Exploring Euronext Paris Dividend Stocks In June 2024

As of June 2024, the French market has shown some volatility with the CAC 40 Index experiencing a decline amid concerns about inflation and European Central Bank policies. This backdrop sets a cautious yet intriguing stage for investors interested in dividend stocks on Euronext Paris, which may offer potential stability and income in uncertain times. In such a market environment, a good dividend stock typically features strong fundamentals including consistent earnings, solid management, and the ability to sustain dividends even when economic conditions are challenging.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 5.98% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.40% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.32% | ★★★★★★ |

Fleury Michon (ENXTPA:ALFLE) | 5.31% | ★★★★★☆ |

Métropole Télévision (ENXTPA:MMT) | 9.10% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 3.85% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.13% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.87% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 3.94% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 6.92% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Vinci

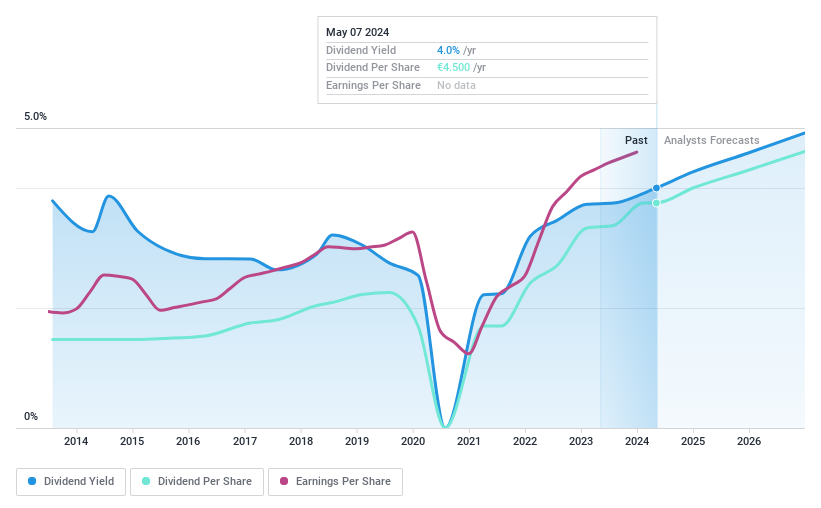

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vinci SA operates in concessions, energy, and construction sectors both in France and globally, with a market capitalization of approximately €64.87 billion.

Operations: Vinci SA generates revenue through various segments, with €31.46 billion from construction (including Eurovia), €19.33 billion from Vinci Energies, €6.88 billion from Vinci Autoroutes concessions, €4.23 billion from Vinci Airports concessions, and smaller contributions of €1.23 billion from Vinci Immobilier and Holding Companies and €0.73 billion from other concessions.

Dividend Yield: 4%

Vinci's dividend profile shows a mix of stability and concern. Despite a volatile dividend history over the past decade, recent financials suggest improvement. The payout ratio stands at 54.4%, indicating that earnings sufficiently cover dividends, complemented by a cash payout ratio of 35.6%, which underscores strong cash flow support for these payments. However, Vinci's dividend yield of 3.96% is below the French market's top quartile average of 5.11%. Additionally, while profits have grown by 10.4% in the past year and are projected to increase by approximately 5.29% annually, high debt levels persist as a financial caution.

Unlock comprehensive insights into our analysis of Vinci stock in this dividend report.

Upon reviewing our latest valuation report, Vinci's share price might be too pessimistic.

La Française des Jeux Société anonyme

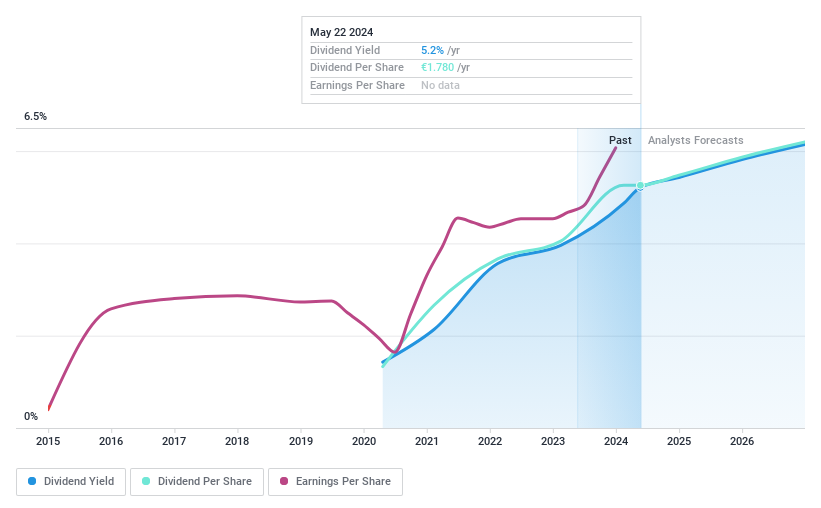

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: La Française des Jeux Société anonyme operates in the gaming and distribution sector both in France and globally, with a market capitalization of approximately €6.16 billion.

Operations: La Française des Jeux Société anonyme generates revenue through three main segments: Lottery, which brought in €1.94 billion, Sport Betting and Online Gaming Open to Competition at €0.52 billion, and Adjacent Activities contributing €0.17 billion.

Dividend Yield: 5.3%

La Française des Jeux Société anonyme, while relatively new to dividend payments with only four years of history, has shown commitment to growing dividends, evidenced by a recent increase to €1.78 per share. Despite this growth, the company's dividend track record remains short. Financially, FDJ reported a 7% revenue increase in Q1 2024 to €710 million and maintains healthy coverage with a payout ratio of 79.9% and cash payout ratio at 65.3%, supporting sustainability amidst its evolving governance structure marked by new board appointments.

Oeneo

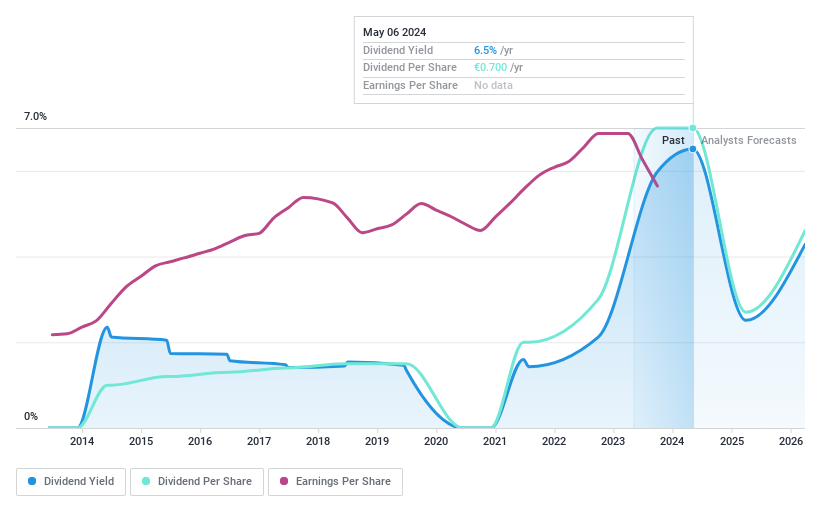

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oeneo SA is a global company involved in the wine industry, with a market capitalization of approximately €692.19 million.

Operations: Oeneo SA generates revenue primarily through two segments: Aging (€103.16 million) and Corking (€226.21 million).

Dividend Yield: 6.5%

Oeneo has exhibited fluctuating dividend payments over the last decade, with a notable annual drop of over 20% in some years, indicating volatility. Despite a high dividend yield of 6.54%, which places it in the top 25% of French dividend payers, its dividends are not well-supported by free cash flow due to a high cash payout ratio of 302.4%. However, earnings cover the dividends with a more reasonable payout ratio of 66.8%.

Summing It All Up

Delve into our full catalog of 33 Top Euronext Paris Dividend Stocks here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:DG ENXTPA:FDJ and ENXTPA:SBT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance