Exploring Top Dividend Stocks In Singapore For April 2024

As Singapore's market continues to evolve, investors are keenly observing trends and performance indicators that could influence their investment decisions. Given the current focus on safety and reliability in various sectors, dividend stocks remain a compelling option for those seeking stable returns in this dynamic environment.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.78% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.68% | ★★★★★☆ |

Civmec (SGX:P9D) | 6.24% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 8.12% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.67% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.47% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.45% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.49% | ★★★★★☆ |

Aztech Global (SGX:8AZ) | 8.56% | ★★★★☆☆ |

Sing Investments & Finance (SGX:S35) | 5.88% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

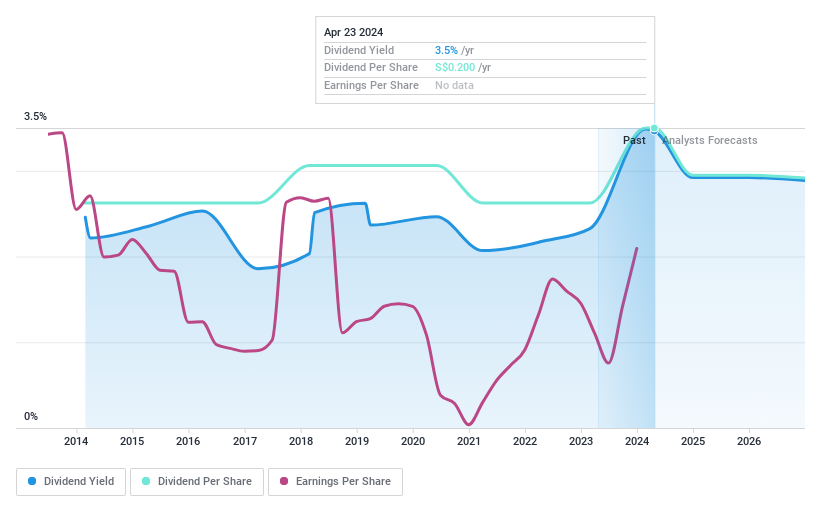

UOL Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOL Group Limited operates in property development and hospitality across multiple countries including Singapore, Australia, the UK, and the US, with a market capitalization of SGD 4.88 billion.

Operations: UOL Group Limited generates revenue primarily through property development in Singapore (SGD 1.16 billion), hotel operations in Singapore (SGD 464.93 million), and property investments (SGD 518.93 million), alongside contributions from technology operations (SGD 110.08 million) and hotel operations in Australia (SGD 125.64 million).

Dividend Yield: 3.5%

UOL Group Limited maintains a low payout ratio of 17.9%, ensuring that dividends are well-covered by earnings, alongside a cash payout ratio of 59.3% which indicates coverage by cash flows as well. Despite this security, the company's dividend yield at 3.47% is lower compared to the top Singapore market payers. Additionally, while UOL has consistently increased its dividends over the past decade and trades below estimated fair value, projected earnings are expected to decline significantly by an average of 30.3% annually over the next three years. Recent executive changes and special dividend announcements may influence investor sentiment but do not directly affect these fundamentals.

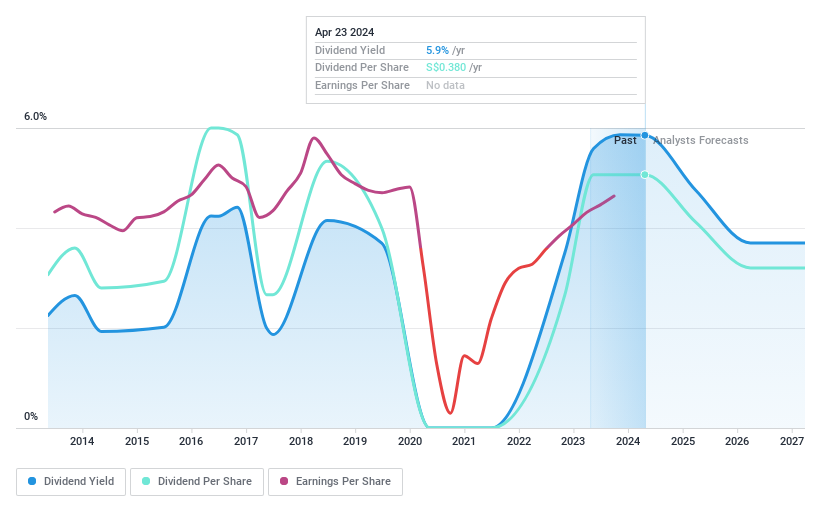

Singapore Airlines

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Singapore Airlines Limited operates passenger and cargo air transportation services globally under the Singapore Airlines and Scoot brands, with a market capitalization of approximately SGD 26.85 billion.

Operations: Singapore Airlines Limited generates revenue primarily through its full-service carrier segment, which brought in SGD 15.83 billion, and its low-cost carrier operations, contributing SGD 2.37 billion.

Dividend Yield: 5.9%

Singapore Airlines has a mixed track record for dividend reliability, with a history of volatile payments over the past decade. Despite this, the dividends are currently supported by both earnings and cash flows, with payout ratios of 73.2% and 29.4% respectively. However, the dividend yield of 5.86% is below the top quartile in Singapore's market at 6.31%. The company's recent financial activities include issuing $498.23 million in senior unsecured notes and reporting increased passenger metrics year-over-year as of March 2024, indicating some operational recovery.

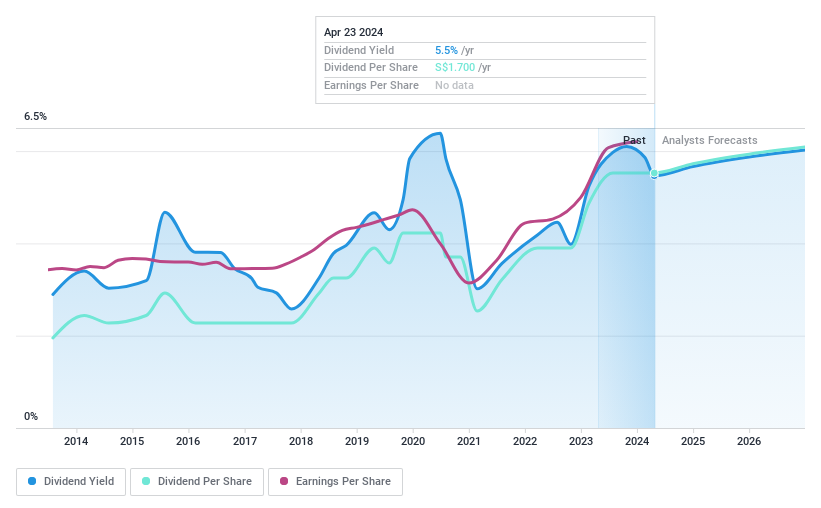

United Overseas Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Overseas Bank Limited operates globally, offering a broad range of banking products and services, with a market capitalization of approximately SGD 52.07 billion.

Operations: United Overseas Bank Limited generates revenue primarily through Group Wholesale Banking and Group Retail, contributing SGD 6.22 billion and SGD 5.20 billion respectively, along with a smaller contribution of SGD 0.39 billion from Global Markets.

Dividend Yield: 5.5%

United Overseas Bank (UOB) has demonstrated a commitment to dividend payouts with a recent increase in its annual dividend to S$1.70 per share, maintaining a 50% payout ratio. Despite this, UOB's dividends have shown volatility over the past decade, reflecting an unstable track record. The bank's allowance for bad loans stands at 85%, which is relatively low, potentially impacting its ability to sustain dividends during economic downturns. Recent executive changes and strategic appointments may influence future financial strategies and performance.

Make It Happen

Discover the full array of 21 Top Dividend Stocks right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:U14 SGX:C6L and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance