Exploring Three SGX Dividend Stocks For Your Portfolio

As global markets navigate through complexities such as the rise in synthetic identity fraud, which poses significant economic threats, investors may seek stability and predictable returns. Dividend stocks in Singapore offer an avenue for potentially steady income, making them an attractive component for diversified investment portfolios during uncertain times.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Civmec (SGX:P9D) | 5.96% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.57% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.92% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.82% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 7.69% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.98% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.13% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

Oversea-Chinese Banking (SGX:O39) | 5.90% | ★★★★☆☆ |

Sing Investments & Finance (SGX:S35) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

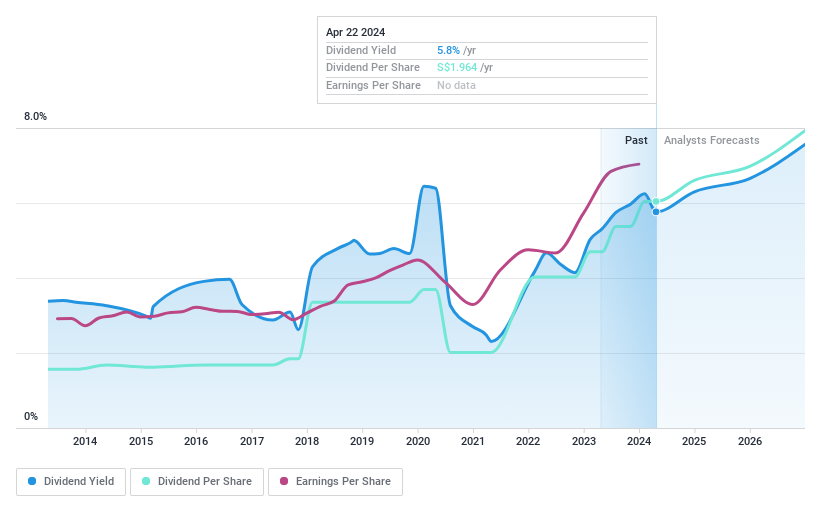

DBS Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd operates as a provider of commercial banking and financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and internationally, with a market capitalization of approximately SGD 101.11 billion.

Operations: DBS Group Holdings Ltd generates its revenue from commercial banking and financial services across multiple regions including Singapore, Hong Kong, Greater China, South and Southeast Asia.

Dividend Yield: 5.5%

DBS Group Holdings has demonstrated a mixed track record in maintaining stable dividend payments over the past decade, with a history of volatility. Despite this, the dividends are currently supported by a payout ratio of 50.8%, which is expected to improve to 66.4% in three years, indicating potential for more sustainable payouts. Recent leadership changes aim to address operational challenges that could impact financial stability. The recent increase in quarterly dividends and solid earnings growth suggest an optimistic outlook for maintaining future dividends.

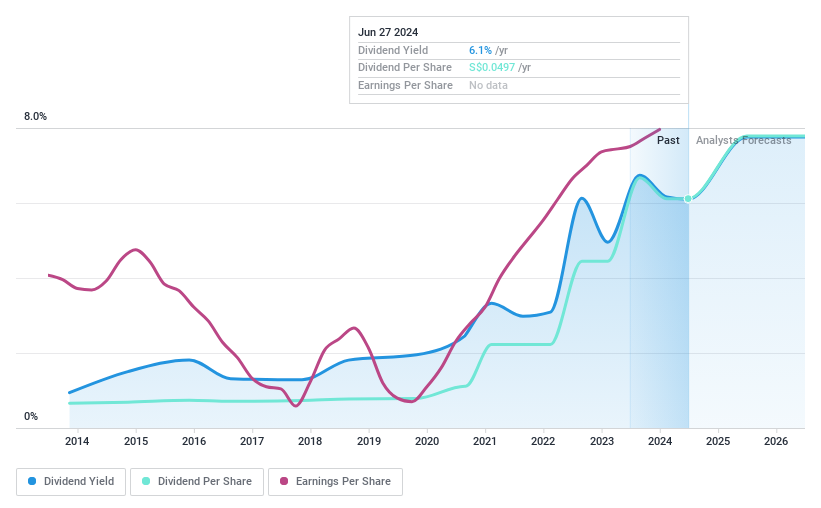

Civmec

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civmec Limited, an investment holding company based in Australia, offers construction and engineering services to sectors including energy, resources, infrastructure, and marine and defense, with a market capitalization of approximately SGD 416.22 million.

Operations: Civmec Limited generates its revenue from three primary segments: energy (A$46.02 million), resources (A$752.82 million), and infrastructure, marine & defense (A$105.52 million).

Dividend Yield: 6%

Civmec has shown robust growth with earnings increasing by 37.3% annually over the past five years and is forecast to grow by 3.93% per year moving forward. Despite a dividend yield of 5.96%, slightly below the top quartile in the Singapore market, its dividends are well-supported, evidenced by a low payout ratio of 45.4% and a cash payout ratio of 27%. The company has consistently raised its dividends over the last decade, ensuring reliability and stability in its dividend payments.

Click to explore a detailed breakdown of our findings in Civmec's dividend report.

Our expertly prepared valuation report Civmec implies its share price may be lower than expected.

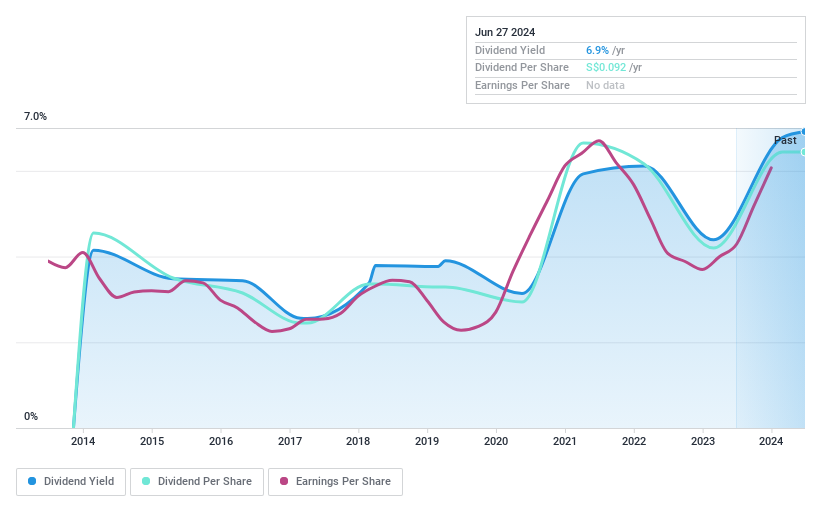

UOB-Kay Hian Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOB-Kay Hian Holdings Limited operates as an investment holding company, offering services such as stockbroking, futures broking, and more across Singapore, Hong Kong, Thailand, Malaysia, and internationally with a market cap of approximately SGD 1.19 billion.

Operations: UOB-Kay Hian Holdings Limited generates revenue primarily through securities and futures broking and related services, amounting to SGD 539.01 million.

Dividend Yield: 6.9%

UOB-Kay Hian Holdings maintains a dividend yield of 6.92%, positioning it well within the top quartile of Singapore's dividend payers. The firm recently declared a one-tier tax-exempt dividend of S$0.092 per share, with payment set for 26 June 2024, pending shareholder approval at their AGM. Despite a volatile dividend history over the past decade, current dividends are supported by a low payout ratio of 48.2% and an even lower cash payout ratio of 21.8%, suggesting sustainability from both earnings and cash flow perspectives.

Key Takeaways

Access the full spectrum of 19 Top SGX Dividend Stocks by clicking on this link.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:D05SGX:P9D and SGX:U10.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance