Exelon (EXC) Q2 Earnings Lag Estimates, Revenues Surpass

Exelon Corporation’s EXC second-quarter 2022 earnings of 44 cents per share lagged the Zacks Consensus Estimate of 46 cents by 4.3%.

On a GAAP basis, second-quarter earnings were 47 cents per share compared with 33 cents in the year-ago quarter. The difference in GAAP and operating earnings per share was due to separation costs and income-tax-related adjustments.

Total Revenues

Exelon's second-quarter total revenues of $4.23 billion surpassed the Zacks Consensus Estimate of $4.12 billion by 2.8%. The top line improved 0.7% from the year-ago figure of $4.2 billion.

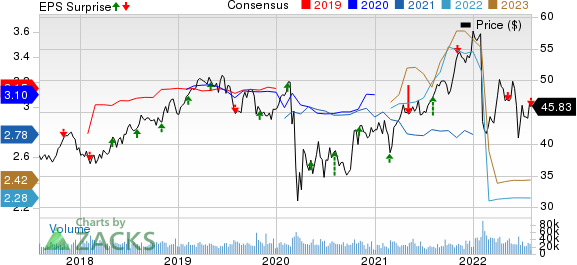

Exelon Corporation Price, Consensus and EPS Surprise

Exelon Corporation price-consensus-eps-surprise-chart | Exelon Corporation Quote

Highlights of the Release

Exelon's second-quarter total operating expenses increased 2.9% year over year to $3.54 billion. The increase was due to a rise in purchased power and fuel expenses, and increased operation and maintenance expenses.

Operating income was $694 million, up 19.7% year over year.

Interest expenses totaled $358 million, up 10.5% from the year-ago quarter.

Financial Highlights

Cash and cash equivalents were $816 million as of Jun 30, 2022, compared with $672 million as of Dec 31, 2021.

Long-term debt was $35,789 million as of Jun 30, 2022, compared with $30,749 million as of Dec 31, 2021.

Cash provided (used in) for operating activities for the first six months of 2022 was $3,420 million compared with $1,138 million in the first six months of 2021.

Guidance

Exelon has reiterated its 2022 earnings at $2.18-$2.32 per share. The mid-point of the revised guided range is $2.25, lower than the Zacks Consensus Estimate of $2.28 per share for the same period.

Exelon plans to issue up to $1.0 billion of registered shares of common stock through 2025. The company aims to establish a $1.0-billion ATM program under which it can issue registered shares of common stock through designated broker-dealers at prevailing market prices.

Zacks Rank

Exelon has a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

NextEra Energy, Inc. NEE reported second-quarter 2022 adjusted earnings of 81 cents per share, which beat the Zacks Consensus Estimate of 75 cents by 8%.

The Zacks Consensus Estimate for NextEra Energy’s 2022 earnings has gone up 2.1% in the past 60 days. NEE’s long-term (three to five years) earnings growth is pegged at 9.3%.

WEC Energy Group WEC delivered second-quarter 2022 earnings per share (EPS) of 91 cents, which beat the Zacks Consensus Estimate of 86 cents by 5.8%.

The Zacks Consensus Estimate for WEC Energy’s 2022 earnings has gone up 0.3% in the past 60 days. WEC’s long-term earnings growth is pegged at 6.1%. The WEC stock has gained 9.5% over the past six months.

American Electric Power Company, Inc. AEP reported second-quarter 2022 operating earnings per share of $1.20, which beat the Zacks Consensus Estimate of $1.18 by 1.7%.

The Zacks Consensus Estimate for American Electric Power’s 2022 earnings has gone up 0.6% in the past 60 days. AEP’s long-term earnings growth is pegged at 6.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exelon Corporation (EXC) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance