Exploring Three SEHK Growth Companies With High Insider Ownership

As global markets show signs of resilience, with the Hang Seng Index recently marking a notable uptick, investors are keenly observing trends in Hong Kong's economic landscape. In this context, exploring growth companies with high insider ownership could offer valuable insights into firms potentially well-positioned for robust governance and aligned interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

New Horizon Health (SEHK:6606) | 16.6% | 61% |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

Meitu (SEHK:1357) | 38% | 34.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

DPC Dash (SEHK:1405) | 38.2% | 91.5% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

Zhejiang Leapmotor Technology (SEHK:9863) | 14.2% | 74% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 15.7% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Beijing Airdoc Technology (SEHK:2251) | 26.4% | 83.9% |

We're going to check out a few of the best picks from our screener tool.

Fenbi

Simply Wall St Growth Rating: ★★★★★☆

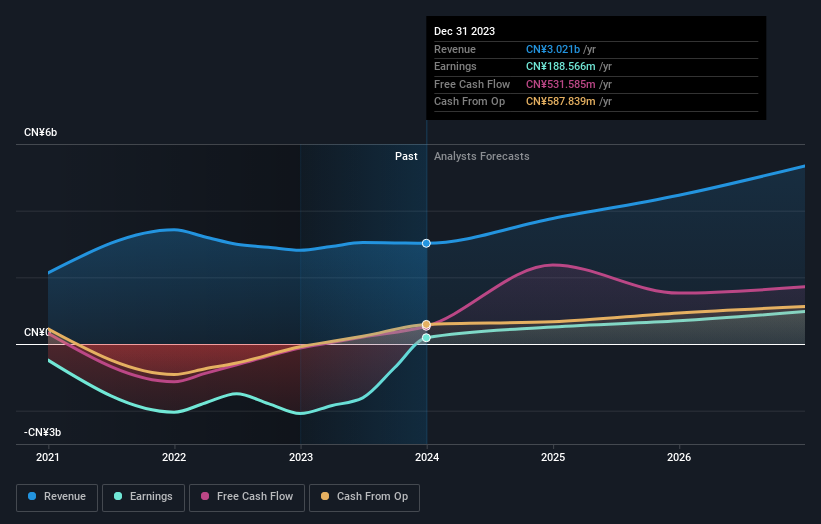

Overview: Fenbi Ltd. is an investment holding company that offers non-formal vocational education and training services in the People’s Republic of China, with a market capitalization of approximately HK$10.43 billion.

Operations: The company generates revenue primarily through tutoring services and book sales, totaling CN¥2.51 billion and CN¥0.66 billion respectively.

Insider Ownership: 32.1%

Fenbi Ltd., a company with high insider ownership, has recently shown a promising turnaround by becoming profitable this year with net income of CNY 188.57 million after a significant loss the previous year. The firm's revenue growth at 18.2% annually is expected to outpace the Hong Kong market average. Additionally, Fenbi announced a substantial share buyback program worth HK$300 million, signaling confidence from management in the company's financial health and future prospects. This aligns with analysts' expectations of significant earnings growth over the next three years and a forecasted high return on equity, indicating robust potential for value appreciation despite current trading at 75.8% below its estimated fair value.

Kingsoft

Simply Wall St Growth Rating: ★★★★☆☆

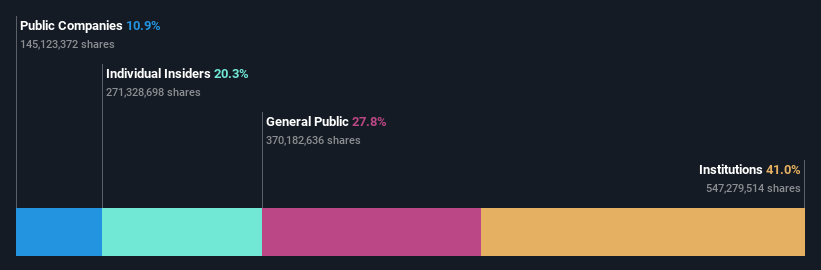

Overview: Kingsoft Corporation Limited operates in the entertainment and office software sectors, serving customers in Mainland China, Hong Kong, and internationally, with a market capitalization of approximately HK$35.68 billion.

Operations: The company generates revenue through two primary segments: office software and services, which brought in CN¥4.56 billion, and entertainment software and others, contributing CN¥3.98 billion.

Insider Ownership: 20.3%

Kingsoft Corporation Limited, recognized for its high insider ownership, has demonstrated a significant financial turnaround by reporting a net income of CNY 483.46 million in 2023 after a substantial loss the previous year. The company's revenue growth is projected at 14.9% annually, surpassing the Hong Kong market average of 8%. Despite this positive trajectory, Kingsoft's forecasted Return on Equity remains modest at 8.3%. Analysts anticipate a potential stock price increase of 30.4%, reflecting confidence in its future performance despite trading at 59.9% below its estimated fair value.

Navigate through the intricacies of Kingsoft with our comprehensive analyst estimates report here.

Our valuation report unveils the possibility Kingsoft's shares may be trading at a discount.

China Youran Dairy Group

Simply Wall St Growth Rating: ★★★★☆☆

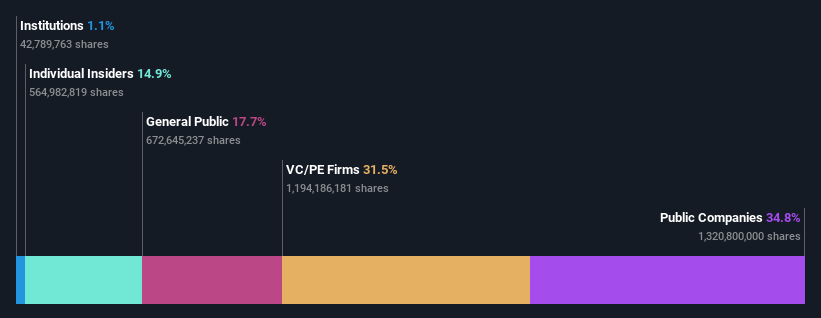

Overview: China Youran Dairy Group Limited operates in the upstream dairy industry in the People's Republic of China, with a market capitalization of approximately HK$5.16 billion.

Operations: The company generates revenue primarily from two segments: the Raw Milk Business, which brought in CN¥12.90 billion, and Comprehensive Ruminant Farming Solutions, contributing CN¥8.09 billion.

Insider Ownership: 14.9%

China Youran Dairy Group, with significant insider ownership, reported a substantial drop in earnings for 2023, transitioning from a net profit to a net loss of CNY 1.05 billion and foregoing the final dividend. Despite this setback, cash EBITDA grew by about 7%, indicating some operational resilience. Analysts predict revenue growth at 8.4% annually and expect profitability within three years, suggesting potential recovery ahead. However, financial challenges persist as interest payments are not well covered by earnings.

Next Steps

Take a closer look at our Fast Growing SEHK Companies With High Insider Ownership list of 52 companies by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:2469 SEHK:3888 and SEHK:9858.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance