Five Below (FIVE) Rides High on Strategies: Should You Retain?

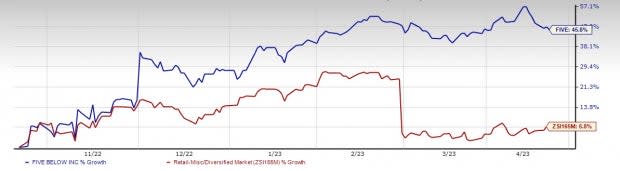

Five Below, Inc. FIVE seems well poised for future growth, thanks to its robust business strategies. FIVE’s focus on providing trend-right products, improving supply-chain operations, strengthening digital capabilities and expanding stores will continue to yield solid results. Also, Five Below is committed to enhancing customer experience in several ways. Impressively, shares of this Philadelphia, PA-based company have surged 45.8% in the past six months compared with the industry’s 6.8% gain.

Let’s Delve Deeper

Five Below has been digitizing vendor transactions, implementing a core merchandising platform and applying cloud-based data and analytics to analyze the demand and accordingly manage inventory. Five Below rolled out curbside pickup and strengthened the buy online, pick up in store business model.

FIVE is adding assisted checkout capabilities and is committed to providing same-day delivery service to make shopping convenient. Five Below has extended its partnership with Instacart to bring expedited same-day delivery to all its outlets. The addition of Venmo and PayPal as payment options also enriches the customer experience.

Image Source: Zacks Investment Research

We note that the company is known for its impressive range of merchandise, as it continues to make innovations and refresh its product range per the evolving consumer trends. On the marketing front, the company is focusing on digital advertising. Moreover, the company continues to build a new prototype Five Beyond. The company concluded the 2022 Five Beyond growth initiative with approximately 250 stores converted to the new store format representing 20% of its store fleet.

Five Below continues to expand its store base and enhance the in-store experience to draw traffic and enhance the customer base. The company believes that expanding scale helps it gain access to renowned shopping centers, capitalize on emerging market trends and increase brand value. Five Below had 1,340 stores at the end of fiscal 2022, up 150 stores or 12.6% from the previous year. The company expects there is a tremendous opportunity to expand its store fleet throughout the United States and expects to open in more than 3,500 locations. The company intends to open about 200 new stores and convert 400 stores to the new Five Beyond format in fiscal 2023.

Conclusion

We believe that Five Below’s wide assortment of trend-right merchandise, solid in-store and online experience and favorable pricing strategy are likely to remain major growth drivers. A VGM Score of A coupled with an impressive long-term expected earnings growth rate of 22.3% for this Zacks Rank #3 (Hold) stock further speaks potential.

In addition, analysts look optimistic about the company. For fiscal 2023, the Zacks Consensus Estimate for Five Below’s sales and earnings per share (EPS) is currently pegged at $3.57 billion and $5.60 each. These estimates suggest growth of 16.1% and 19.4%, respectively, from the year-ago period’s corresponding figures. Also, for fiscal 2024, the consensus estimate for sales and EPS is pegged at $4.21 billion and $6.82 each, suggesting year-over-year increases of 17.8% and 21.8%.

Here are 3 Key Stocks for You

We have highlighted three top-ranked stocks, Urban Outfitters URBN, Stitch Fix SFIX and Boot Barn BOOT.

Urban Outfitters, a retailer of fashion apparel, accessories and footwear, currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Urban Outfitters’ current financial-year sales and EPS suggests growth of 4.3% and 41.7%, respectively, from the year-ago reported figures. URBN delivered break-even earnings in the last reported quarter.

Stitch Fix, a leading online personal styling retailer, currently sports a Zacks Rank #2.

The Zacks Consensus Estimate for Stitch Fix’s current financial-year sales and EPS suggests growth of 1.2% from the year-ago reported figure. SFIX delivered a negative earnings surprise of 3% in the last reported quarter.

Boot Barn, a fashion apparel and accessories retailer, currently carries a Zacks Rank of 2. The company has a trailing four-quarter earnings surprise of 8.7%, on average.

The Zacks Consensus Estimate for Boot Barn’s current financial-year sales suggests growth of 8.2% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Five Below, Inc. (FIVE) : Free Stock Analysis Report

Stitch Fix, Inc. (SFIX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance