Fidelity National Information Services Inc's Dividend Analysis

An In-depth Look at FIS's Dividend Performance and Future Prospects

Introduction to Fidelity National Information Services Inc's Dividend Announcement

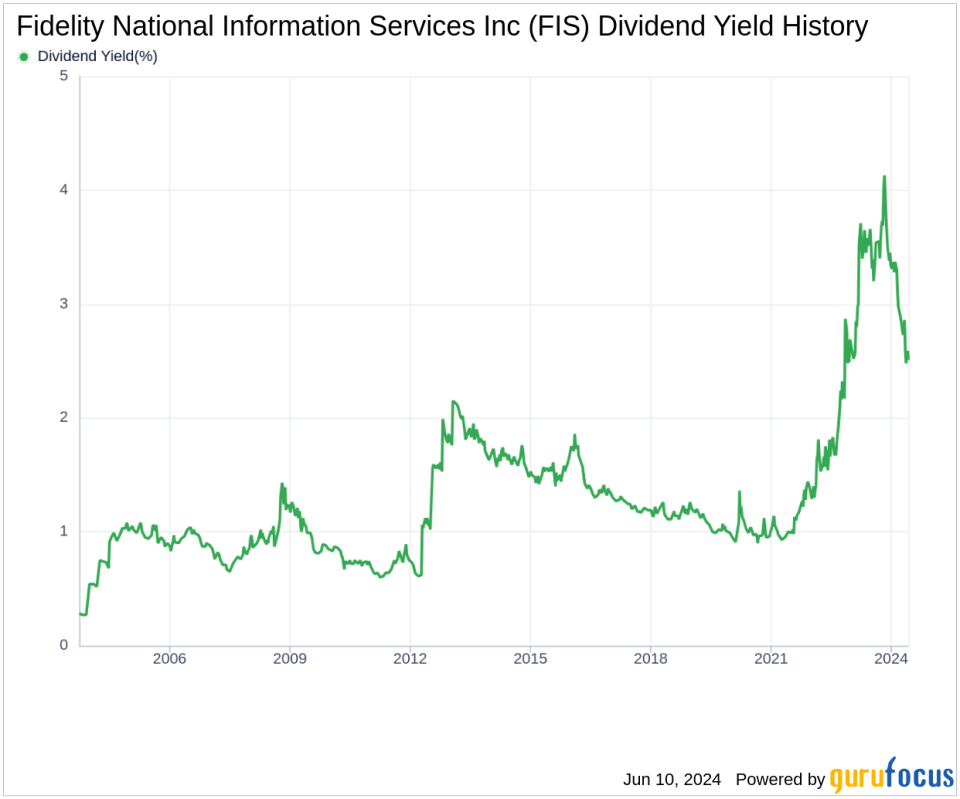

Fidelity National Information Services Inc (NYSE:FIS) recently announced a dividend of $0.36 per share, set to be payable on 2024-06-24, with the ex-dividend date marked for 2024-06-10. As investors mark their calendars for this upcoming payment, it's crucial to delve into the company's dividend history, yield, and growth rates. This analysis will draw upon extensive data from GuruFocus to evaluate the sustainability and potential future performance of FIS's dividends.

Understanding Fidelity National Information Services Inc

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

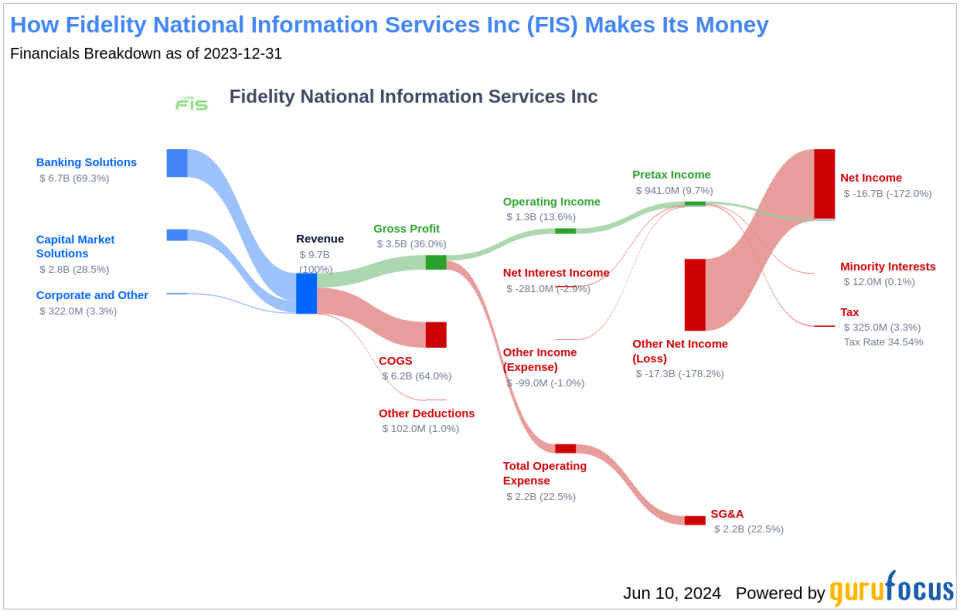

Fidelity National Information Services provides core processing and ancillary services primarily to the banking sector. Its acquisition of SunGard in 2015 and Worldpay in 2019 significantly expanded its service offerings to include record-keeping for investment firms and payment processing for merchants. Although FIS has recently scaled back its ownership in Worldpay to a minority stake, its diversified service portfolio continues to position it strongly in both the U.S. and U.K. markets.

A Look at Fidelity National Information Services Inc's Dividend History

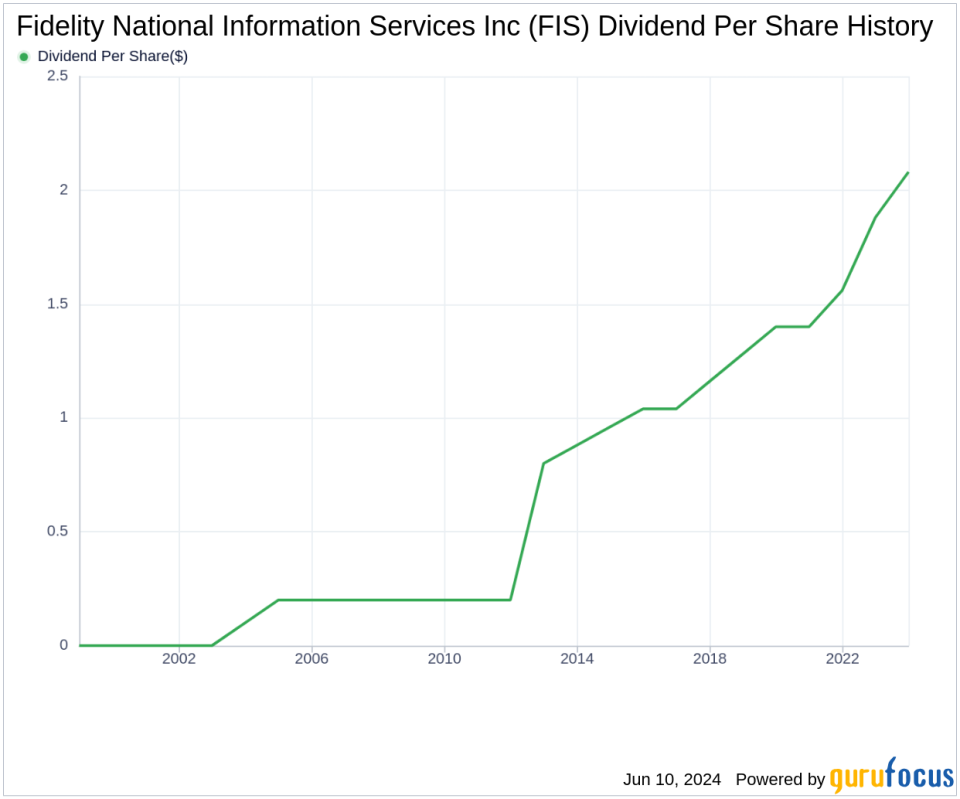

Since 2003, Fidelity National Information Services Inc has maintained a reliable dividend payment track record, distributing dividends quarterly. The company has also achieved the status of a dividend achiever by increasing its dividend annually since 2003, a testament to its financial health and commitment to returning value to shareholders.

Below is a visualization of the annual Dividends Per Share to illustrate historical trends.

Examining Dividend Yield and Growth

Fidelity National Information Services Inc currently boasts a 12-month trailing dividend yield of 2.48% and a forward dividend yield of 2.27%, indicating a slight expected decrease in dividend payments over the next year. Over the past three, five, and ten years, annual dividend growth rates have been 14.10%, 10.30%, and 8.50% respectively, reflecting a robust pattern of growth. The 5-year yield on cost for FIS stock is approximately 4.08%.

Sustainability of Dividends: Payout Ratio and Profitability

To evaluate the sustainability of FIS's dividends, examining the dividend payout ratio is crucial. As of 2024-03-31, Fidelity National Information Services Inc's dividend payout ratio stands at 0.42, suggesting a balanced approach between distributing earnings as dividends and retaining profits for future growth. Additionally, FIS's profitability rank is 6 out of 10, indicating fair profitability with consistent net profit reported in 8 out of the past 10 years.

Future Growth Prospects

The growth outlook for Fidelity National Information Services Inc, with a growth rank of 6 out of 10, appears stable. Key metrics such as revenue per share and 3-year revenue growth rate, however, show a -6.00% annual decline, underperforming 80.96% of global competitors. In contrast, the 3-year EPS growth rate has increased by an average of 36.80% annually. Despite a challenging 5-year EBITDA growth rate of -9.50%, FIS's robust dividend growth and strategic market positioning provide a cautiously optimistic future outlook.

Conclusion: Evaluating FIS's Dividend Strategy

In conclusion, Fidelity National Information Services Inc's consistent dividend increases and strategic financial management practices offer a promising scenario for dividend investors. However, potential investors should also consider the mixed signals from the company's growth metrics and market performance. For those looking to explore further, GuruFocus Premium provides tools such as the High Dividend Yield Screener to discover high-yield investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance