Explore These 3 US Growth Companies With High Insider Ownership

The United States stock market has shown robust performance, with a 1.0% increase over the last week and a notable 22% rise over the past year. In this context of promising growth, companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those most familiar with the business.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.1% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Celsius Holdings (NasdaqCM:CELH) | 10.4% | 21.6% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Let's take a closer look at a couple of our picks from the screened companies.

monday.com

Simply Wall St Growth Rating: ★★★★★☆

Overview: Monday.com Ltd. is a global software application developer operating in regions including the United States, Europe, the Middle East, Africa, and the United Kingdom, with a market capitalization of approximately $11.18 billion.

Operations: The company generates its revenues primarily from the Internet Software & Services segment, totaling $784.35 million.

Insider Ownership: 16.6%

Revenue Growth Forecast: 20.4% p.a.

Monday.com is experiencing robust growth with earnings projected to increase by 34% annually, outpacing the US market's average. Revenue forecasts also suggest strong growth at 20.4% per year, significantly above market trends. Recently, the company turned profitable and provided an upbeat financial outlook for Q2 and the full year of 2024, expecting revenues between US$942 million to US$948 million. However, shareholder dilution occurred over the past year, and return on equity is anticipated to remain low at 15%.

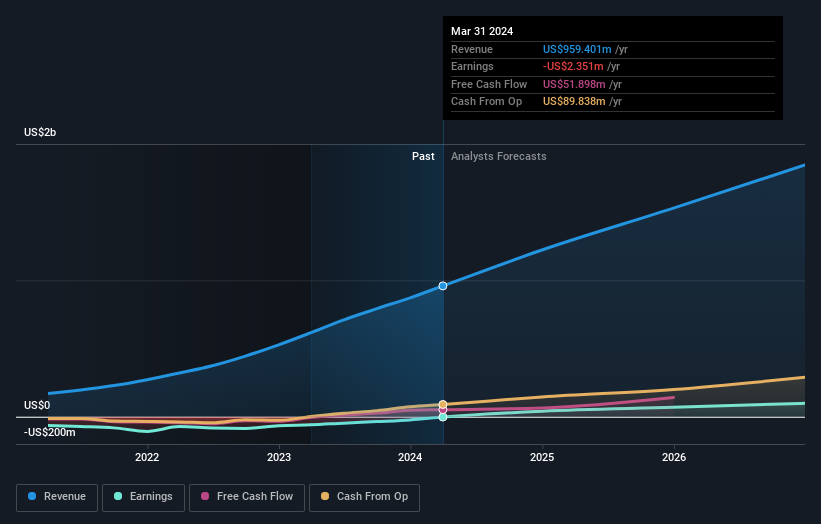

Hims & Hers Health

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hims & Hers Health, Inc. operates a global telehealth platform that connects consumers with licensed healthcare professionals in the United States and internationally, with a market capitalization of approximately $4.73 billion.

Operations: The company generates revenue primarily through its online retail segment, totaling $959.40 million.

Insider Ownership: 13.9%

Revenue Growth Forecast: 17.8% p.a.

Hims & Hers Health, Inc. is expanding its product offerings with the addition of GLP-1 injections to its weight loss treatments, enhancing customer access to affordable and high-quality options amid branded medication shortages. Recent financials show a significant revenue jump to US$278.17 million in Q1 2024 from the previous year, turning a prior net loss into a profit of US$11.13 million. Insider transactions have been positive with more buying than selling in recent months, reflecting confidence from those closest to the company. However, shareholder dilution has occurred over the past year and revenue growth projections are slightly below industry standards at 17.8% annually.

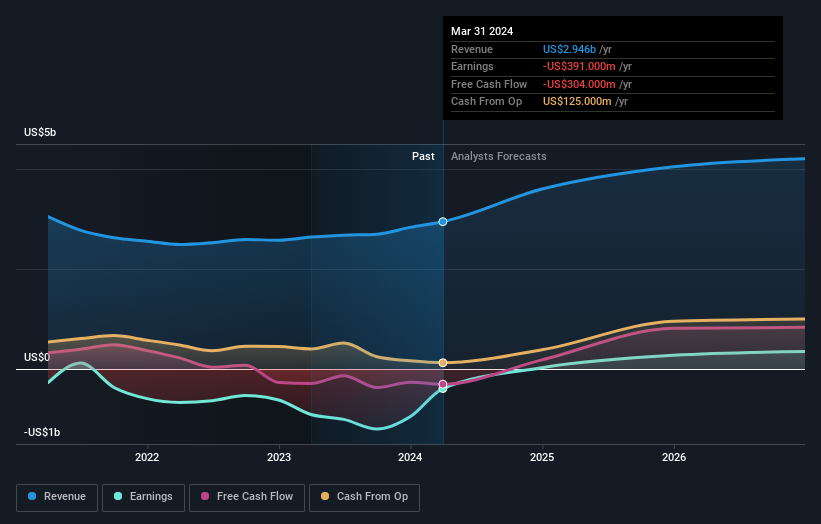

Transocean

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Transocean Ltd. offers offshore contract drilling services for oil and gas wells globally, with a market capitalization of approximately $4.59 billion.

Operations: The company generates its revenue primarily from the provision of contract drilling services, totaling $2.95 billion.

Insider Ownership: 11.9%

Revenue Growth Forecast: 13.6% p.a.

Transocean Ltd. is navigating a transformative phase with significant contract wins, including a US$161 million backlog from harsh environment semisubmersibles in Norway and Australia, signaling robust operational capabilities and market trust. Despite challenges like shareholder dilution and low forecasted return on equity (2.3%), the company's strategic amendments to its Articles of Association and proactive debt management underscore its commitment to long-term financial health. Earnings have rebounded impressively, with recent figures showing a shift from a substantial loss to a net income of US$98 million in Q1 2024, supported by earnings growth projected at an impressive rate annually.

Make It Happen

Unlock our comprehensive list of 183 Fast Growing US Companies With High Insider Ownership by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:MNDY NYSE:HIMS and NYSE:RIG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance