Exploring Three US Growth Companies With High Insider Ownership

Amid a backdrop of global market volatility and economic uncertainty, particularly with recent political crises in Europe influencing investor sentiment, the importance of stability and insider confidence in growth companies cannot be overstated. High insider ownership can signal strong belief in the company's future from those who know it best, making such stocks potentially appealing during turbulent times.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Celsius Holdings (NasdaqCM:CELH) | 10.4% | 21.6% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Here's a peek at a few of the choices from the screener.

CarGurus

Simply Wall St Growth Rating: ★★★★★☆

Overview: CarGurus, Inc. operates an online platform for buying and selling vehicles, serving both the United States and international markets, with a market capitalization of approximately $2.70 billion.

Operations: The company's revenue is primarily generated from two segments: the U.S. Marketplace, which brought in $664.65 million, and Digital Wholesale, which contributed $179.75 million.

Insider Ownership: 16.5%

Earnings Growth Forecast: 30% p.a.

CarGurus, with high insider ownership, shows promise as a growth company despite some challenges. The firm's recent shareholder-approved bylaw changes and active conference participation highlight strategic engagement and transparency. Financially, CarGurus reported a solid increase in net income to US$21.3 million in Q1 2024 from the previous year and forecasts revenue between US$202 million to US$222 million for Q2 2024. However, profit margins have decreased compared to last year, indicating areas needing efficiency improvements.

LGI Homes

Simply Wall St Growth Rating: ★★★★★☆

Overview: LGI Homes, Inc. is a company that designs, constructs, and sells homes, with a market capitalization of approximately $2.22 billion.

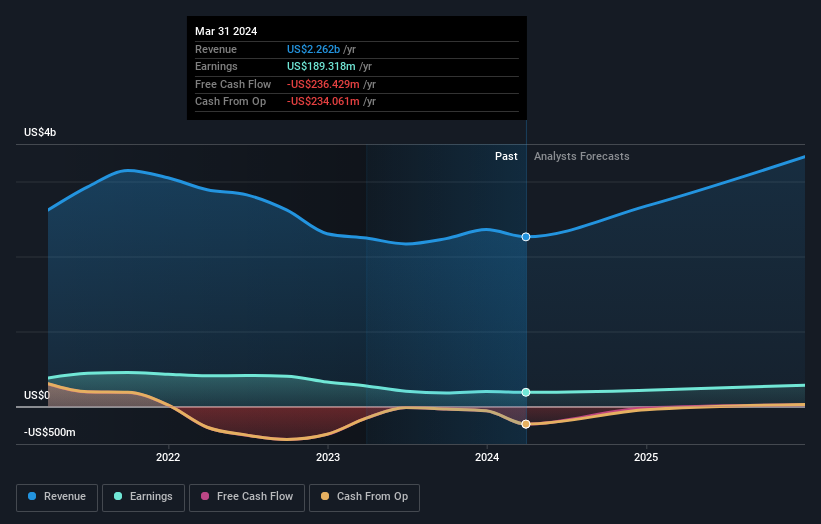

Operations: The primary revenue source, generating $2.26 billion, comes from its homebuilding operations.

Insider Ownership: 12.3%

Earnings Growth Forecast: 23.2% p.a.

LGI Homes, a company with significant insider ownership, is actively expanding its footprint with multiple new communities across the U.S., such as Rosewood Estates in Texas and Cambridge Cove in Minnesota. These developments cater to a range of buyers by offering upgraded features and affordable pricing. While LGI's net profit margin has declined from the previous year to 8.4%, its earnings are expected to grow significantly at 23.22% annually over the next three years, outpacing broader market projections. However, its debt is not well covered by operating cash flow, presenting a financial challenge that needs addressing.

Unlock comprehensive insights into our analysis of LGI Homes stock in this growth report.

Our valuation report here indicates LGI Homes may be overvalued.

Jefferies Financial Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jefferies Financial Group Inc. is an investment banking and capital markets firm operating across the Americas, Europe, the Middle East, and Asia-Pacific, with a market capitalization of approximately $9.31 billion.

Operations: The firm generates revenue primarily through asset management, contributing $393.20 million, and its investment banking and capital markets operations, which bring in $4.74 billion.

Insider Ownership: 20.7%

Earnings Growth Forecast: 37.6% p.a.

Jefferies Financial Group has been active in the fixed-income market, recently announcing several senior unsecured notes offerings. Despite a forecasted low return on equity of 9.2% in three years, Jefferies is expected to see robust earnings growth at an annual rate of 37.61%. However, its profit margins have declined from last year's 10.4% to this year's 5.5%, indicating potential efficiency challenges ahead. The company trades at a significant discount to estimated fair value, suggesting possible undervaluation by the market.

Seize The Opportunity

Delve into our full catalog of 183 Fast Growing US Companies With High Insider Ownership here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:CARG NasdaqGS:LGIH and NYSE:JEF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance