First Commonwealth Financial Corp Reports Q1 2024 Earnings: A Detailed Overview

Net Income: Reported at $37.5 million, up from $30.2 million in Q1 2023, exceeding the estimate of $36.88 million.

Earnings Per Share (EPS): Achieved $0.37, surpassing the estimated $0.36, and up from $0.30 in Q1 2023.

Revenue: Net interest income reported at $92.3 million, slightly below the estimated $119.93 million.

Provision for Credit Losses: Increased to $4.2 million from a credit of $1.9 million in the previous quarter.

Deposits: End of period deposits rose by $254.1 million, marking an 11.1% annualized increase from the previous quarter.

Loan-to-Deposit Ratio: Decreased to 95.6%, down 228 basis points from the previous quarter.

Dividend: Quarterly cash dividend increased by 4.0% to $0.13 per share.

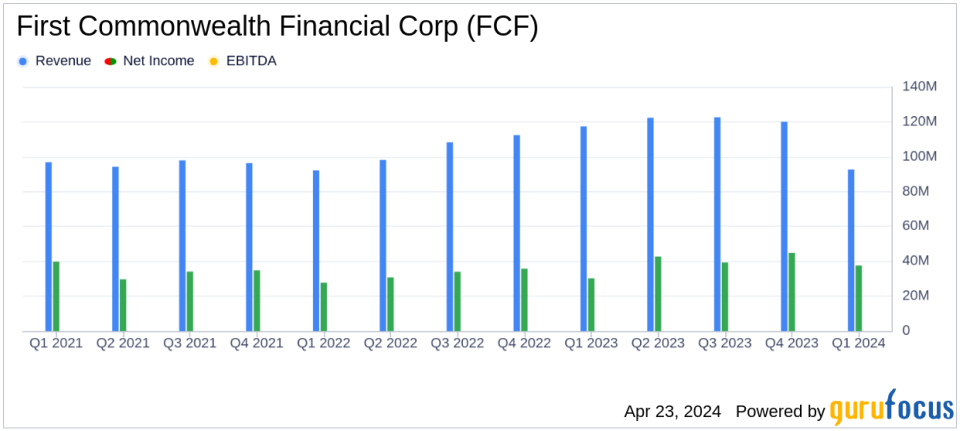

On April 23, 2024, First Commonwealth Financial Corp (NYSE:FCF) disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company reported a net income of $37.5 million with diluted earnings per share (EPS) of $0.37. These figures show a notable improvement from the first quarter of 2023's net income of $30.2 million and EPS of $0.30, aligning closely with current analyst estimates which projected an EPS of $0.36 for this quarter.

First Commonwealth Financial Corp, headquartered in Indiana, Pennsylvania, operates primarily in the financial services sector in the United States. Through its subsidiary, First Commonwealth Bank, the company offers a diverse range of banking services including consumer and commercial banking products, mortgage and equipment finance, as well as wealth management and insurance services.

Quarterly Financial Highlights

The company's financial performance this quarter reflects a robust strategic focus, despite facing challenges such as a decrease in net interest income and a tightening net interest margin. Net interest income for Q1 stood at $92.6 million, a slight decrease from the previous year's $94.4 million. The net interest margin also saw a reduction to 3.52% from 4.01% in Q1 2023, primarily due to an increase in the cost of funds.

Noninterest income was reported at $24.0 million, marginally lower than the $24.3 million in the previous quarter. Meanwhile, noninterest expenses slightly increased to $65.5 million from $65.0 million in the preceding quarter. The core efficiency ratio deteriorated to 55.05% from 52.41% in the first quarter of 2023, indicating higher costs relative to revenue.

Asset Quality and Capital Adequacy

Asset quality showed mixed signals; the provision for credit losses was $4.2 million, up from a credit of $1.9 million in the previous quarter. However, the net charge-offs decreased significantly to $4.3 million from $16.3 million in the prior quarter, showing an improvement in asset quality. The nonperforming loans ratio slightly increased to 0.47% from 0.44% at the end of the previous quarter.

From a capital perspective, First Commonwealth remains well-capitalized with a Common Equity Tier 1 (CET1) ratio of 11.4%, comfortably above the regulatory requirement. The board also approved a 4.0% increase in the quarterly cash dividend, reflecting confidence in the bank's financial stability and profitability.

Strategic Moves and Outlook

The bank's strategic initiatives include retiring $50 million of variable rate subordinate corporate debentures, which is expected to improve the net interest margin starting from the third quarter of 2024. This move underscores First Commonwealth's proactive management of its capital structure and commitment to enhancing shareholder value.

President and CEO T. Michael Price (Trades, Portfolio) commented on the results, stating,

We are pleased to report another solid quarter of performance, highlighted by our strong pre-tax, pre-provision return on average assets of 1.77% and return on average tangible common equity of 16.51%. Our commitment to disciplined financial management and profitability remain our primary focus."

In conclusion, First Commonwealth Financial Corp's first quarter results for 2024 demonstrate a solid financial position with strategic initiatives aimed at sustaining profitability and shareholder value. The company's adherence to a disciplined financial approach, despite a challenging interest rate environment, positions it well for future stability and growth.

Explore the complete 8-K earnings release (here) from First Commonwealth Financial Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance