2

adidas AG

Aa3

Aa2

A2

CDS Spread Increases

Issuer

Senior Ratings

Mar. 23

Mar. 16

Spread Diff

Vue International Bidco plc

Ca

1,122

835

287

Banco Comercial Portugues, S.A.

Ba1

252

205

47

thyssenkrupp AG

B1

306

259

47

Casino Guichard-Perrachon SA

Caa1

956

911

45

Sappi Papier Holding GmbH

Ba2

353

333

19

Valeo S.E.

Baa3

243

227

16

Piraeus Financial Holdings S.A.

Caa2

698

684

14

Renault S.A.

Ba2

308

295

14

Ziggo Bond Company B.V .

B3

306

292

14

TDC Holding A/S

B2

186

172

14

CDS Spread Decreases

Issuer

Senior Ratings

Mar. 23

Mar. 16

Spread Diff

Boparan Finance plc

Caa1

1,758

2,100

-341

Novafives S.A.S.

Caa2

1,041

1,092

-51

Vedanta Resources Limited

B3

856

900

-44

UPC Holding B.V.

B3

205

230

-25

Fortum Oyj

Baa2

195

213

-19

Banca Monte dei Paschi di Siena S.p.A .

Caa1

463

477

-14

Hammerson Plc

Baa3

187

200

-13

FCE Bank plc

Baa3

182

191

-9

Deutsche Lufthansa Aktiengesellschaft

Ba2

309

316

-7

Jaguar Land Rover Automotive Plc

B1

552

559

-7

Source: Moody's, CMA

CDS Spreads

CDS Implied Ratings

CDS Implied Ratings

CDS Spreads

Figure 4. CDS Movers - Europe ( March 16, 2022 – March 23, 2022)

MOODY’S ANALYTICS CAPITAL MARKETS RESEARCH / WEEKLY MARKET OUTLOOK

21

CDS Movers

CDS Implied Rating Rises

Issuer

Mar. 23

Mar. 16

Senior Ratings

Nippon Yusen Kabushiki Kaisha

A1

Baa1

Ba3

JFE Holdings, Inc.

Aa3

A2

Baa3

Honda Motor Co., Ltd.

Aa1

Aa3

A3

Indonesia , Government of

Baa2

Baa3

Baa2

Export-Import Bank of Korea (The)

Aa1

Aa2

Aa2

China Development Bank

Baa1

Baa2

A1

Export-Import Bank of China (The)

A3

Baa1

A1

SoftBank Group Corp.

B1

B2

Ba3

Chubu Electric Power Company, Incorporated

Aa1

Aa2

A3

Industrial & Commercial Bank of China Ltd

Baa1

Baa2

A1

CDS Implied Rating Declines

Issuer

Mar. 23

Mar. 16

Senior Ratings

Westpac Banking Corporation

A2

A1

Aa3

National Australia Bank Limited

A1

Aa3

Aa3

Commonwealth Bank of Australia

A1

Aa3

Aa3

DBS Bank Ltd.

A1

Aa3

Aa1

Wesfarmers Limited

A2

A1

A3

Nippon Telegraph and Telephone Corporation

Aa1

Aaa

A1

Singapore Telecommunications Limited

A2

A1

A1

Japan , Government of

Aaa

Aaa

A1

China , Government of

A3

A3

A1

Australia , Government of

Aaa

Aaa

Aaa

CDS Spread Increases

Issuer

Senior Ratings

Mar. 23

Mar. 16

Spread Diff