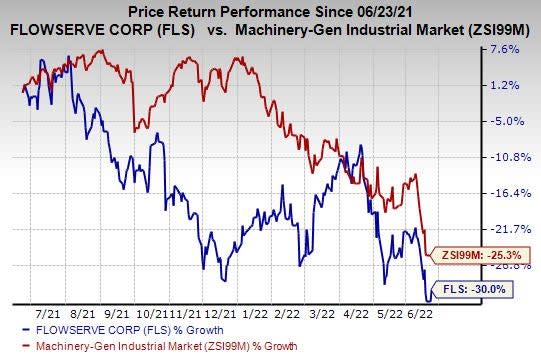

Flowserve (FLS) Down 30% in a Year: What's Hurting the Stock?

Shares of Flowserve Corporation FLS have lost 30% compared with the industry’s decline of 25.3% over the past year. The decrease in share price primarily reflects the adverse impacts of tough end-market conditions and other challenges on its operational performance.

Image Source: Zacks Investment Research

The company has a market capitalization of nearly $3.7 billion. It currently carries a Zacks Rank #5 (Strong Sell).

Factors Affecting the Company

Flowserve has been experiencing weakness in its original equipment and aftermarket businesses, owing to supply-chain challenges, logistics problems and labor issues. In the first quarter of 2022, the company’s original equipment and aftermarket sales were down 5.8% and 2.8%, respectively, on a year-over-year basis. In the quarter, its adjusted operating margin also declined 480 basis points year over year. These issues will likely affect FLS’ performance in the near term.

High effective tax rates will be worrisome for the company. For 2022, Flowserve predicts a 20-22% rate, suggesting a rise from 16.6% recorded in 2021. This is expected to adversely impact the company’s earnings for the year.

FLS’ high-debt profile also poses a concern. Exiting the first-quarter, its long-term debt was high at $1,251.6 million, while its cash and cash equivalents were $575.8 million. For 2022, the company anticipates interest expenses of $45-$50 million. Further, an increase in debt levels can raise the company’s financial obligations and hurt profitability.

Given its extensive regional presence, the company is exposed to geopolitical risks and headwinds from unfavorable movements in foreign currencies. In the first quarter, its sales in the Asia Pacific, Europe and Middle East & Africa decreased 16.7%, 12% and 15.5%, respectively. A stronger U.S. dollar might hurt the company’s overseas business results in the quarters ahead.

The Zacks Consensus Estimate for Flowserve’s earnings is pegged at $1.51 for 2022 and $2.09 for 2023, marking declines of 15.2% and 8.7% from the respective 60-day-ago figures. Notably, there have been six downward revisions in estimates for both 2022 and 2023 in the past 60 days.

Stocks to Consider

Some better-ranked companies from the same space are discussed below:

RBC Bearings Incorporated ROLL is presently Zacks #2 (Buy) Ranked. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. ROLL’s earnings surprise in the last four quarters was 3.4%, on average.

In the past 60 days, the stock’s earnings estimates have increased 9.7% for fiscal 2023 (ending March 2023). The same has declined 10.2% in the past year.

IDEX Corporation IEX presently has a Zacks Rank of 2. IEX delivered a trailing four-quarter earnings surprise of 2.8%, on average.

IDEX’s earnings estimates have increased 3.2% for 2022 in the past 60 days. Its shares have declined 19% in the past year.

Nordson Corporation NDSN presently carries a Zacks Rank #2. Its earnings surprise in the last four quarters was 4.5%, on average.

In the past 60 days, NDSN’s earnings estimates have increased 3% for 2022. The stock has declined 9.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance