Fastly (FSLY) Q2 Earnings Beat, Customer Growth Aids Revenues

Fastly FSLY reported second-quarter 2020 non-GAAP earnings of 2 cents per share that beat the Zacks Consensus Estimate by 300%. The company had reported loss of 16 cents per share in the year-ago quarter.

Revenues of $74.7 million also surpassed the consensus mark by 4.2% and jumped 61.7% year over year.

Customer count increased to 1,951, up from 1,837 in the previous quarter. Moreover, total-enterprise customer count increased from 297 in first quarter to 304 in the reported quarter.

Average-enterprise customer spending was roughly $716K, up from $642K in the previous quarter. Rapid adoption of Fastly’s optimization and security products such as Media Shield, Cloud Optimizer, WAF and TLS services drove growth.

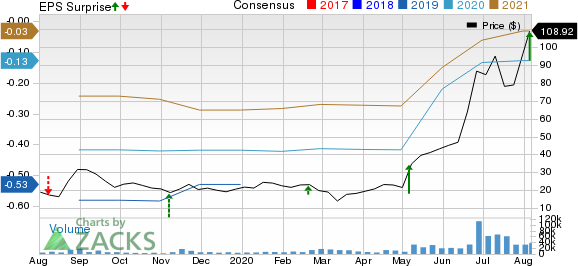

Fastly, Inc. Price, Consensus and EPS Surprise

Fastly, Inc. price-consensus-eps-surprise-chart | Fastly, Inc. Quote

Markedly, enterprise customers generated 88% of Fastly’s trailing twelve-month total revenues.

Quarterly Details

Dollar-based net expansion rate was 137% in the quarter under review, up from 133% reported in the previous quarter.

Moreover, net retention rate was of 138%, up from 130% reported in the previous quarter.

As of second-quarter 2020, Fastly was operating in 55 markets, providing access to 100 Tb/sec of global network capacity, representing 35% growth since the beginning of the year.

Gross margin in the fiscal second quarter expanded 610 basis points (bps) year over year to 61.7%.

Adjusted EBITDA was $6.6 million against adjusted EBITDA loss of $5.6 million.

Research & development expenses as a percentage of revenues increased 590 bps year over year to 16.9%.

Sales & marketing expenses as a percentage of revenues was 23.6%, down from 35.3% in the year-ago quarter.

General & administrative expenses as a percentage of revenues expanded 80 bps to 18.8%.

Operating income was $1.8 million against an operating loss of $9.4 million reported in the year-ago quarter.

Balance Sheet and Cash Flow

Fastly had cash and cash equivalents of $384 million as of Jun 30, 2020, which included proceeds of $275 million, net of underwriting fees from the company’s follow-on offering in May 2020.

Cash flow used in operating activities was $8.8 million compared with $5.6 million in the year-ago quarter.

Free cash outflow was $3.1 million compared with free cash outflow of $4.4 million in the year-ago quarter.

Guidance

For the third quarter of 2020, revenues are expected to be $73.5-$75.5 million. Adjusted loss is projected to be 1 cent per share.

Fastly expects fiscal 2020 revenues of $290-$300 million. Non-GAAP operating loss is expected to be $2-$12 million.

Adjusted loss is estimated to be 1-6 cents per share.

Fastly continues to expect annual capital expenditures as a percentage of revenues to be roughly 13-14% of revenues. Long-term, the company expects capital expenditures to approach 10% of revenues on a calendar year basis.

Zacks Rank & Stocks to Consider

Fastly currently carries a Zacks Rank #3 (Hold).

Dropbox DBX, Asure Software ASUR and Analog Devices ADI are some better-ranked stocks in the broader computer & technology sector. While Asure Software sports a Zacks Rank #1 (Strong Buy), both Dropbox and Analog Devices carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Dropbox, Asure Software and Analog Devices are set to report their quarterly results on Aug 6, 10, and 19, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Fastly, Inc. (FSLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance