Five9 Inc (FIVN) Q1 2024 Earnings: Surpasses Revenue Forecasts and Narrows GAAP Net Loss

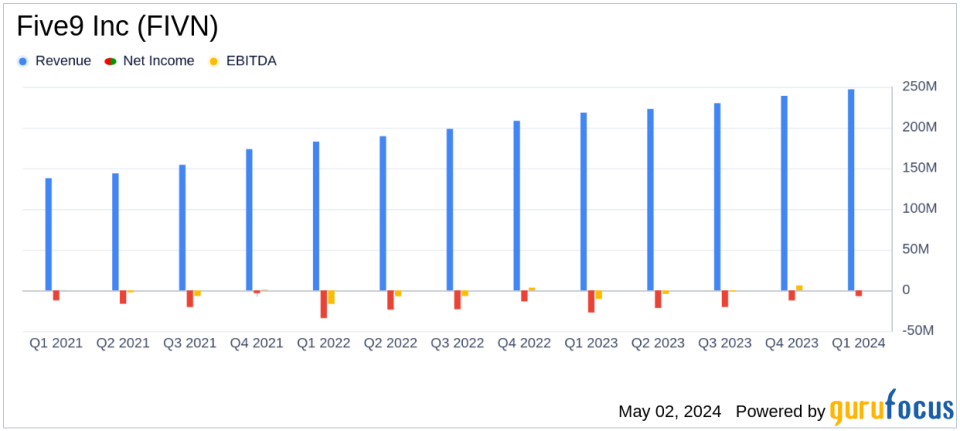

Revenue: Reached $247.0 million in Q1 2024, up 13% year-over-year, surpassing estimates of $239.99 million.

Net Income: Reported a GAAP net loss of $7.1 million, improved from a net loss of $27.2 million in Q1 2023, but fell far below the estimated net income of $28.72 million.

Earnings Per Share: Non-GAAP net income per diluted share was $0.48, exceeding the estimated $0.38.

Gross Margin: GAAP gross margin increased to 53.6% in Q1 2024 from 52.0% in Q1 2023; adjusted gross margin slightly improved to 60.8% from 60.4%.

Subscription Revenue: Grew by 20% year-over-year, highlighting strong demand for the company's services.

Operating Cash Flow: GAAP operating cash flow was $32.4 million, slightly below the $33.4 million reported in the prior year.

Full Year Guidance: Expects 2024 revenue between $1.053 billion and $1.057 billion and non-GAAP net income per share between $2.15 and $2.19.

On May 2, 2024, Five9 Inc (NASDAQ:FIVN) released its 8-K filing, detailing a quarter of significant achievements and financial growth. The company, a leading provider of cloud-native contact center software, reported a 13% year-over-year increase in total revenue, reaching a record $247.0 million for the first quarter of 2024, surpassing the estimated $239.99 million. This growth was underpinned by a 20% increase in subscription revenue, reflecting strong market demand for Five9's innovative solutions.

Five9's GAAP gross margin improved to 53.6% from 52.0% in the previous year, while adjusted gross margin slightly increased to 60.8%. Notably, the company narrowed its GAAP net loss to $(7.1) million, or $(0.10) per share, significantly improving from a net loss of $(27.2) million, or $(0.38) per share, in Q1 2023. This performance demonstrates effective cost management and operational efficiency.

Company Overview and Market Position

Five9 offers a comprehensive suite of solutions that enable effective customer interactions through its Intelligent CX Platform. The platform's capabilities span from telephony and omnichannel engagement to AI-enhanced services and analytics, catering to over 3,000 organizations globally. With a focus on innovation and market leadership in the contact center as a service (CCaaS) industry, Five9 continues to capture significant market share and deliver value to some of the largest global brands.

Strategic Highlights and Future Outlook

During the quarter, Five9 signed its largest deal ever with a Fortune 50 financial services company, underscoring its upward trajectory and expanding market influence. CEO Mike Burkland expressed enthusiasm about the company's direction, citing the massive, underpenetrated market and Five9's positioning as a clear market leader. For the full year 2024, Five9 anticipates revenues to be in the range of $1.053 to $1.057 billion and projects a non-GAAP net income per share between $2.15 and $2.19.

Financial Health and Operational Efficiency

The balance sheet remains robust with $240.19 million in cash and cash equivalents, and marketable investments of $843.21 million as of March 31, 2024. Total assets increased significantly to $1.87 billion from $1.49 billion at the end of 2023. This financial health supports sustained investment in technology and market expansion. Furthermore, GAAP operating cash flow was reported at $32.4 million, highlighting strong liquidity and operational cash generation.

Analysis of Performance

Five9's performance this quarter reflects a solid trajectory towards sustained growth and profitability. The substantial reduction in GAAP net loss and the consistent improvement in gross margins are indicative of effective cost control and higher operational efficiency. The strategic focus on expanding its customer base and enhancing its technology offerings is likely to continue driving growth, particularly as enterprises increasingly adopt cloud-based contact center solutions.

Overall, Five9's Q1 2024 results not only exceeded revenue expectations but also demonstrated strategic advancements and operational improvements, positioning the company well for ongoing success in the evolving CCaaS market.

Explore the complete 8-K earnings release (here) from Five9 Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance