FED MEETING — What you need to know in markets on Wednesday

Wednesday will be all about the Federal Reserve.

At 2:00 p.m. ET on Wednesday, the Federal Open Market Committee will release its latest monetary policy decision, which markets expect will see the central bank take its benchmark interest rate to 0.75%-1% from 0.50%-0.75%.

This would be the third interest rate hike from the Fed since the financial crisis.

Fed Chair Janet Yellen is expected to hold a press conference that will kick off around 2:30 p.m. ET on Wednesday afternoon, and should field questions for about an hour.

And while the Fed will be the main event on Wednesday, the morning will be busy with economic data as the February reports on both retail sales and inflation will cross in the morning.

Economists forecast retail sales rose 0.1% in February, while “core” inflation — which excludes the more volatile costs of food and gas — should rise 2.2% over the prior year. Recall that the Fed is targeting 2% inflation.

Watch the dots

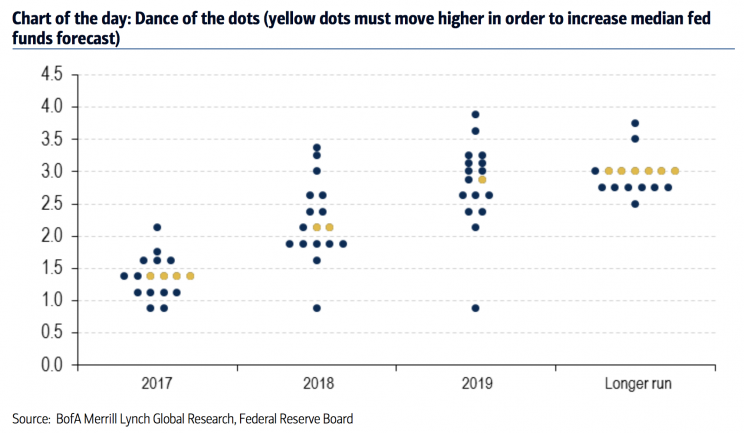

Alongside the Fed’s latest policy statement, markets will also get an updated set of economic projections from the Fed for GDP and inflation, as well as an updated “dot plot,” which shows where Fed officials expect benchmark interest rates to be in the future.

“Given the hawkish commentary from Fed officials, we think the dots will likely shift higher,” economists at Bank of America Merrill Lynch wrote in a note to clients earlier this week.

“The doves, such as Fed Governor Brainard and Chicago President Evans, have seemingly become more comfortable with the hiking cycle, which will likely mean moving from the 2 to 3 hike camp. Moreover, the hawks have probably become more enthusiastic about the prospects for a faster hiking cycle.

“However, the big question is about the moderates; we would need to see 4 FOMC officials revise expectations from 3 hikes this year to 4 hikes to move up the 2017 median. It is a close call, but we think we will fall short, which means the median dot is unchanged even though the average dot will head higher. As such, the median dot will still imply 3 hikes for this year.”

During Chair Yellen’s press conference, we’d expect there to be questions relating to any discussions the Fed has had about economic programs discussed by the Trump administration, notably the $1 trillion infrastructure package Donald Trump touted as recently at February 28.

In the past, however, Fed officials have demurred at providing any color around the central bank’s thinking, given that any impacts this may or may not have on the economy are largely unknown on account of details about this plan being scarce.

The Fed’s policy statement itself, while perhaps not quite as exciting given the expected rate hike and commentary form Chair Yellen, should also get an update and perhaps show an improved outlook from the Fed on the economy.

“In the January statement the committee said: ‘Near-term risks to the economic outlook appear roughly balanced,'” note economists at Goldman Sachs.

“This time we expect the FOMC to indicate that risks to the outlook are ‘balanced,’ which the committee has not said since December 2015. The statement may also drop the reference to ‘near-term’ if Fed officials want to indicate a brighter medium-term outlook as well.”

Though perhaps the most comprehensive outlook for Wednesday’s meeting came from economist Neil Dutta at Renaissance Macro, who said in a note on Monday, “The FOMC meeting already happened.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance