Exploring Top Dividend Stocks In The UK For May 2024

As the global rally cools, the UK's FTSE 100 is poised for a subdued opening, reflecting a cautious sentiment that mirrors broader market trends. Amid these conditions, investors might consider the stability offered by top dividend stocks, which can provide potential income in fluctuating markets and serve as a buffer against economic uncertainties.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 7.81% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.29% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.68% | ★★★★★☆ |

DCC (LSE:DCC) | 3.26% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.95% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.68% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 5.89% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.58% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.52% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.80% | ★★★★★☆ |

Click here to see the full list of 53 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

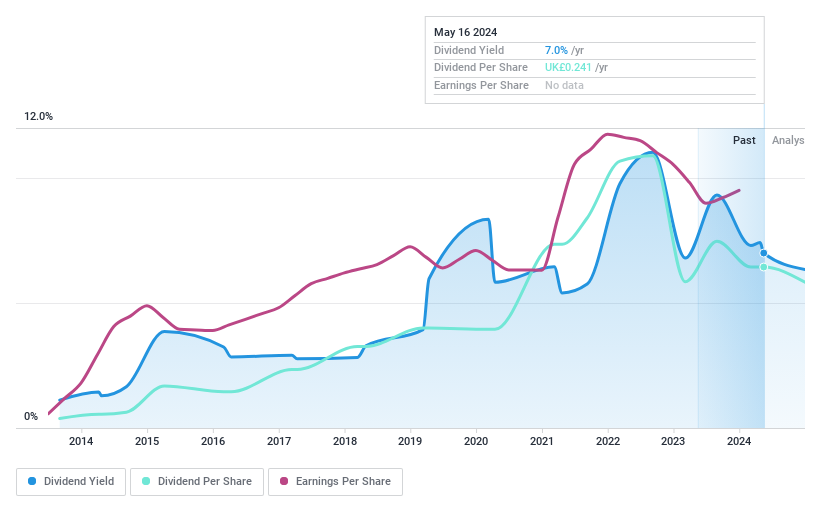

Somero Enterprises

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Somero Enterprises, Inc. specializes in designing, assembling, remanufacturing, selling, and distributing equipment for concrete leveling, contouring, and placing across the United States and globally, with a market capitalization of approximately £190.10 million.

Operations: Somero Enterprises generates revenue primarily from its construction machinery and equipment segment, totaling $120.70 million.

Dividend Yield: 7.0%

Somero Enterprises has declared both a final ordinary dividend of US$0.1319 and a supplemental dividend of US$0.074, payable in May 2024, reflecting a commitment to shareholder returns despite reduced earnings from US$31.12 million to US$27.98 million in 2023. The company's dividends are supported by earnings with a payout ratio of 46.2% and cash flows with a cash payout ratio of 74.2%, indicating sustainability despite past volatility in dividend payments and an unstable track record over the last decade.

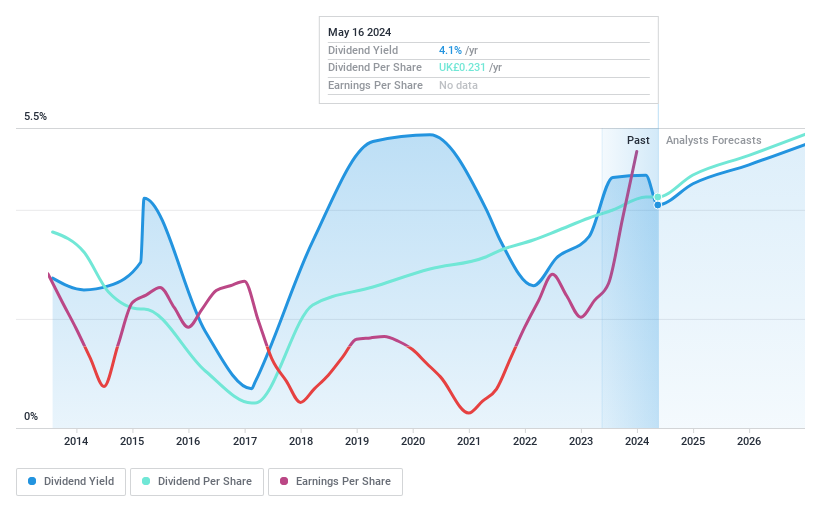

Drax Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc operates in the renewable power generation sector in the United Kingdom, with a market capitalization of approximately £2.18 billion.

Operations: Drax Group plc generates revenue primarily through three segments: Customers (£4.96 billion), Generation (£6.79 billion), and Pellet Production (£0.82 billion).

Dividend Yield: 4.1%

Drax Group plc recently approved a final dividend of 13.9 pence per share for 2023, demonstrating its ongoing commitment to shareholder returns. Despite this, Drax's dividend history has been marked by volatility over the past decade and its current yield of 4.09% is below the top quartile of UK dividend payers at 5.69%. Financially, Drax maintains a strong coverage with a low payout ratio of 16.2% and cash payout ratio of 22.6%, ensuring dividends are well supported by earnings and cash flows despite an overall high debt level and forecasts suggesting a potential decline in earnings by an average of 15.3% annually over the next three years.

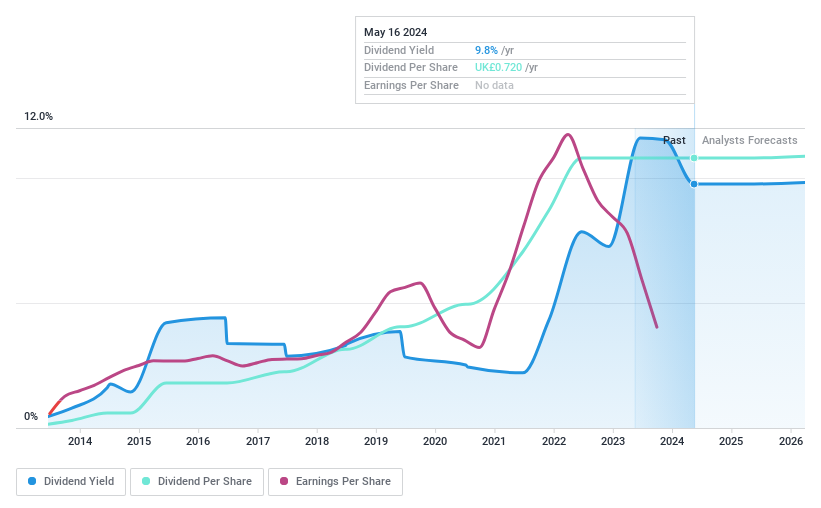

Liontrust Asset Management

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liontrust Asset Management Plc is a publicly owned investment manager, with a market capitalization of approximately £470.76 million.

Operations: Liontrust Asset Management primarily generates its revenue from investment management services, totaling £231.10 million.

Dividend Yield: 9.8%

Liontrust Asset Management offers a high dividend yield of 9.76%, placing it among the top 25% of UK dividend payers. However, this yield is shadowed by concerns over sustainability, as both earnings and cash flow coverage are lacking, with payout ratios at 267% and cash payout ratio at 121.6%. Despite a stable decade-long history of dividend payments and an expected earnings growth rate of 48.76% per year, recent profit margins have declined to 7.5% from last year's 18.5%.

Taking Advantage

Click here to access our complete index of 53 Top Dividend Stocks.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:SOM LSE:DRXLSE:LIO and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance