Exploring Chen Hsong Holdings And Two Other Key Dividend Stocks

As global markets exhibit mixed results with the Hang Seng Index in Hong Kong showing a notable increase, investors continue to seek stable returns amid fluctuating economic conditions. In this context, dividend stocks like Chen Hsong Holdings become particularly attractive for their potential to offer regular income and relative stability in uncertain times.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 8.19% | ★★★★★★ |

Chongqing Rural Commercial Bank (SEHK:3618) | 9.12% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.27% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 9.49% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.09% | ★★★★★☆ |

Bank of China (SEHK:3988) | 7.06% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.81% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.27% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 8.96% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.42% | ★★★★★☆ |

Click here to see the full list of 82 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Chen Hsong Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chen Hsong Holdings Limited is an investment holding company that manufactures and sells plastic injection molding machines and related products across Mainland China, Hong Kong, Taiwan, and other international markets, with a market capitalization of approximately HK$0.97 billion.

Operations: Chen Hsong Holdings Limited generates HK$1.99 billion in revenue primarily from the sale of plastic injection molding machines and related products.

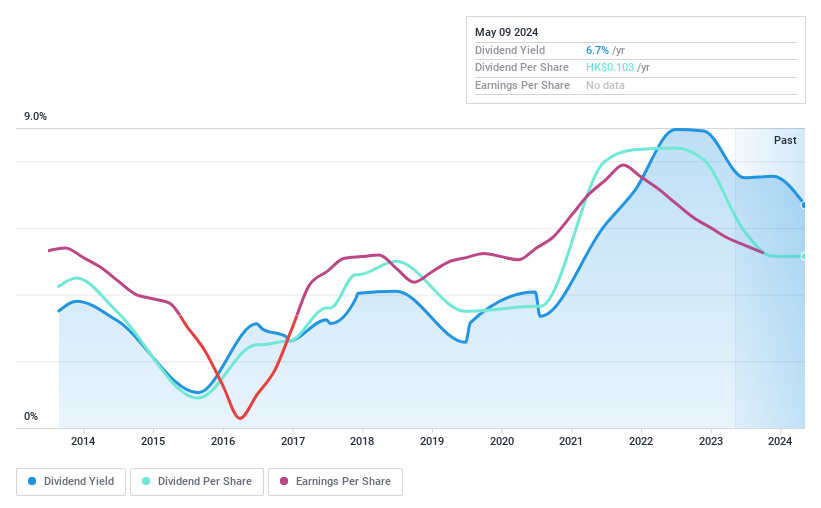

Dividend Yield: 6.7%

Chen Hsong Holdings offers a modest dividend yield of 6.69%, lower than the top quartile in Hong Kong's market at 7.84%. While its payout ratio stands at a sustainable 61.5%, reflecting earnings coverage, the dividends are also well-supported by cash flows with a cash payout ratio of 37.9%. However, the firm has experienced volatility in dividend payments and an unstable track record over the past decade, despite a general increase in dividends during this period. Additionally, its Price-To-Earnings ratio is slightly below the market average at 9.2x compared to Hong Kong's 9.4x.

Get an in-depth perspective on Chen Hsong Holdings' performance by reading our dividend report here.

Our valuation report here indicates Chen Hsong Holdings may be overvalued.

Shougang Fushan Resources Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shougang Fushan Resources Group Limited operates primarily in the raw coal mining, processing, and sales sectors within the People's Republic of China, boasting a market capitalization of approximately HK$15.91 billion.

Operations: Shougang Fushan Resources Group Limited generates revenue primarily through its coking coal mining segment, which produced HK$5.89 billion in sales.

