Exploring Dividend Stocks On Euronext Paris Featuring Exacompta Clairefontaine And Two Others

Amid a backdrop of cautious optimism in European markets, where recent ECB rate cuts hint at a delicate balancing act between fostering growth and controlling inflation, investors continue to look for stable returns. Dividend stocks, such as those listed on Euronext Paris including Exacompta Clairefontaine, offer potential havens because they typically represent well-established companies with the financial robustness to distribute regular dividends.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 6.58% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.86% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.70% | ★★★★★★ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 4.06% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.28% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.07% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.93% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.16% | ★★★★★☆ |

Carrefour (ENXTPA:CA) | 5.95% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.69% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Euronext Paris Dividend Stocks screener.

We'll examine a selection from our screener results.

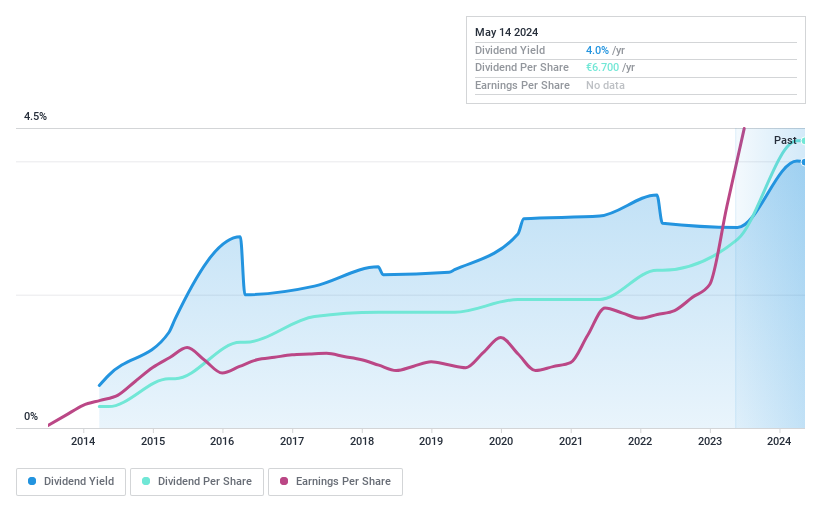

Exacompta Clairefontaine

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exacompta Clairefontaine S.A. operates in the production, finishing, and formatting of papers across France, Europe, and internationally, with a market capitalization of €181.04 million.

Operations: Exacompta Clairefontaine S.A. generates its revenue primarily through two segments: Paper, which contributes €368.58 million, and Processing, accounting for €613.23 million.

Dividend Yield: 4.2%

Exacompta Clairefontaine S.A. demonstrated a strong financial performance in 2023, with sales rising to €843.25 million and net income increasing significantly to €43.12 million. Despite a dividend yield of 4.16%, which is below the top French dividend payers, its dividends are well-supported, evidenced by a low payout ratio of 17.6% and cash payout ratio of 10.3%. The company has maintained stable and growing dividends over the past decade, underpinned by robust earnings growth of 59.4% last year and an attractive price-to-earnings ratio of 4.2x compared to the broader French market.

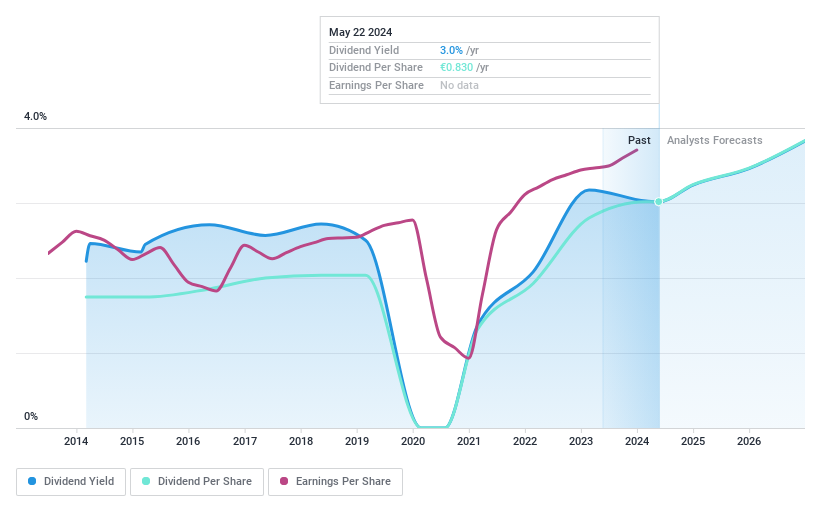

Bureau Veritas

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bureau Veritas SA operates in the field of laboratory testing, inspection, and certification services, with a market capitalization of approximately €12.91 billion.

Operations: Bureau Veritas SA's revenue is generated from several segments, including Buildings & Infrastructure at €1.75 billion, Industry at €1.25 billion, Agri-Food & Commodities at €1.23 billion, Consumer Products Services at €710.70 million, Certification at €465 million, and Marine & Offshore at €455.70 million.

Dividend Yield: 3%

Bureau Veritas offers a modest dividend yield of 3.01%, lower than the top quartile in France at 5.38%. While its dividends are supported by both earnings and cash flows, with payout ratios of 74.6% and 56.9% respectively, the company's dividend history has been inconsistent over the past decade, showing volatility in payments. Recent financial activities include a successful €500 million bond issue, indicating strong market confidence and strategic positioning for future corporate actions like refinancing existing debts.

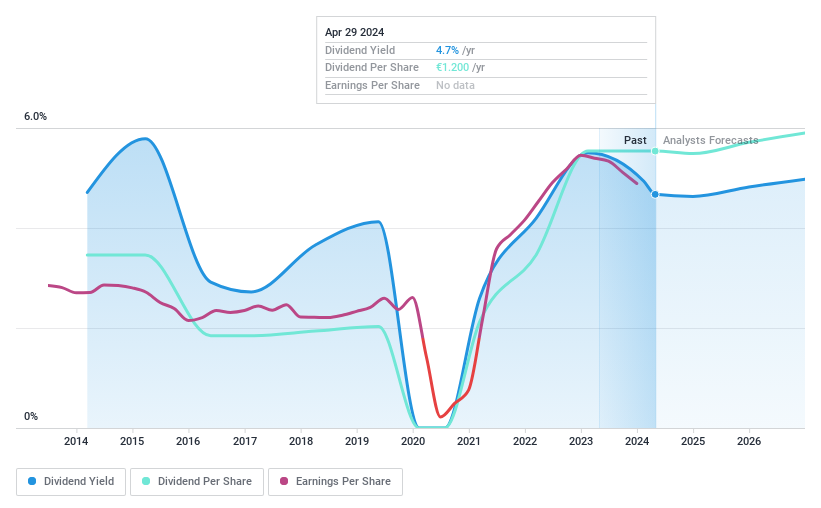

Rexel

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rexel S.A. operates as a distributor of low and ultra-low voltage electrical products and services across residential, commercial, and industrial sectors in regions including France, Europe, North America, and Asia-Pacific, with a market capitalization of approximately €8.17 billion.

Operations: Rexel S.A. generates €19.15 billion in revenue from its wholesale electronics segment.

Dividend Yield: 4.6%

Rexel's dividend yield at 4.6% trails the top quartile of French dividend stocks. Despite a decade of fluctuating dividends, both earnings and cash flows adequately cover payouts, with payout ratios standing at 46.6% and 45.6% respectively. Recent financials show a slight downturn in sales to €4.71 billion, impacted by currency fluctuations and price adjustments in specific segments, though partially offset by acquisitions like Wasco in the Netherlands. The company forecasts stable to mildly positive sales growth for 2024.

Click here to discover the nuances of Rexel with our detailed analytical dividend report.

Our expertly prepared valuation report Rexel implies its share price may be lower than expected.

Summing It All Up

Discover the full array of 33 Top Euronext Paris Dividend Stocks right here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ALEXA ENXTPA:BVI and ENXTPA:RXL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance