Exploring HL Global Enterprises As A Privatisation Play?

To most investors, it would be a surprising thing to know that Singapore-listed HL Global Enterprises (HLGE) is part of the Hong Leong Group of Companies which also owns Mainboard-listed City Developments Limited (CDL). For those who know or do not have any clue of HLGE as a company or what their business model is, here’s a brief look at what they do as a business entity.

HLGE is primarily a Singapore-based investment holding company with operations that stretch to three segments, namely Investments and others, Hospitality and restaurant, and Property development. Some of the existing properties they own include Copthorne Hotel Qingdao based in Mainland China. The other hotel is the 270-guestroom hotel, Hotel Copthorne Cameron Highlands (CHCH) located in Malaysia, and Elite Residences Serviced Apartments.

HLGE’s twelve-month dividend yield which according to information from SGX StockFacts is approximately 8.1 percent, with the latest dividend payout made on May 23, 2018 at 3 Singapore cents per share after taxes. HLGE last paid a dividend back in July 1998, and the 8.1 percent dividend yield is also higher than CDL’s twelve-month dividend yield of 1.4 based on information sourced from SGX StockFacts.

How Do The Financials Stand Out for HLGE?

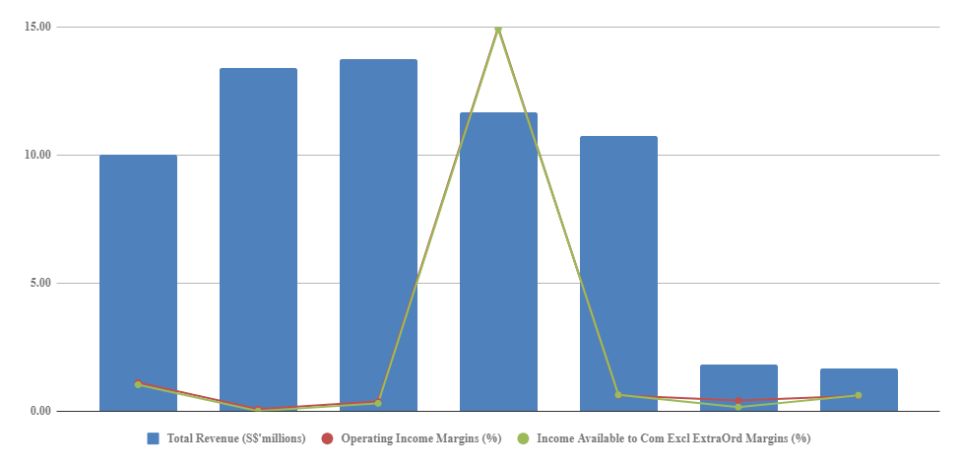

Source: SGX StockFacts, Company’s Financials

Based on the chart shown above depicting the total revenue and margin trends, it appeared the overall total revenues have been on a declining trend, with most recent 1Q19 total revenue declining by 9.9 percent year-over-year to $1.7 million.

In the 1Q19 earnings release, management attributed the 9.9 percent decline in total revenues to $1.7 million was mainly due to the oversupply of new hotel rooms and apartments in the vicinity of Copthorne Hotel Cameron Highlands (CHCH). During the same period (1Q19), management noted that the average occupancy rate for CHCH dropped slightly by 0.6 percentage point to 61.0 percent due to the oversupply of hotel rooms and apartments in in the vicinity of CHCH . The average room rate also declined by RM7 to RM206.

Moreover, the hospitality segment reported a lower operating profit of $244,000 for 1Q19 versus the operating profit of $255,000 for 1Q18. However, this operating profit was not sufficient to cover the operating loss of S61,000 and $279,000 incurred by the property development segment and investments/other segment (comprised of investment property operations and corporate overhead costs) respectively.

How is the balance sheet condition for HGLE?

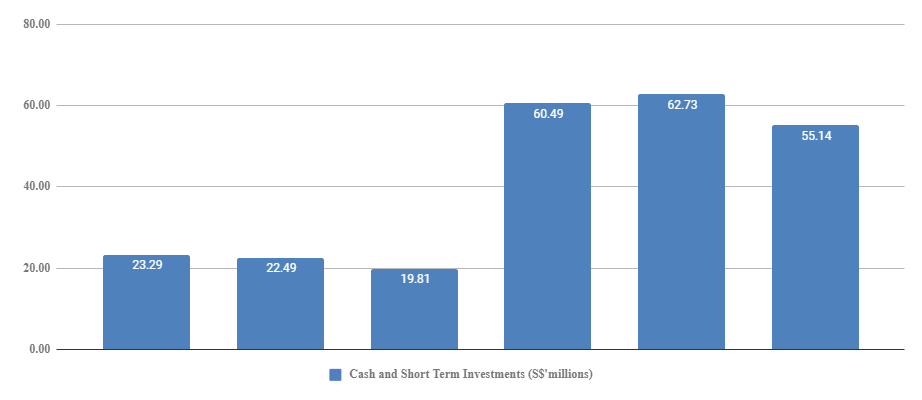

Source: SGX StockFacts, Company’s Financials

Based on the latest company’s balance sheets for the period ending March 31, 2019, HLGE’s latest cash and short-term investments amounted to $55.1 million, and has been declined slightly from $60 million in the two previous fiscal years in 2017 and 2018 shown in the chart above.

HLGE’s total net cash from operating activities (Net CFO) declined to $297,000 in 1Q19, compared to $474,000 during the same period last year.

Moreover, HLGE did not incur any significant interest-bearing debt since December 31, 2018.

How do the valuations show for HLGE?

HL Global Enterprises (HGLE) | City Developments (CDL) | |

Price-to-Book (P/B) Value | 0.45 | 0.85 |

Price-to-Sales (P/S) Value | 3.3 | 2.2 |

Dividend Yield (%) | 8.1% | 1.4% |

Dividend Yield (%) – Five-year average | N/A | 1.3% |

Enterprise Value ($’millions) | (28) | 13,729.9 |

Price-to-Cash Flows (P/CF) Value | 11.4 | 9.2 |

Price-to-Earnings (P/E) Ratio | 16.8 | 13.9 |

Net Debt ($’millions) | (54.8) | 4,700.3 |

Source: SGX StockFacts

Comparing the price multiples of both HLGE, and CDL shown in the table above, we note that most of the price multiples, with the exception of price-to-book (P/B) multiple, CDL appears to be relatively cheaper than HLGE.

However, if we evaluate both real estate companies based on common valuation methods for the industry like P/B multiples and twelve-month dividend yields, HLGE appears to be relatively cheaper based on its 0.45 P/B multiple compared to the 0.85 P/B multiple of CDL, and the relatively high twelve-month dividend yield of 8.1 percent compared to CDL’s twelve-month dividend yield of 1.4 per cent.

Moreover, HLGE is in a net cash position of $54.8 million, whereas CDL is in net positive debt amount of close to $4.7 billion.

Should Investors Consider Ploughing Into HLGE?

While the average twelve-month dividend yield of 8.1 percent looks high for a developer stock relatively to its sister company, CDL, and low or almost no debt leverage, it is also important for investors to read about management’s expectations where they were quoted saying that Copthorne Hotels Cameron Highlands (CHCH) operations continues to operate in a challenging condition amidst highly competitive hospitality market in the area in Malaysia. Moreover, due to its overseas operations, HLGE continues to be exposed to currency fluctuations.

However, there is also the possibility of privatisation given the run-up in quite a number of privatisations happening across many public-listed companies so far in 2019. Although one should not invest based on the possibility of privatisation or market rumours, it is also not difficult to figure out that with the low trading liquidity, coupled with seemingly worsening environment in the hospitality industry as a whole, Hong Leong Group of Companies as the parent might consider restructuring its business, and evaluate closely if listed subsidiaries like HLGE has any complementary role with its other property, leisure or hospitality sectors. Merging with another subsidiary could also be seen as a possibility for cost savings purposes, and better operational control.

Related Article:

Yahoo Finance

Yahoo Finance