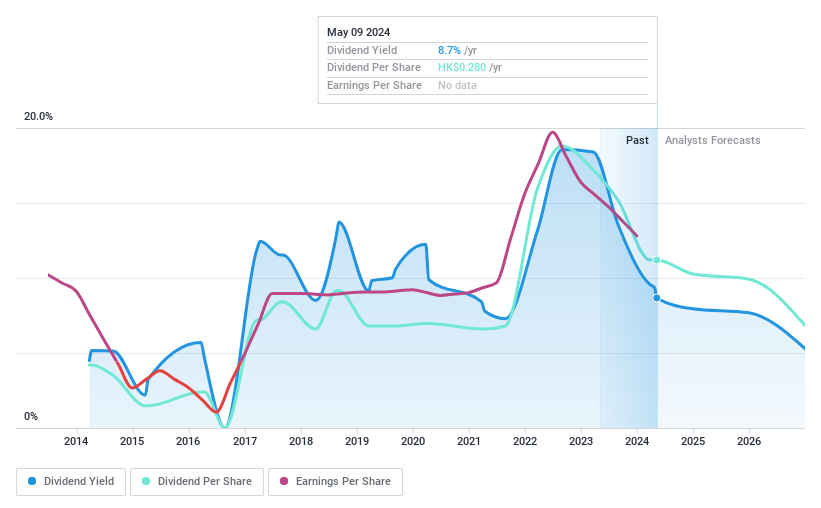

Dividend Yield: 8.7%

Shougang Fushan Resources Group has seen its dividend grow over the last decade, with a current yield of 8.67%, ranking it well within Hong Kong's top dividend payers. Its dividends are sustainably covered by earnings and cash flows, with payout ratios at 74.4% and 34.2% respectively. Despite this, the company has faced challenges such as a recent dividend cut to HK$0.18 per share and declining annual earnings, down to HK$1.89 billion from HK$2.72 billion previously, signaling potential concerns for future stability and growth in payouts.

Dive into the specifics of Shougang Fushan Resources Group here with our thorough dividend report.

Our valuation report here indicates Shougang Fushan Resources Group may be undervalued.

Lenovo Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lenovo Group Limited, an investment holding company, specializes in developing, manufacturing, and marketing technology products and services with a market capitalization of approximately HK$126.78 billion.

Operations: Lenovo Group Limited generates revenue primarily through three segments: the Intelligent Devices Group (IDG) with $43.93 billion, the Solutions and Services Group (SSG) at $7.30 billion, and the Infrastructure Solutions Group (ISG), which contributes $8.59 billion.

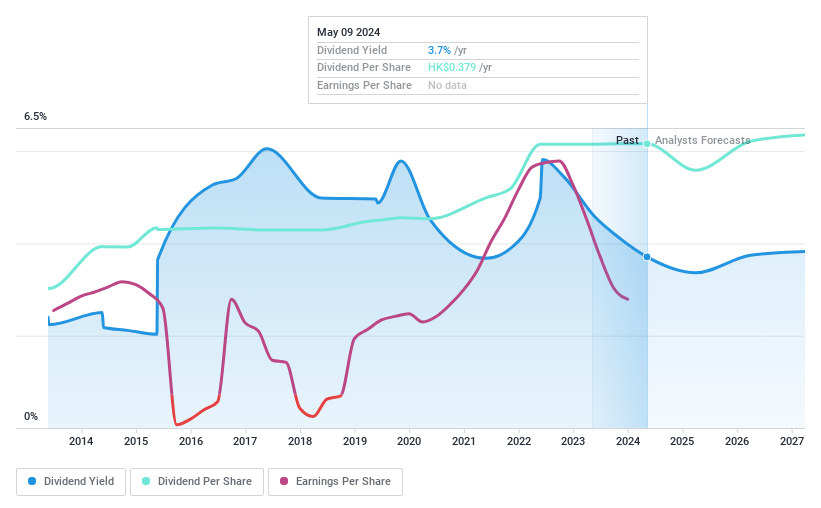

Dividend Yield: 3.7%

Lenovo Group's recent legal setback in Germany, where it was found to infringe on InterDigital’s patents, poses potential risks for its operational stability. However, the company's proactive strides in cybersecurity and AI infrastructure development could bolster its market position. Despite a dividend yield of 3.71%, the sustainability is questionable with an 80% payout ratio and a cash payout ratio of 196.8%, indicating that dividends are not well-covered by earnings or free cash flow. This financial backdrop suggests cautious evaluation for dividend-focused portfolios considering Lenovo's current fiscal health and innovation-driven growth initiatives.

Delve into the full analysis dividend report here for a deeper understanding of Lenovo Group.

Our valuation report unveils the possibility Lenovo Group's shares may be trading at a discount.

Make It Happen

Unlock more gems! Our Top Dividend Stocks screener has unearthed 79 more companies for you to explore.Click here to unveil our expertly curated list of 82 Top Dividend Stocks.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:57 SEHK:639 and SEHK:992.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance