Exploring April 2024's Noteworthy US Dividend Stocks

As US futures trade higher and the market anticipates a potential end to the S&P 500 and Nasdaq's losing streak, investors are keenly observing the unfolding economic landscape. Amid these conditions, dividend stocks may present an attractive investment option due to their potential for consistent income generation.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Peoples Bancorp (NasdaqGS:PEBO) | 5.48% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 6.19% | ★★★★★★ |

First Interstate BancSystem (NasdaqGS:FIBK) | 7.34% | ★★★★★★ |

Financial Institutions (NasdaqGS:FISI) | 6.91% | ★★★★★★ |

Southside Bancshares (NasdaqGS:SBSI) | 5.18% | ★★★★★★ |

Evans Bancorp (NYSEAM:EVBN) | 5.04% | ★★★★★★ |

CVB Financial (NasdaqGS:CVBF) | 4.81% | ★★★★★★ |

Bank of Marin Bancorp (NasdaqCM:BMRC) | 6.44% | ★★★★★★ |

West Bancorporation (NasdaqGS:WTBA) | 5.91% | ★★★★★★ |

Citizens & Northern (NasdaqCM:CZNC) | 6.32% | ★★★★★★ |

Click here to see the full list of 267 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

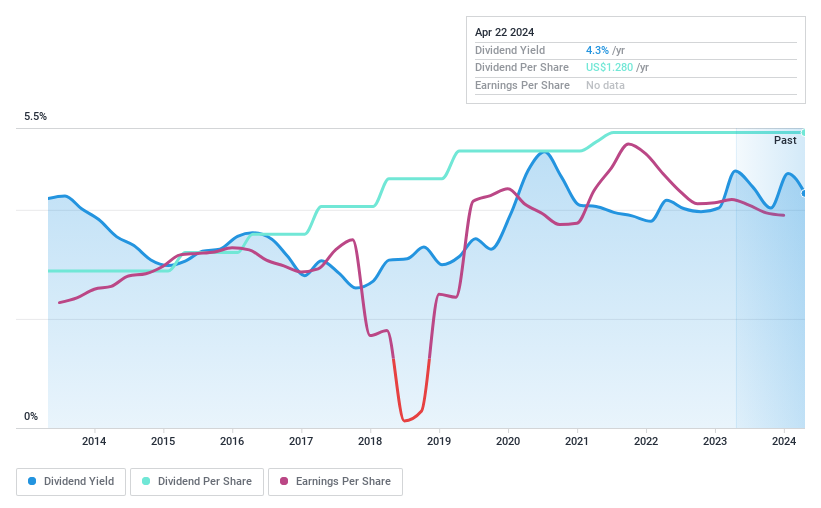

Franklin Financial Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Franklin Financial Services Corporation, trading under the ticker NasdaqCM:FRAF, is a bank holding company for Farmers and Merchants Trust Company of Chambersburg that offers commercial and retail banking services to various entities in Pennsylvania, with a market capitalization of $130.71 million.

Operations: Franklin Financial Services Corporation, identified by the ticker NasdaqCM:FRAF, generates its revenue primarily through traditional banking and related financial services, which contributed $65.76 million to its earnings.

Dividend Yield: 4.3%

Franklin Financial Services, trading at 51.2% below estimated fair value, offers a reliable dividend of 4.3%, which is slightly lower than the top 25% of US dividend payers (4.8%). The company's dividends have been stable and growing over the past decade, with a low payout ratio of 41.2%, suggesting well-covered payments by earnings. Recently, on April 11th, Franklin declared a regular cash dividend of US$0.32 per share for Q2-2024, consistent with Q1-2024's payout.

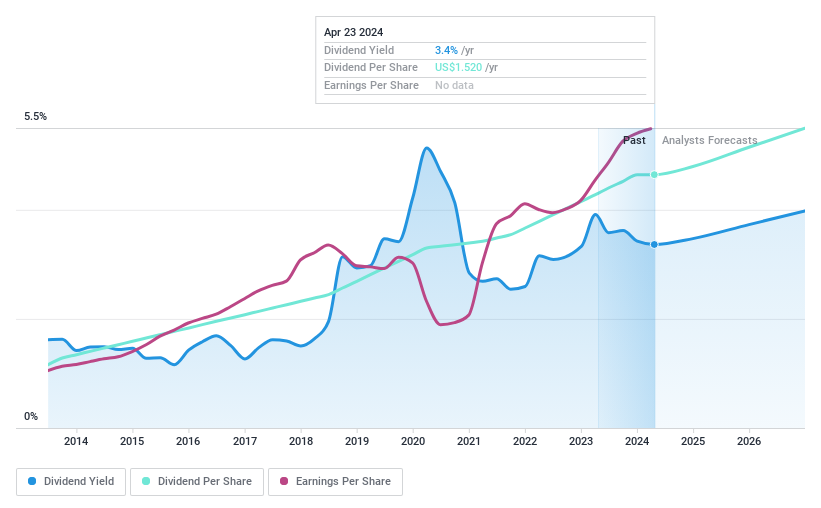

Bank OZK

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank OZK, operating in the United States, offers a range of retail and commercial banking services to individuals and businesses, with a market cap of approximately $5.12 billion.

Operations: Bank OZK, with its operations based in the United States, generates revenue primarily through its Community Banking segment, which accounts for approximately $1.40 billion.

Dividend Yield: 3.4%

Bank OZK, trading at a significant 69.6% below estimated fair value, offers a steady dividend yield of 3.38%. The company's dividends have been stable and increasing over the past decade, backed by a low payout ratio (24.4%), indicating well-covered payments by earnings. Despite recent growth in earnings (16.2% over the past year), its dividend yield is lower than the top quartile of US dividend payers (4.8%). On April 1st, Bank OZK declared an increased quarterly cash dividend of US$0.39 per share for Q2-2024.

Get an in-depth perspective on Bank OZK's performance by reading our dividend report here.

The valuation report we've compiled suggests that Bank OZK's current price could be quite moderate.

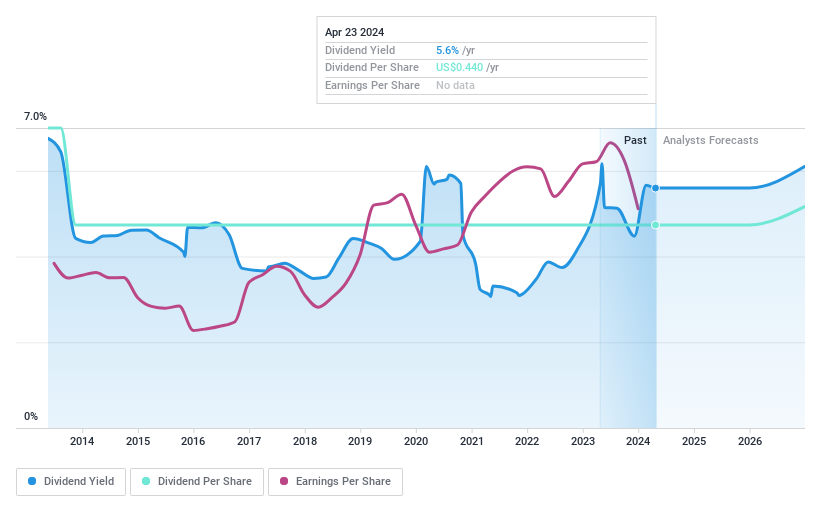

Valley National Bancorp

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valley National Bancorp, operating as the holding company for Valley National Bank, offers a range of commercial, private banking, retail, insurance and wealth management financial services products with a market cap of approximately $3.99 billion.

Operations: Valley National Bancorp, with its diverse financial services portfolio, generates revenue primarily through two segments: Consumer Banking and Commercial Banking. The former contributes approximately $224.75 million while the latter significantly outperforms with an impressive $1.51 billion in revenue.

Dividend Yield: 5.6%

Valley National Bancorp offers an appealing 5.71% dividend yield, ranking in the top 25% of US dividend payers. The company's dividends are well covered by earnings with a payout ratio of 46.3%, and forecasted to remain so in three years (37.3%). However, its track record reveals unstable and falling dividend payments over the past decade. Trading at a notable 57.1% below fair value, it presents good relative value compared to industry peers, despite recent significant insider selling.

Taking Advantage

Click this link to deep-dive into the 267 companies within our Top Dividend Stocks screener.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:FRAF NasdaqGS:OZK and NasdaqGS:VLY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance