Exploring TSX Dividend Stocks In June 2024

As the Canadian market experiences a phase of stabilization and potential recovery, influenced by rate cuts from the Bank of Canada, investors are closely monitoring opportunities within the TSX. In this context, dividend stocks emerge as particularly noteworthy, offering potential for steady income in a landscape where economic and employment conditions are normalizing.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Canadian Natural Resources (TSX:CNQ) | 8.61% | ★★★★★★ |

Bank of Nova Scotia (TSX:BNS) | 6.64% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.02% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.56% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.37% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.46% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 5.56% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.88% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.38% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 9.15% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Aecon Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aecon Group Inc. operates as a construction and infrastructure development company serving private and public sector clients in Canada, the U.S., and internationally, with a market cap of approximately CA$1.04 billion.

Operations: Aecon Group Inc. generates revenue primarily through its Concessions and Construction segments, with CA$59.50 million from Concessions and CA$4.33 billion from Construction.

Dividend Yield: 4.6%

Aecon Group recently affirmed a quarterly dividend of C$0.19 per share, payable on July 3, 2024. Despite a challenging financial period with Q1 sales dropping to C$846.59 million from C$1.11 billion year-over-year and a net loss of C$6.12 million, Aecon maintains its dividend commitment. The company's payout ratio stands at 27.9%, suggesting dividends are well-covered by earnings, although cash flow coverage is weak with a high cash payout ratio of 4232.8%. Recent board changes introduce experienced leaders potentially stabilizing governance amidst financial uncertainties and forecasted earnings decline averaging -21.5% annually over the next three years.

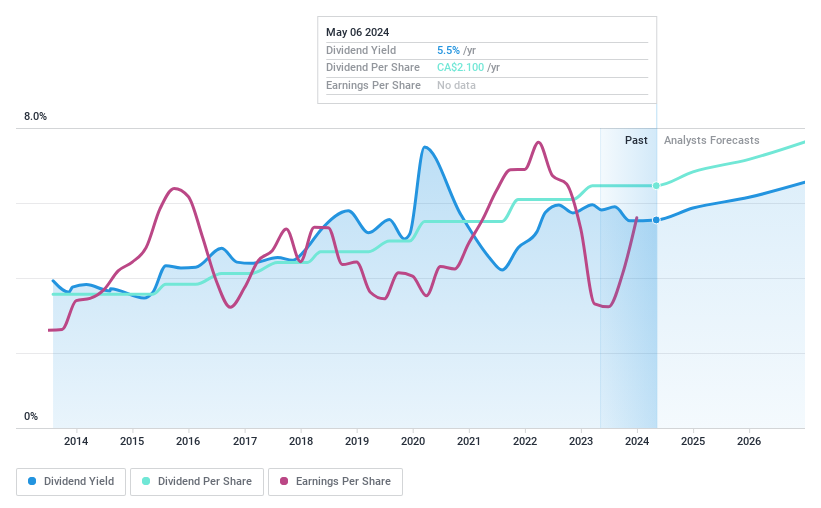

Power Corporation of Canada

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada, an international management and holding company, operates in financial services across North America, Europe, and Asia with a market capitalization of approximately CA$26.07 billion.

Operations: Power Corporation of Canada generates CA$23.51 billion from Lifeco, CA$3.67 billion from Power Financial - IGM, and CA$1.59 billion from its Alternative Asset Investment Platforms.

Dividend Yield: 5.6%

Power Corporation of Canada offers a stable dividend history, maintaining consistent payouts over the last decade with a current yield of 5.6%. The dividends are well-supported, evidenced by a payout ratio of 49.9% and cash flow coverage at 28.4%. Despite trading below its estimated fair value by 36.6%, its dividend yield is lower than the top quartile in the Canadian market, which averages 6.4%. Recent financials show robust earnings growth, with net income rising to CAD 722 million in Q1 2024 from CAD 326 million year-over-year, supporting continued dividend reliability and potential future increases.

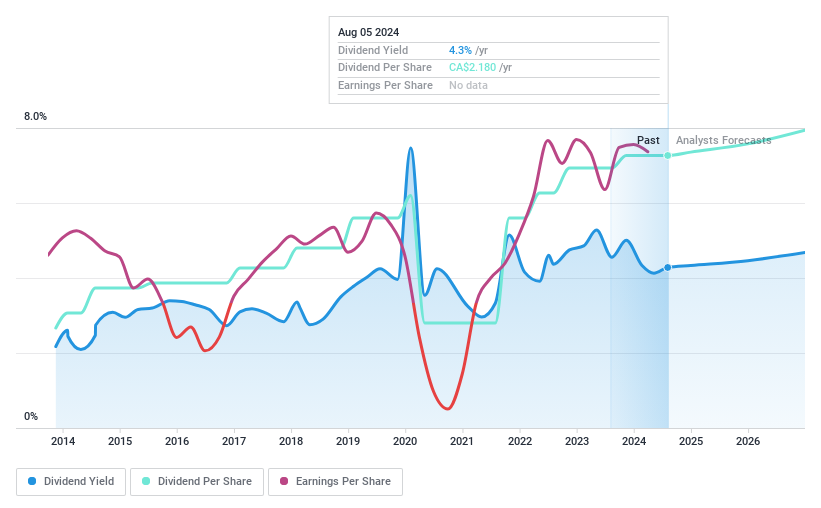

Suncor Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations across Canada, the United States, and internationally, boasting a market capitalization of approximately CA$67.52 billion.

Operations: Suncor Energy's revenue is primarily derived from its Oil Sands segment, which generated CA$23.76 billion, and its Refining and Marketing segment, contributing CA$31.51 billion, along with a smaller contribution of CA$2.17 billion from Exploration and Production.

Dividend Yield: 4.2%

Suncor Energy's recent performance and strategic financial actions reflect a mixed outlook for dividend investors. In Q1 2024, the company reported increased production and refinery throughput, alongside a net income of CAD 1.61 billion, down from CAD 2.05 billion year-over-year. Despite this decrease, Suncor maintained its quarterly dividend at CAD 0.545 per share and continued its share repurchase program, signaling confidence in its financial health. However, the rejection of shareholder proposals related to climate commitments suggests potential future governance challenges that could impact investor sentiment.

Where To Now?

Delve into our full catalog of 32 Top TSX Dividend Stocks here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:ARETSX:POW and TSX:SU

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance