Exploring Top Dividend Stocks In The UK For June 2024

As the FTSE 100 faces its fifth consecutive weekly decline, the longest since March 2020, investors may be seeking stability in their portfolios. Amidst these fluctuations and broader economic uncertainties, dividend stocks in the UK could offer a semblance of predictability and regular income, making them an appealing option for those looking to navigate through turbulent market conditions.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.07% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.71% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.47% | ★★★★★☆ |

DCC (LSE:DCC) | 3.49% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.02% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.85% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.75% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.31% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.00% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.61% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

London Security

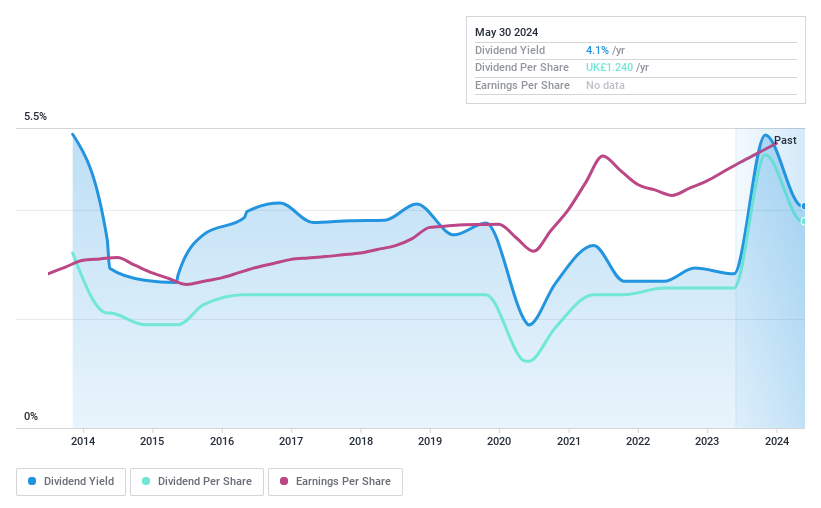

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: London Security plc is an investment holding company that manufactures, sells, and rents fire protection equipment across several European countries, with a market capitalization of approximately £0.37 billion.

Operations: London Security plc generates revenue primarily through the provision and maintenance of fire protection and security equipment, totaling £219.71 million.

Dividend Yield: 4.1%

London Security's dividend history shows a pattern of growth over the past decade, although it has been marked by volatility with significant annual fluctuations. Despite its lower yield of 4.07% compared to the top UK dividend payers, its dividends are reasonably covered by both earnings and cash flows, with payout ratios at 65.3% and 79.8%, respectively. The company recently affirmed a final dividend of £0.42 per share for 2023, maintaining the previous year's level, payable on July 12, 2024.

Click to explore a detailed breakdown of our findings in London Security's dividend report.

The valuation report we've compiled suggests that London Security's current price could be inflated.

Somero Enterprises

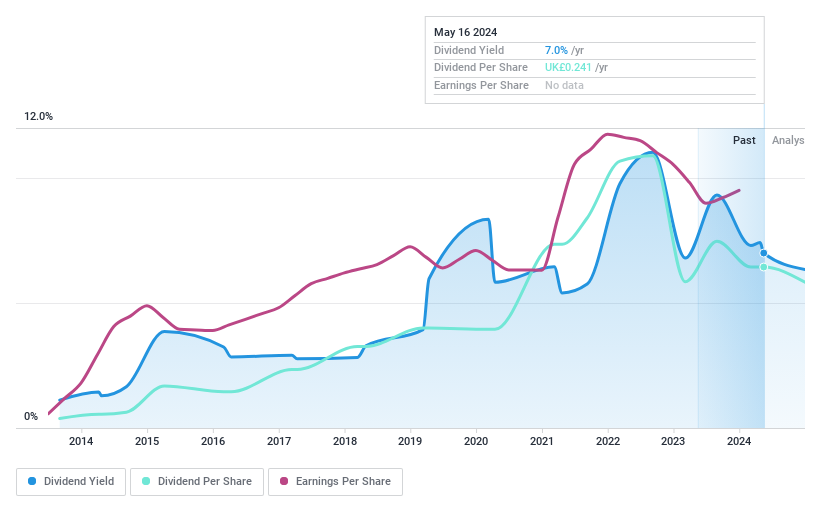

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Somero Enterprises, Inc. is a company that designs, assembles, remanufactures, sells, and distributes concrete leveling and contouring equipment globally, with a market capitalization of approximately £194.16 million.

Operations: Somero Enterprises generates its revenue primarily from the construction machinery and equipment segment, amounting to $120.70 million.

Dividend Yield: 6.8%

Somero Enterprises has displayed a mixed track record in dividend reliability, with payments showing volatility and occasional significant drops over the past decade. Despite this, the dividends are reasonably covered by both earnings and cash flows, with payout ratios of 46.2% and 74.2% respectively, suggesting a sustainable level under current conditions. Additionally, the dividend yield stands at a competitive 6.85%, positioning it well within the upper quartile of UK dividend payers. Recently, Jesse Aho's appointment as COO could signal continued focus on operational efficiency and product development.

Unlock comprehensive insights into our analysis of Somero Enterprises stock in this dividend report.

Plus500

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Plus500 Ltd. is a fintech company that operates technology-based trading platforms across Europe, the United Kingdom, Australia, and other international markets, with a market capitalization of approximately £1.67 billion.

Operations: Plus500 Ltd. generates its revenue primarily from CFD trading, amounting to $719.10 million.

Dividend Yield: 6%

Plus500's dividend history shows volatility over the past decade, making its reliability questionable for consistent income. However, the dividends are sustainably covered with a payout ratio of 25.4% and a cash payout ratio of 37.9%, indicating sound financial management regarding shareholder returns. Trading at 61.5% below estimated fair value and offering a high yield of 6.02%, it ranks well among UK dividend stocks despite forecasts suggesting a slight earnings decline over the next three years.

Turning Ideas Into Actions

Get an in-depth perspective on all 59 Top Dividend Stocks by using our screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:LSC AIM:SOM and LSE:PLUS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance