Expat pay packages in Singapore rose by 6% to S$326,000 in 2018: survey

SINGAPORE — The overall cost of sending a mid-level expatriate to Singapore rose by US$13,163 – or 6 per cent – last year, bringing the total package to US$236,258 (S$326,000).

This was one of the findings of the latest MyExpatriate Market Pay survey published annually by ECA International, an information and software provider in the management and assignment of employees around the world.

The average expatriate salary increased by US$4,874 and benefits went up by US$6,400, according to a press release by ECA on Tuesday (21 May).

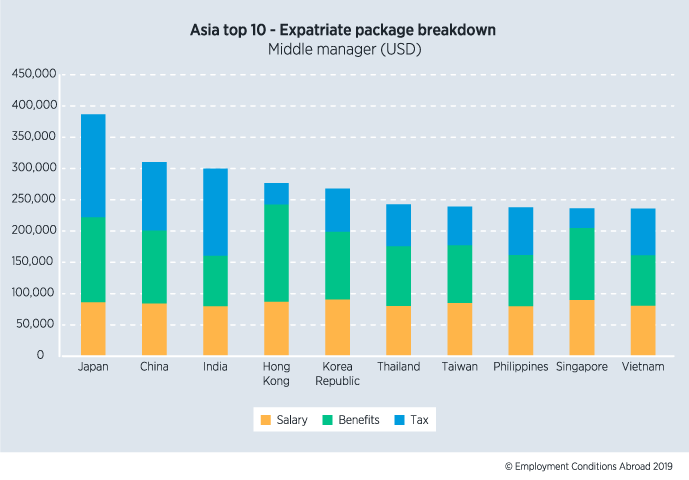

“However, with minimal increases in personal tax and extremely low tax-related costs as compared to most of the other locations in our rankings, Singapore sits at the 19th position globally,” said Lee Quane, ECA International’s regional director for Asia.

When considering the cost of an expatriate package, companies need to factor in three main elements: the cash salary, benefits – such as accommodation, international schools, utilities or cars – and tax, the survey said.

Regional Highlights

Hong Kong’s expatriate pay packages continued to grow last year, with the average package costing companies US$276,417, including an average salary of US$86,984.

The overall expatriate pay package in Hong Kong has risen by a total of US$7,902 since last year, with increases to salaries and benefits making up the vast majority of the rise.

The pay and benefits package of an expatriate living and working in China saw a significant rebound last year, after falling in 2017. The average package is now valued at US$310,204, marking an increase of over US$33,000. This pushes China up one place in the rankings to the third position globally.

“The Chinese yuan experienced a better year in 2018 due to a stronger economy and currency, and this has resulted in a considerable improvement in the pay package for overseas workers in Chinese locations,” Quane said.

Japan is no longer the most expensive location in the world to send expatriates, after being overtaken in the rankings by the United Kingdom.

The UK now offers the most expensive expatriate pay package, mainly due to a major jump in the value of benefits, which rose by 25 per cent.

The rise in accommodation costs was mainly responsible, due to an increase in housing and rental prices throughout the UK, Quane said. This was especially the case in Central London – a location that has long attracted high numbers of expatriate workers, said Quane.

Although sending a mid-level overseas employee to Japan would now amount to US$386,451, the cost is still US$35,347 behind the total cost of sending an expatriate to the UK, the survey said.

Elsewhere in Asia, the pay and benefits packages of expatriates living and working in Thailand saw a major increase, with the overall package rising by US$27,917 compared to the previous year.

Related stories:

These Are the Best Countries to Live and Work in — and to Boost Your Salary

Singapore is 18th most expensive location in the world for expats: survey

Singapore cuts 2019 GDP forecast as Q1 growth hits decade low

Yahoo Finance

Yahoo Finance