Fastly Inc (FSLY) Q1 2024 Earnings: Revenue Surpasses Estimates, Despite Challenges in Net Loss

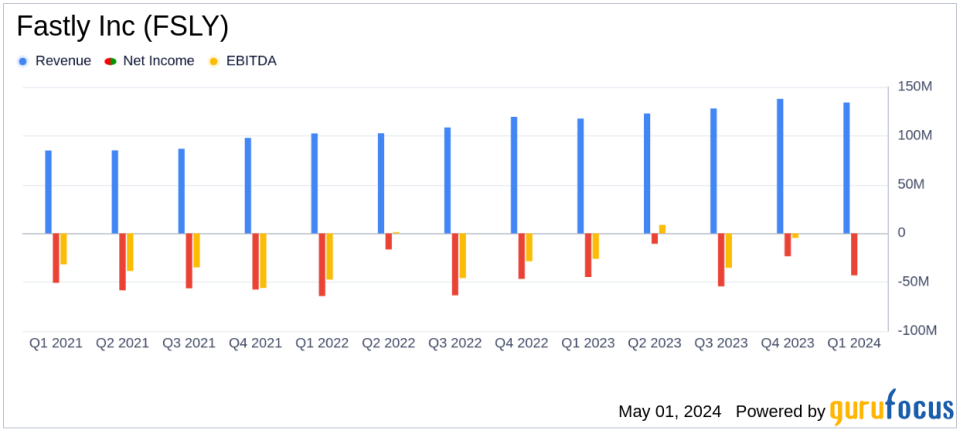

Revenue: $133.52M, up 14% year-over-year, surpassing estimates of $133.11M.

Net Loss: $43.43M, an improvement from a net loss of $44.69M in the previous year, but exceeded the estimated net loss of $8.40M.

Earnings Per Share (EPS): GAAP net loss per share was $0.32, an improvement from $0.36 year-over-year, but above the estimated loss per share of $0.06.

Gross Margin: GAAP gross margin increased to 54.8% from 51.3% last year; Non-GAAP gross margin also rose to 58.8% from 55.6%.

Operating Cash Flow: Positive cash flow from operations reported at $11.1M.

Customer Growth: Total customer count reached 3,290, up from the previous quarter, with enterprise customers slightly down by 1 to 577.

Product Innovations: Launched new Bot Management Solution and several other enhancements aimed at improving security and operational efficiency.

On May 1, 2024, Fastly Inc (NYSE:FSLY) disclosed its financial results for the first quarter ended March 31, 2024, through an 8-K filing. The company reported a revenue of $133.52 million, exceeding the estimated $133.11 million, showcasing a robust 14% year-over-year growth. However, the net loss widened to $43.43 million, or $0.32 per share on a GAAP basis, and $6.48 million, or $0.05 per share on a non-GAAP basis, missing the estimated net loss of $8.40 million and earnings per share of -$0.06.

About Fastly Inc (NYSE:FSLY)

Fastly operates a content delivery network essential for providing faster and more reliable online content. Unlike traditional CDNs, Fastly's platform allows customers to program directly on its platform, facilitating edge computing and better servicing dynamic content. Primarily serving large enterprises, Fastly generated nearly three-fourths of its 2022 revenue from the United States.

Financial and Operational Highlights

The first quarter saw Fastly achieving a non-GAAP gross margin of 58.8%, up from 55.6% in the previous year, reflecting improved operational efficiency. Despite the revenue growth, the company faced a GAAP operating loss of $46.26 million, slightly improved from the $47.28 million loss in Q1 2023. The non-GAAP operating loss was $9.66 million, better than the $14.07 million loss reported last year.

Fastly's CEO, Todd Nightingale, expressed satisfaction with the quarter's operational performance and the positive cash flow from operations, which stood at $11.1 million. However, he noted concerns over the company's revenue growth outlook.

I am pleased with the first quarter operating performance, posting non-GAAP operating loss above our guidance and positive cash flow from operations," said Nightingale. "But, we're not satisfied with our revenue growth outlook."

Strategic Developments and Future Outlook

During the quarter, Fastly launched several new products, including the Fastly Bot Management Solution, aimed at enhancing security offerings. The company also simplified its product bundles to facilitate customer choice and predictability in billing.

For the upcoming quarter, Fastly forecasts revenue between $130.0 million and $134.0 million and anticipates a non-GAAP operating loss between $16.0 million and $12.0 million. For the full year, the company expects revenue to range from $555.0 million to $565.0 million, with a non-GAAP operating loss projected between $28.0 million and $22.0 million.

Investor and Analyst Perspectives

Despite the challenges in narrowing its net loss, Fastly's strategic initiatives and product enhancements indicate a strong focus on long-term growth and market adaptation. Investors and analysts might view the revenue outperformance positively, balanced against the concerns over future profitability and the ongoing need to manage operating losses.

Fastly's continued investment in innovation and customer acquisition strategies, coupled with its efforts to diversify its customer base, are pivotal as it navigates through competitive pressures and strives for a turnaround in its financial health.

Explore the complete 8-K earnings release (here) from Fastly Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance