Exxon Mobil Corp (XOM) Reports Mixed Q1 2024 Results: Earnings Miss, Revenue Aligns with ...

Earnings Per Share (EPS): Reported at $2.06, falling short of the estimated $2.20.

Net Income: Achieved $8.22 billion, slightly below the estimated $8.782 billion.

Revenue: Specific revenue figures for Q1 2024 were not disclosed, comparisons to estimated revenue of $78.352 billion cannot be made.

Free Cash Flow: Generated a strong $10.1 billion in free cash flow during the quarter.

Dividends: Declared a quarterly dividend of $0.95 per share, payable on June 10, 2024.

Share Repurchases: Conducted $3.0 billion in share repurchases, with plans to increase the annual pace to $20 billion post-Pioneer transaction closure.

Debt Ratios: Reported a debt-to-capital ratio of 16% and a net-debt-to-capital ratio of 3%, reflecting strong financial health.

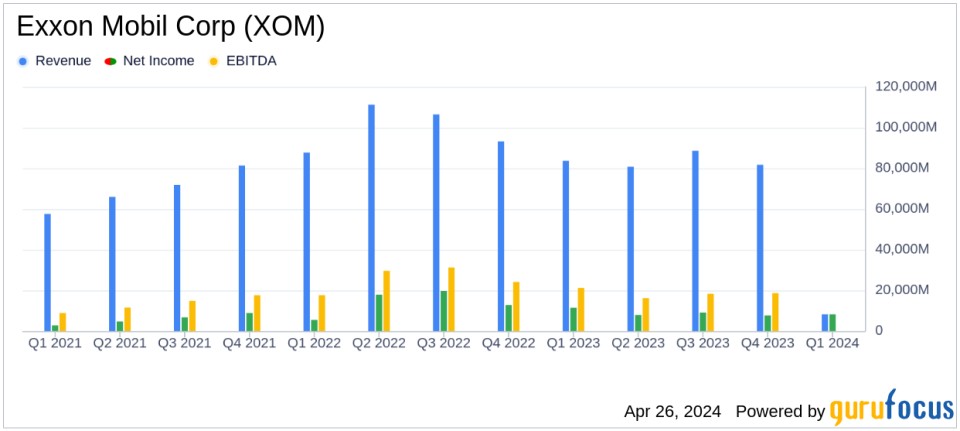

On April 26, 2024, Exxon Mobil Corp (NYSE:XOM) released its 8-K filing, announcing its financial results for the first quarter of 2024. The company reported earnings of $8.2 billion, translating to $2.06 per share, which fell short of the estimated earnings per share of $2.20. However, the reported revenue closely matched the analyst expectations, amounting to $78.35 billion.

ExxonMobil, a leading integrated oil and gas company, operates across the globe in oil exploration, production, and refining. As of 2023, it managed daily productions of 2.4 million barrels of liquids and 7.7 billion cubic feet of natural gas. With reserves totaling 16.9 billion barrels of oil equivalent at year-end 2023, ExxonMobil also boasts significant refining capacities and chemical manufacturing operations.

Performance Highlights and Challenges

The first quarter saw ExxonMobil generating substantial cash flow from operations, amounting to $14.7 billion, and achieving a strong free cash flow of $10.1 billion. This financial robustness enabled the company to distribute $6.8 billion to shareholders through dividends and share repurchases. Despite these strengths, the company faced a downturn in earnings compared to the previous year, primarily due to lower industry refining margins and natural gas prices, which have returned to a more typical range.

Strategic growth in regions like Guyana, where production exceeded expectations, and advancements in high-value chemical products were key drivers this quarter. However, these were offset by reduced base volumes from divestments and other operational challenges.

Strategic Investments and Future Outlook

Chairman and CEO Darren Woods highlighted the company's strategic focus on high-growth potential areas such as advanced recycling and carbon capture technologies. ExxonMobil's commitment to reducing emissions was evident from a more than 60% reduction in operated methane emissions intensity since 2016. Looking forward, the company plans to enhance its earnings capacity through strategic asset investments and cost reductions, aiming for a total of $15 billion in structural cost savings by 2027.

The company also confirmed a second-quarter dividend of $0.95 per share, reflecting its ongoing commitment to shareholder returns. The financial position remains strong with a low debt-to-capital ratio of 16%, providing flexibility for future growth and shareholder distributions.

Detailed Financial Analysis

The Upstream segment reported earnings of $5.7 billion, a decrease from the previous year, mainly due to lower natural gas prices and divestments. The Energy Products segment faced challenges from weaker refining margins, resulting in earnings of $1.4 billion. In contrast, the Chemical Products segment performed well, with earnings of $785 million driven by higher margins and volume growth in performance chemicals.

Overall, while Exxon Mobil's earnings per share did not meet analyst expectations, its revenue alignment and strategic positioning suggest a resilient operational model capable of navigating market volatility. The company's focus on cost efficiency and high-value projects is expected to continue driving its performance in the challenging energy sector.

For a more detailed analysis and ongoing updates, investors and stakeholders are encouraged to visit ExxonMobil's official communications and financial reporting platforms.

Explore the complete 8-K earnings release (here) from Exxon Mobil Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance