Even With A 30% Surge, Cautious Investors Are Not Rewarding Enviro-Hub Holdings Ltd.'s (SGX:L23) Performance Completely

Enviro-Hub Holdings Ltd. (SGX:L23) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 49% over that time.

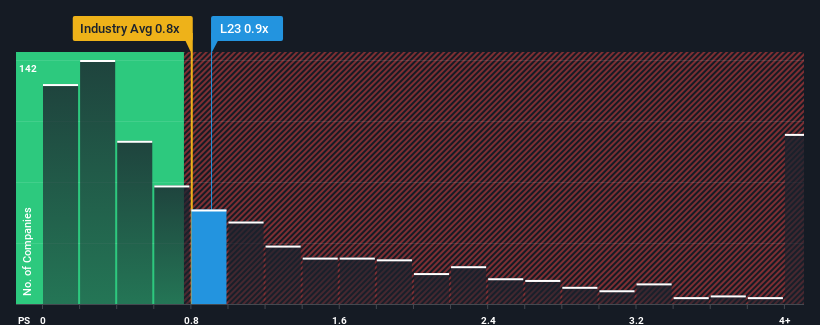

In spite of the firm bounce in price, Enviro-Hub Holdings may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Metals and Mining industry in Singapore have P/S ratios greater than 1.8x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Enviro-Hub Holdings

What Does Enviro-Hub Holdings' P/S Mean For Shareholders?

We'd have to say that with no tangible growth over the last year, Enviro-Hub Holdings' revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. Those who are bullish on Enviro-Hub Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Enviro-Hub Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

Do Revenue Forecasts Match The Low P/S Ratio?

Enviro-Hub Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Although pleasingly revenue has lifted 34% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

This is in contrast to the rest of the industry, which is expected to grow by 7.8% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Enviro-Hub Holdings' P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Enviro-Hub Holdings' P/S

Enviro-Hub Holdings' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Enviro-Hub Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

You should always think about risks. Case in point, we've spotted 6 warning signs for Enviro-Hub Holdings you should be aware of, and 1 of them shouldn't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance