Fixed Deposit Linked Home Loans – Are the Interest Rates Really More Stable?

Fixed deposit linked home loans! It’s the latest innovation the banks have come up with in the mortgage sector and it looks like it’s here to stay. For a while. At least.

If you’re new to the world of home ownership and mortgage loans, you’re probably wondering what fixed deposit linked home loans are all about. And frankly, we don’t blame you! What with all the complicated terms like FHR9, 15FDPR, FHR18 and even OCBC’s now defunct 15FDMR. What do all these terms mean? Why do people always talk about FD linked home loans and fixed deposit interest rates like they’re the same thing? Well, rest easy. Here’s what fixed deposit linked home loans are:

What are Fixed Deposit linked home loans?

Fixed deposit linked home loans are basically home loan packages whose interest rates are pegged to the rates the bank is offering to customers who put a fixed deposit with them.

Most home loans have interest rates that are derived from an equation that looks like this:

UOB 15FDPR + 1.2%

The first half (in this case, “UOB 15FDPR”) is what I’d like to think of as the banks’ “cost price”. The important thing to remember is that banks cannot guarantee this part will not change. All the types of rates you keep hearing so much about (eg board rates, fixed deposit interest rates SIBOR, SOR etc) make up this part of the equation.

The second half (in this case, 1.2%) is called the spread. We’ll get to this later.

Fixed deposit linked home loans, if you haven’t guessed already, use fixed deposit account interest rates as this part of the equation! In other words, the banks are charging you based on the same interest rate to their fixed deposit account holders.

Different banks use different abbreviations to refer to these rates (eg DBS FHR, UOB FDPR, and OCBC FDMR). Don’t know why they like to use such cheem terms…

The number next to the acronym though, signifies the average period of which these fixed deposits are deposited. Naturally, the interest rates are higher when they’re linked to a higher month interest rate. For example, the DBS FHR9 is 0.25% while the same bank’s FHR18 is 0.60%.

Why? Because customers need more incentives for putting in money in the bank for 18 months as opposed to a shorter 9 months lah! If I don’t give you a higher return rate for parking your money with me longer, why should you right? Unless you’re a billionaire, you know, happy like bird, and don’t care where you park your money lah.

Still with me? Good.

The second half (1.2% in the above example) is called the spread. This signifies the bank’s profits, and unlike the first half of the mortgage rate, this will not change in a home loan package.

Here are the answers to some other questions you might be asking…

No, you don’t have to have a fixed deposit account with the bank to get a fixed deposit linked mortgage.

When we say the loan packages are linked or pegged to the bank’s fixed deposit rates, we’re referring to how the home loan rates are derived. Having a fixed deposit account with the bank is not a prerequisite, although feel free to open one!

Advantages and disadvantages of fixed-deposit linked home loans

Let’s start with the disadvantages first:

Because it is based on the bank’s own fixed deposit rate, banks have unilateral control of these rates. They can raise or lower their fixed deposit interest rates anytime without external influences.

The banks can also change the type of fixed deposit interest rate their mortgage loans are pegged to and how they’re computed. For example,

When DBS first introduced their FHR rates, it was based on the average of their 12-month and 24-month S$ Fixed Deposit (FD) rates at 0.25% and 0.55% respectively. The initial FHR was 0.4%.

Subsequently, DBS simplified their fixed deposit linked home loans to follow a single fixed deposit rate. First, it was FHR18 (0.6%), and now FHR9 (0.25%).

Of course, DBS will still honour the terms of existing contracts. That means if you were on an FHR18 package, you won’t suddenly find yourself on a FHR9 package.

While no one’s complaining (because lower now mah), the precedent has been set for banks to change their packages whenever they deem fit.

What about the advantages?

Because of the nature of this interest rate, fixed deposit rates are a “double-edged sword” for the banks. If banks raise the rates, while they earn higher interest from your home loan rates, they’ll also have to pay out higher interest to their fixed deposit account holders.

So there is less incentive for banks to increase your fixed-deposit linked home loan rate. Compare this to say, a board rate which is less transparent. A bank can choose to increase their board rates anytime without too much cost to themselves.

Are fixed deposit linked home loans really more stable?

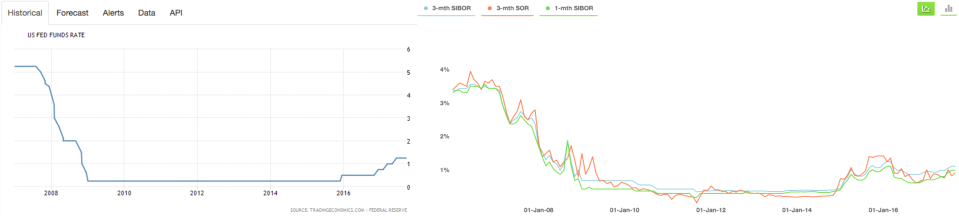

We believe fixed deposit interest rates are more stable compared to board rates as well as the SIBOR and SOR. This is because the US federal rates have been rising over the past 2 years and are forecasted to continue rising into the rest of 2017 and 2018. Hence, rates that correlate to US interest rates (such as SIBOR and SOR) are at a higher risk of increasing. When US fed rates rise, SIBOR would also rise.

The only other choices you have are fixed rate home loans, and a board rate, and you already know how we feel about board rates

While fixed rates do revert back to floating rates eventually (sometimes at a higher interest rate compared to a fixed deposit linked home loan package), there are instances where people would appreciate the added years of a non-fluctuating rate. It all boils down to preference and your cashflow situation.

If you have trouble choosing between a fixed-deposit linked rate and a fixed rate, do give our mortgage specialists a call to find out which best suits you.

The post Fixed Deposit Linked Home Loans - Are the Interest Rates Really More Stable? appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

More From MoneySmart

Yahoo Finance

Yahoo Finance