Exploring Yangzijiang Shipbuilding Holdings Plus Two Notable Dividend Stocks

Amid a buoyant mood in global markets, Singapore's Straits Times Index reflected investor optimism with a modest uptick, bolstered by strong performances across regional indexes and positive earnings reports from local companies. In such an environment, dividend stocks like Yangzijiang Shipbuilding Holdings stand out for their potential to offer investors a steady income stream alongside the prospects of capital appreciation.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Singapore Exchange (SGX:S68) | 3.63% | ★★★★★☆ |

DBS Group Holdings (SGX:D05) | 6.45% | ★★★★★☆ |

Oversea-Chinese Banking (SGX:O39) | 6.42% | ★★★★★☆ |

Civmec (SGX:P9D) | 6.17% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.50% | ★★★★★☆ |

Asia Enterprises Holding (SGX:A55) | 7.25% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.67% | ★★★★★☆ |

Aztech Global (SGX:8AZ) | 7.92% | ★★★★☆☆ |

Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.58% | ★★★★☆☆ |

Oiltek International (Catalist:HQU) | 6.40% | ★★★★☆☆ |

Click here to see the full list of 24 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

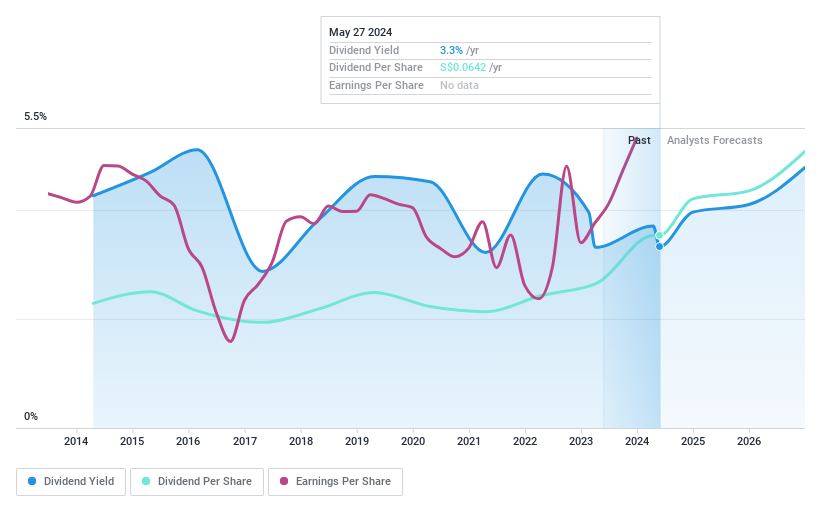

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company specializing in shipbuilding across China, Canada, Japan, Bulgaria, and various other Asian and European nations, with a market capitalization of approximately SGD 7.11 billion.

Operations: Yangzijiang Shipbuilding (Holdings) Ltd. generates revenue primarily through its shipbuilding segment, which contributed CN¥22.79 billion, and its shipping operations, which added CN¥1.02 billion to the total revenue.

Dividend Yield: 3.6%

Yangzijiang Shipbuilding's P/E ratio at S$9.30 is below the Singapore market average, suggesting a value opportunity. Despite a history of dividend volatility over the past decade, its dividends are well-covered by both earnings and cash flows, with payout ratios at 33.6% and 19.1%, respectively. However, its yield of 3.58% falls short compared to Singapore's top dividend payers. Recent contracts for eco-friendly ships align with maritime decarbonisation efforts, potentially bolstering future performance amidst environmental concerns.

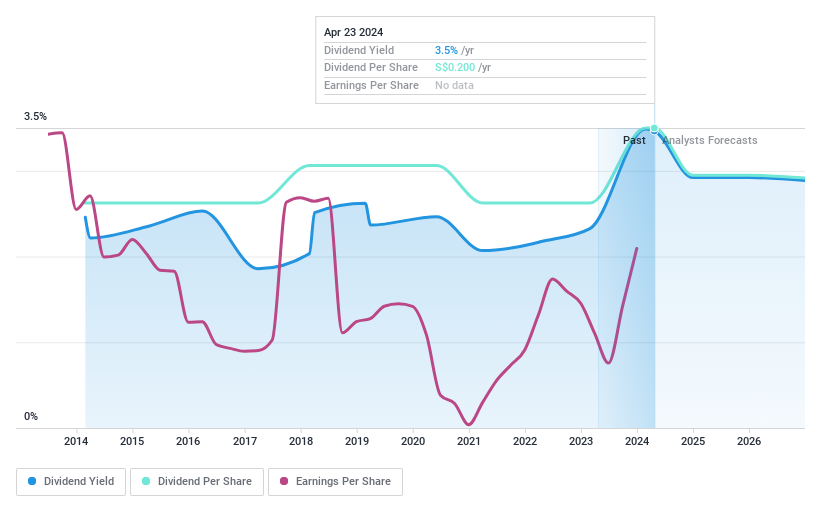

UOL Group (SGX:U14)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOL Group Limited is a diversified company operating in property development, investment, and hospitality sectors across various countries including Singapore, Australia, the UK, China, and more, with a market capitalization of approximately SGD 4.83 billion.

Operations: UOL Group Limited generates revenue primarily through its Property Development segment in Singapore with SGD 1.16 billion, followed by Property Investments at SGD 518.93 million, and Hotel Operations across Singapore and Australia contributing SGD 590.57 million combined, alongside Technology Operations which add another SGD 110.08 million to the total revenue.

Dividend Yield: 3.5%

UOL Group's dividends, with a 3.5% yield, are underpinned by a decade of stability and growth, supported by earnings and cash flows with payout ratios of 17.9% and 59.3%, respectively. Despite trading below its estimated fair value by 28.4%, UOL faces headwinds: forecasted earnings declines averaging 30.3% annually over the next three years could pressure future payouts. Recent executive changes signal strategic shifts, while the announced special dividend reflects confidence in current financial health after reporting S$707.71 million net income on S$2.68 billion sales for FY2023.

Click here and access our complete dividend analysis report to understand the dynamics of UOL Group.

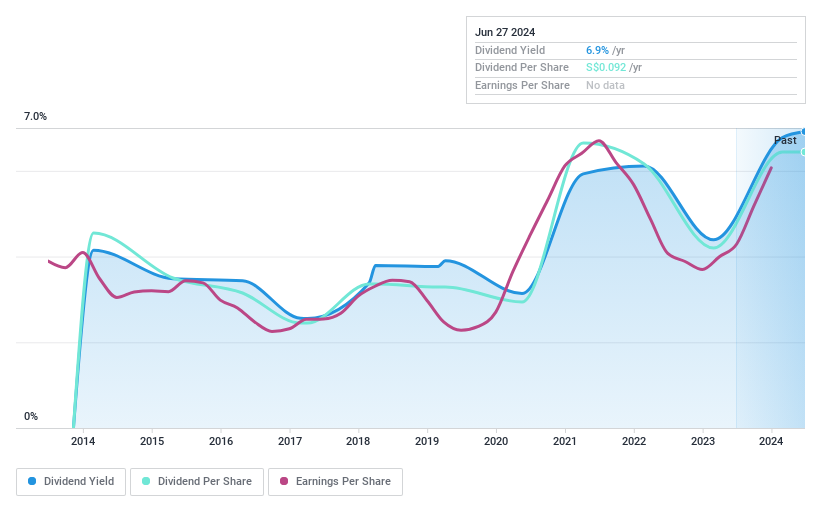

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOB-Kay Hian Holdings Limited is an investment holding company offering a range of services including stockbroking, futures broking, and margin financing across Singapore, Hong Kong, Thailand, Malaysia, and other global markets with a market capitalization of approximately SGD 1.24 billion.

Operations: UOB-Kay Hian Holdings Limited generates its revenue primarily from securities and futures broking and related services, amounting to SGD 539 million.

Dividend Yield: 6.7%

UOB-Kay Hian Holdings' recent S$165.64 million net income marks a significant uptick from the previous year, aligning with a proposed dividend of S$0.092 per share, evidencing a commitment to shareholder returns. The firm's dividends are well-covered by both earnings and cash flows, with payout ratios at 49.6% and 22.4%, respectively, suggesting sustainability despite past volatility in dividend distribution. The appointment of Michael Tay as an independent director could infuse new perspectives into the company's strategic direction amidst its current financial performance.

Make It Happen

Click through to start exploring the rest of the 21 Top Dividend Stocks now.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance