First Community Bankshares' (NASDAQ:FCBC) Dividend Will Be $0.29

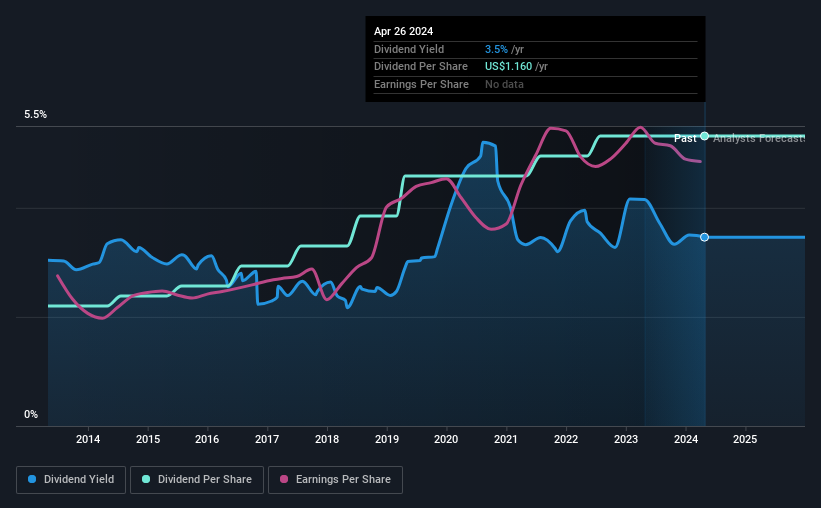

First Community Bankshares, Inc. (NASDAQ:FCBC) has announced that it will pay a dividend of $0.29 per share on the 24th of May. This means that the annual payment will be 3.5% of the current stock price, which is in line with the average for the industry.

View our latest analysis for First Community Bankshares

First Community Bankshares' Dividend Forecasted To Be Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable.

First Community Bankshares has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Taking data from its last earnings report, calculating for the company's payout ratio shows 44%, which means that First Community Bankshares would be able to pay its last dividend without pressure on the balance sheet.

Over the next year, EPS is forecast to fall by 8.3%. But assuming the dividend continues along recent trends, we believe the future payout ratio could be 52%, which we are pretty comfortable with and we think would be feasible on an earnings basis.

First Community Bankshares Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from an annual total of $0.48 in 2014 to the most recent total annual payment of $1.16. This implies that the company grew its distributions at a yearly rate of about 9.2% over that duration. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

The Dividend's Growth Prospects Are Limited

The company's investors will be pleased to have been receiving dividend income for some time. Earnings per share has been crawling upwards at 3.2% per year. Growth of 3.2% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

We should note that First Community Bankshares has issued stock equal to 13% of shares outstanding. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

We Really Like First Community Bankshares' Dividend

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. The distributions are easily covered by earnings, and there is plenty of cash being generated as well. We should point out that the earnings are expected to fall over the next 12 months, which won't be a problem if this doesn't become a trend, but could cause some turbulence in the next year. All of these factors considered, we think this has solid potential as a dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, First Community Bankshares has 2 warning signs (and 1 which can't be ignored) we think you should know about. Is First Community Bankshares not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance