Exploring Singapore's Stellar Dividend Stocks In April 2024

As April 2024 unfolds, the Singapore market continues to demonstrate resilience amidst global economic uncertainties, maintaining its reputation as a robust and stable financial hub. This article explores three stellar dividend stocks in Singapore that have shown remarkable performance despite the challenging market conditions. In this context, a good stock is one that consistently provides healthy dividends and showcases strong fundamentals, aligning with the current market's demand for reliable income generation amidst volatility.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Singapore Exchange (SGX:S68) | 3.80% | ★★★★★☆ |

Civmec (SGX:P9D) | 6.27% | ★★★★★☆ |

Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.60% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 8.21% | ★★★★★☆ |

Asia Enterprises Holding (SGX:A55) | 7.14% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.72% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.55% | ★★★★★☆ |

New Toyo International Holdings (SGX:N08) | 8.89% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.39% | ★★★★★☆ |

Tat Seng Packaging Group (SGX:T12) | 6.34% | ★★★★★☆ |

Click here to see the full list of 36 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

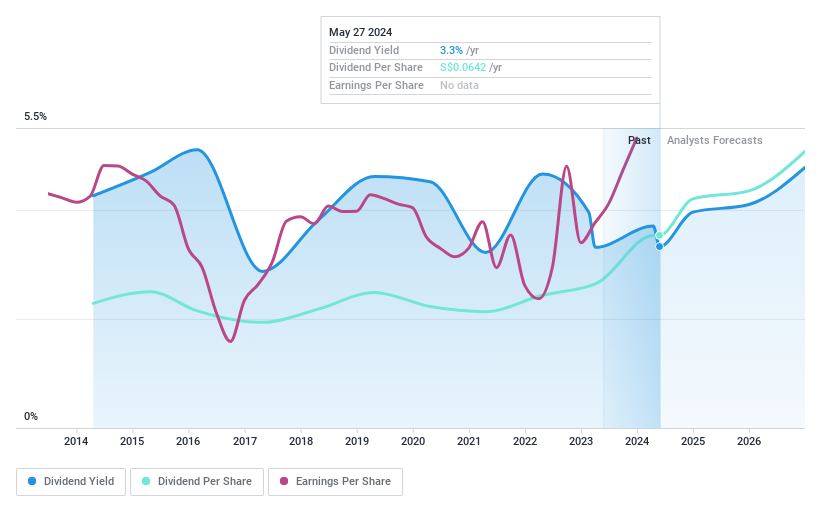

Yangzijiang Shipbuilding (Holdings)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company that operates in the shipbuilding industry across Greater China, Canada, Japan, Italy, Greece and other European countries with a market capitalization of SGD 7.03 billion.

Operations: Yangzijiang Shipbuilding (Holdings) Ltd. generates its revenue primarily from three segments, with CN¥22.79 billion from Shipbuilding, CN¥1.02 billion from Shipping, and a smaller portion derived from other areas of operation.

Dividend Yield: 3.6%

Yangzijiang Shipbuilding's earnings are forecasted to grow by 9.35% per year, with dividends well covered by earnings and cash flows, indicating a sustainable payout. The company has maintained stable dividends over the past decade and offers a reliable yield of 3.6%. However, this yield is lower than the top quartile of Singaporean dividend payers (6.34%). Recently, Yangzijiang proposed a tax-exempt final dividend of SGD$0.065 per share for FY2023 and reported significant sales growth from CNY¥20.71 billion to CNY¥24.11 billion.

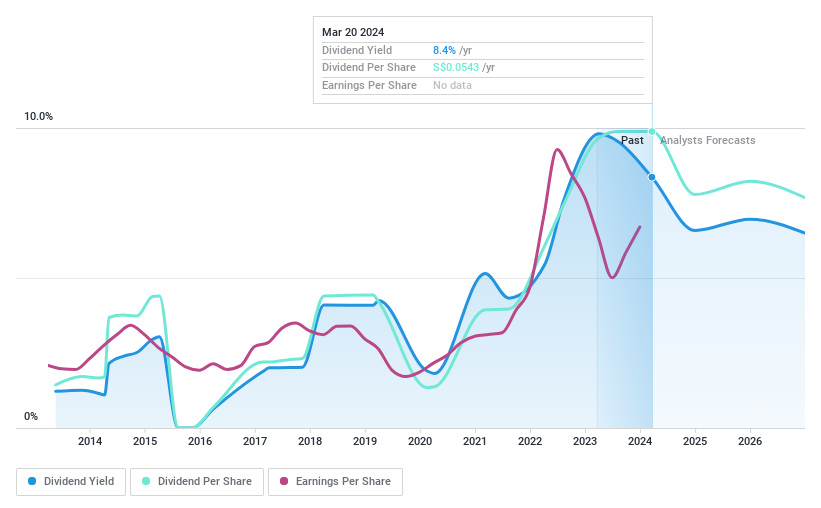

Bumitama Agri

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd. is an investment holding company with a market cap of SGD 1.36 billion, primarily involved in the production and trade of crude palm oil, palm kernel, and related products within Indonesia's refineries.

Operations: Bumitama Agri Ltd. generates its revenue predominantly from the Plantations and Palm Oil Mills sector, amounting to IDR 15.44 billion.

Dividend Yield: 6.4%

Bumitama Agri's recent announcement of a final tax-exempt one-tier dividend of S$0.0363 and a special dividend of S$0.0192 per share indicates the company's commitment to rewarding shareholders. Despite a volatile dividend track record over the past decade, dividends are well covered by earnings (40.4% payout ratio) and cash flows (60.8% cash payout ratio), suggesting sustainability in payouts. However, it is worth noting that earnings are forecasted to decline by an average of 4.6% per year for the next three years.

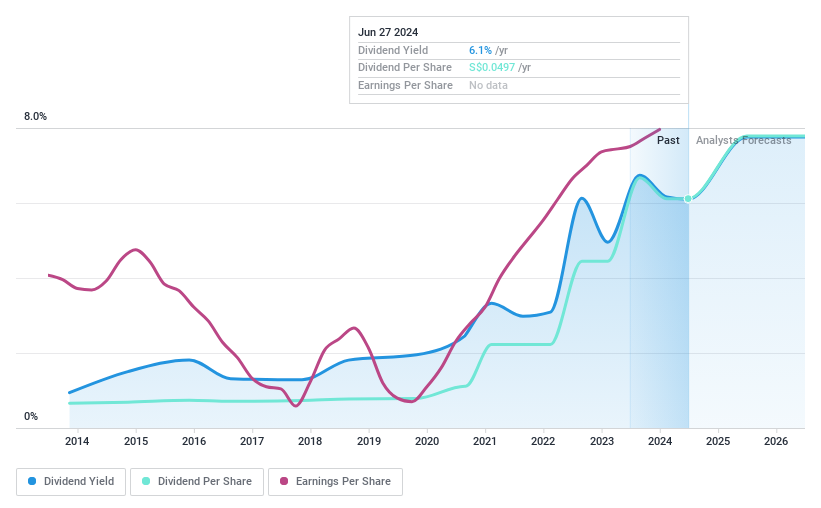

Civmec

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civmec Limited (SGX:P9D) is an investment holding company that offers construction and engineering services to various sectors including energy, resources, infrastructure, marine and defense in Australia, with a market capitalization of SGD 388.31 million.

Operations: Civmec Limited (SGX:P9D) generates its revenue through three major segments: Energy, which contributes A$46.02 million; Resources, with a significant contribution of A$752.82 million; and Infrastructure, Marine & Defence, contributing A$105.52 million to the company's earnings.

Dividend Yield: 6.3%

Civmec's consistent dividend payments over the past decade, coupled with a recent increase to A$0.025 per share, are underpinned by a stable cash payout ratio of 27% and earnings payout ratio of 45.4%. Despite its dividend yield of 6.27% being slightly below the top quartile in Singapore's market, earnings have shown robust growth at 37.3% annually over the past five years and are forecasted to grow further by 4.98% per year.

Where To Now?

Navigate through the entire inventory of 36 Top Dividend Stocks here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:BS6 SGX:P8Z and SGX:P9D.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance