Exploring Franklin Financial Services And Two More Leading Dividend Stocks

The United States stock market has experienced a robust climb, ascending 1.0% in the past week and achieving a 22% increase over the last year, with earnings projected to grow by 15% annually. In such an environment, dividend stocks like Franklin Financial Services can be particularly appealing for their potential to provide investors with steady income alongside capital appreciation.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.53% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.26% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.02% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.14% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.98% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.94% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 4.88% | ★★★★★★ |

East West Bancorp (NasdaqGS:EWBC) | 3.07% | ★★★★★☆ |

Southside Bancshares (NasdaqGS:SBSI) | 5.58% | ★★★★★☆ |

CVB Financial (NasdaqGS:CVBF) | 4.84% | ★★★★★☆ |

Click here to see the full list of 212 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

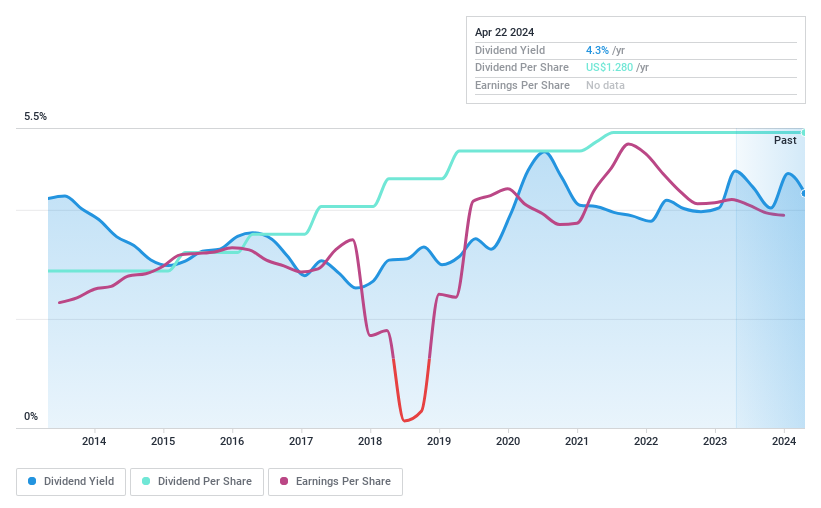

Franklin Financial Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Franklin Financial Services Corporation, operating through its subsidiary Farmers and Merchants Trust Company of Chambersburg, offers commercial and retail banking, along with trust services to a diverse clientele in Pennsylvania, with a market capitalization of approximately $117.54 million.

Operations: Franklin Financial Services Corporation generates its revenue primarily from traditional banking and related financial services, amounting to $67.52 million.

Dividend Yield: 4.5%

Franklin Financial Services maintains a consistent dividend payout, declaring a regular cash dividend of US$0.32 per share for Q2 2024, matching the previous quarter's distribution. Despite trading at 36.2% below its estimated fair value and offering a 4.52% yield which is slightly below the top tier in the U.S., its dividends are well-supported by a reasonable payout ratio of 40.9%. However, there's insufficient data to confirm if future dividends will be covered by earnings or cash flows beyond three years.

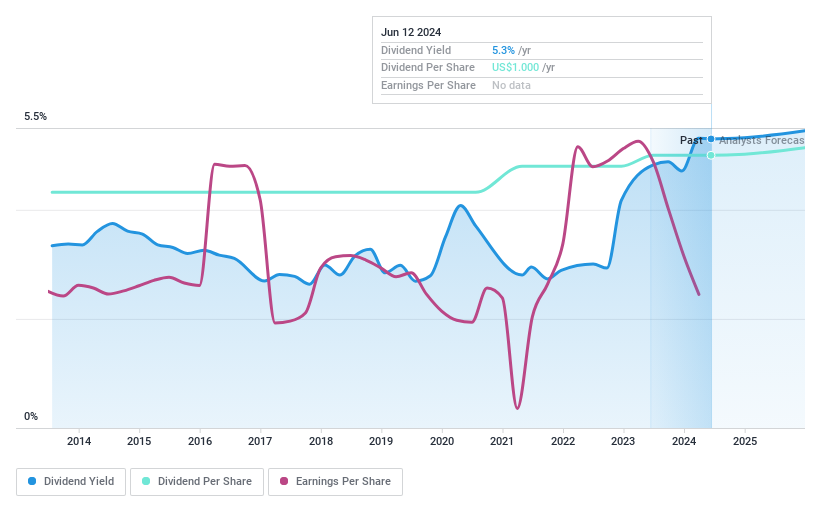

Dime Community Bancshares

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dime Community Bancshares, Inc. serves as the holding company for Dime Community Bank, offering a range of commercial banking and financial services with a market capitalization of approximately $704.58 million.

Operations: Dime Community Bancshares generates its revenue primarily through its community banking segment, which amassed $328.39 million.

Dividend Yield: 5.3%

Dime Community Bancshares offers a high dividend yield of 5.3%, ranking in the top 25% of US dividend payers. The company's dividends have shown growth and reliability over the past decade, supported by a sustainable payout ratio of 56.1%. Despite trading at 59.5% below its estimated fair value, recent executive changes and a shelf registration filing indicate strategic shifts, possibly affecting future performance. However, profit margins have declined from last year, which could impact earnings growth forecasted at 29.14% annually.

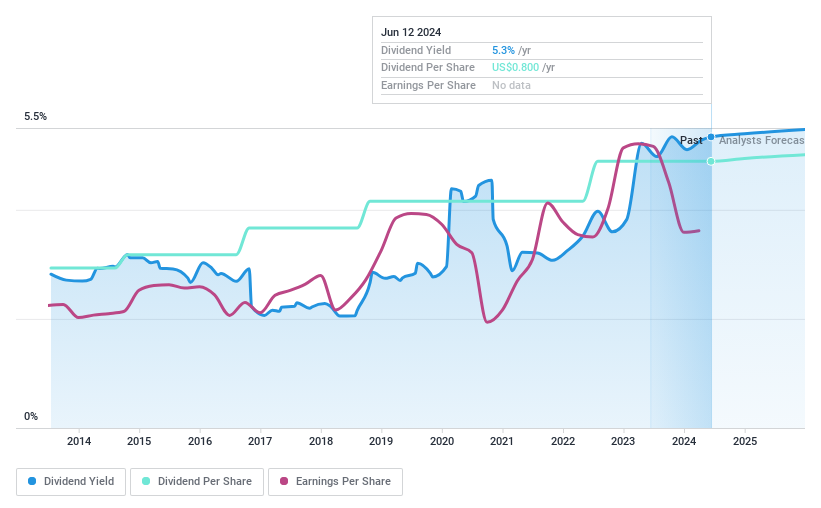

OceanFirst Financial

Simply Wall St Dividend Rating: ★★★★★☆

Overview: OceanFirst Financial Corp. serves as the bank holding company for OceanFirst Bank N.A., with a market capitalization of approximately $848.66 million.

Operations: OceanFirst Financial Corp. generates its revenue primarily through community banking operations, which amounted to $385.73 million.

Dividend Yield: 5.3%

OceanFirst Financial Corp. maintains a solid track record in dividend reliability, having declared its 109th consecutive quarterly dividend recently. The dividends are well-supported by a low payout ratio of 46.8%, ensuring sustainability from earnings. Although the stock trades at 47.5% below its estimated fair value, suggesting potential undervaluation, analysts predict a price increase of 24.8%. However, it's important to note that there is insufficient data to confirm the future coverage of dividends by earnings or cash flows beyond three years.

Turning Ideas Into Actions

Click through to start exploring the rest of the 209 Top Dividend Stocks now.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:FRAF NasdaqGS:DCOM and NasdaqGS:OCFC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance